The Real Reason Why Stop/Go Is Back To Stop Again

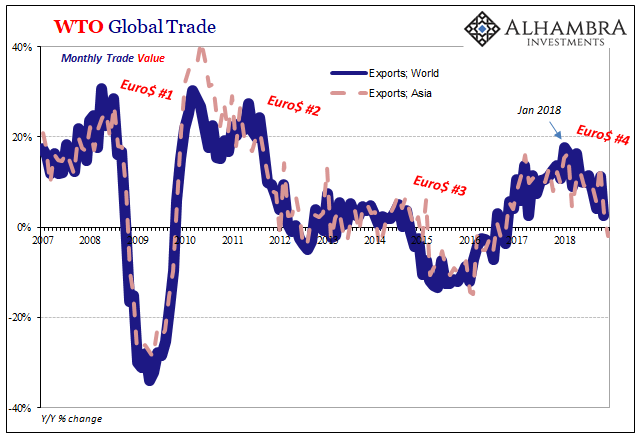

These things have typically started in global trade. This makes sense given what we are dealing with are intermittent problems in global money. Quite simply, you can’t trade if you can’t get any. Therefore, the more acute the dollar shortage the more disruptive to the global merchandise economy.

The one exception to this pattern was the first. Euro$ #1 registered beginning by damaging broad demand within the developed world. This, too, was unsurprising since the first outbreak of it registered as a reverse for the credit-driven asset bubbles. Difficulties for trade materialized later, the middle of 2008, which for a time fueled the narrative of decoupling (weakness in US and Europe wouldn’t spill over into Asia and EM’s). Eventually, shadow money would disappear for Asia, too, and then decoupling did.

Either way, the result has been the same each and every time. Every piece of the global economy eventually succumbs. Despite some claiming a new version of decoupling in 2018, weakness in Asia and EM’s that won’t spillover into the US and Europe, there is growing evidence of first that weakness in trade directed at Asia followed by greater concerns over Europe.

The US hasn’t been spared, either, though it is currently lagging behind all the rest in the race which has no winners.

