Broken Record

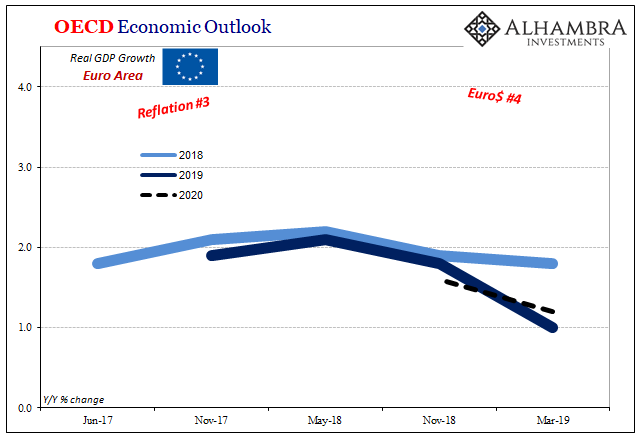

The OECD has become the latest mainstream Economist outfit to relent on growth. Two years ago, they had grown cautiously optimistic as reflation appeared in the back half of 2016. By the middle of 2017, positively giddy barely able to contain their increasingly rabid excitement:

The global economy is now growing at its fastest pace since 2010, with the upturn becoming increasingly synchronised across countries. This long awaited lift to global growth, supported by policy stimulus, is being accompanied by solid employment gains, a moderate upturn in investment and a pick-up in trade growth.

The text leaves no doubt as to what OECD’s Economists were thinking. Echoing more positive official sentiment around the world, 2017 was in their view a signal for the end of the Great “Recession.” Policy “stimulus” would finally be properly lauded for its designers’ collective patience and, in the words of many, courage.

But in that view was expressed a promise. This globally synchronized growth was not “it”, merely the first step toward it. The big payoff was set for 2018 and beyond – unquestionable acceleration!

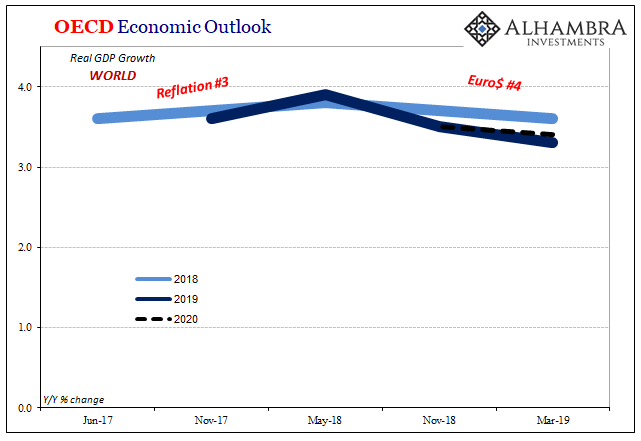

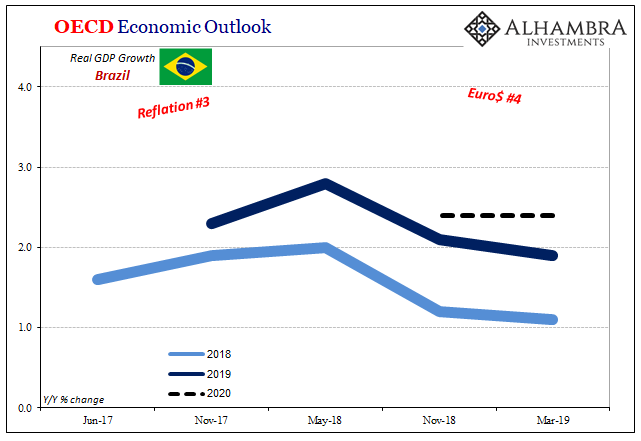

In its March 2019 update, however, 2017 increasingly appears to have been the anomaly. Estimates for economic growth are now starting to be cut again, reminiscent of what ended up happening with 2014. Worse, the disappointment of 2018 doesn’t appear to be simply a delay before the promised payoff, rather toward the end of last year economic behavior outright refuted what was quoted above.

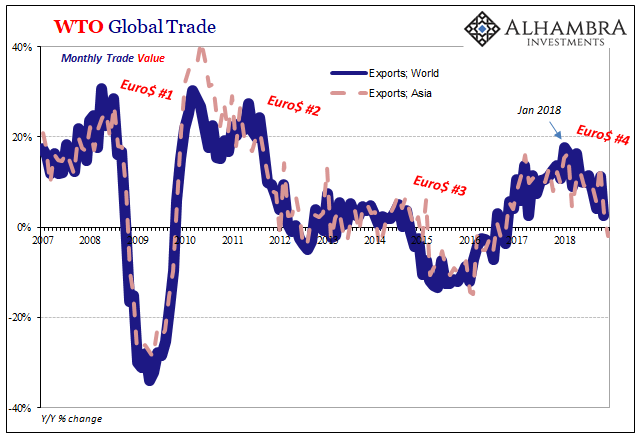

Particularly that part about “pick-up in trade growth.”

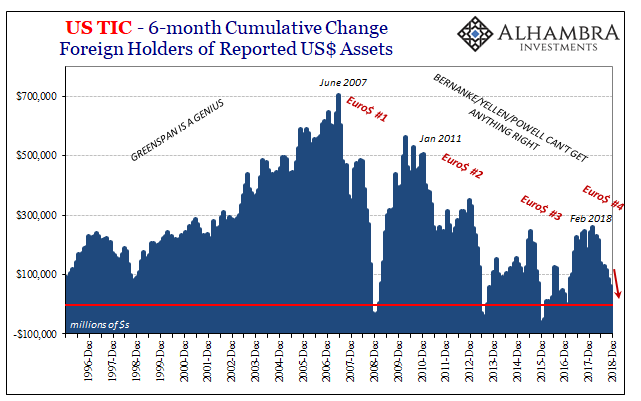

The pattern for the economy and therefore these forecasts is absolutely clear. When reflation registers in the data, predictions are raised and the good times are attributed to “policy stimulus.” Once all that fails, the dreaded but inevitable false dawn, forecasts are uniformly downgraded and nobody has a clue why.

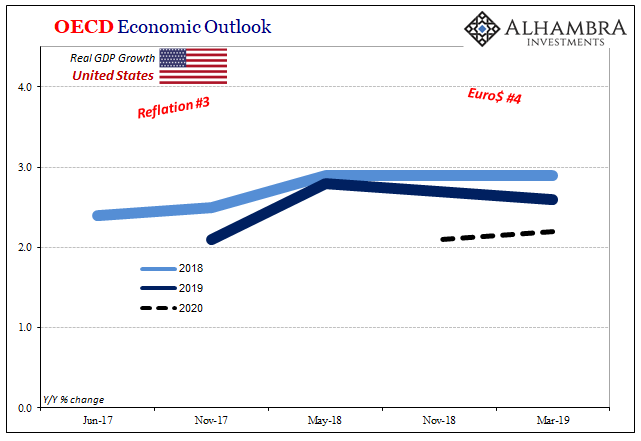

The very fact that the latest update continues to cling to the dream of decoupling tells you everything you need to know. For Economists, there is no global economy, rather a loose configuration of almost completely separate systems under the command of each’s central bank. This view is confirmed, in the mainstream, by reflation but then contrarily ignored for the next downturn.

It isn’t a very good doctrine that maybe can explain what’s going on half the time.

Even the text of the OECD’s current update recognizes the connections:

Global growth is slowing after reaching a peak in 2017. Growth continues to decouple: it remains strong in the US, but it starts plateauing. More worryingly, it has markedly slowed in the euro area…

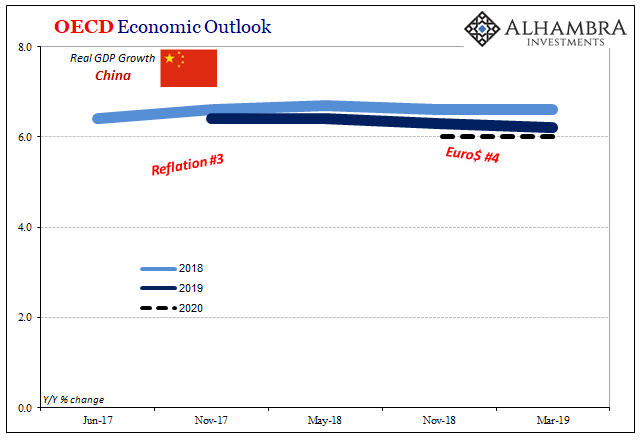

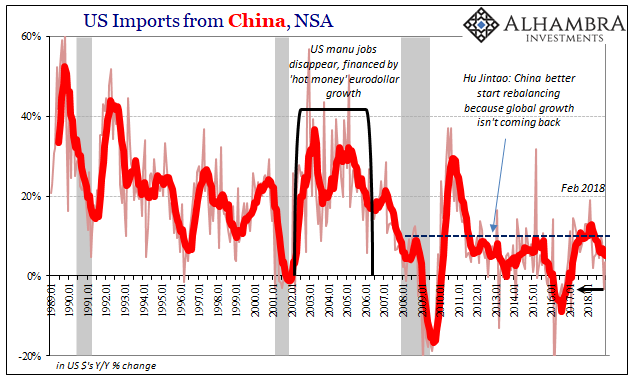

Trade growth has slowed further, to 4% in 2018 from 5 ¼% in 2017. EA trade growth has fallen sharply to zero, partly due to weaker demand for exports, notably from China: exports to China were growing at 13% in 2017, the growth rate was zero at the end of 2018.

Europe is weak because of China, and China is on the verge of full-blown downturn because why? Maybe the same reason as Europe?

People won’t remember, but we went through all this just four years ago, including the US decoupling (cleanest dirty shirt in 2015’s vernacular). This after experiencing the same thing three years before that. The cycle is simply repeating. And the reason it does is because nobody remembers what happened the cycle before.

Something something transitory factors. This truly is the worst case.

Just when everyone gets a sense that there is (still) something wrong, even Economists like Paul Krugman almost putting their finger right on it, another reflation episode shows up just in time for everyone to go back to sleep. Urgency in 2016 very quickly turned into fantasy globally synchronized growth in 2017; “hey, there really is something wrong” transformed into “never mind” as if all was just forgiven and forgotten.

From our collective experience in 2014-16, a global one, when 2017’s super-positive narrative showed up it should’ve been outright rejected. Past experience alone was sufficient evidence; two false dawns to that point already. Instead, it was enthusiastically, hysterically embraced.

Now we are facing a third, what will happen in 2020 or 2021 when the latest cycle is completed? Will people still be looking to Jay Powell’s marshmallow economic confidence and chickenhawk sensibilities?

What was written in 2017, 2014, and 2011, will be written again in the future. Economists will uniformly, homogenously predict, “This long-awaited lift to global growth, supported by policy stimulus, is being accompanied by solid employment gains, a moderate upturn in investment and a pick-up in trade growth.” The only difference will be the years; they’ll be changed in the description for however many more of them we’ve lost in between.

Years the world can’t afford to keep losing to Economists, hoping one day before too long they first realize they really don’t know what they are doing.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more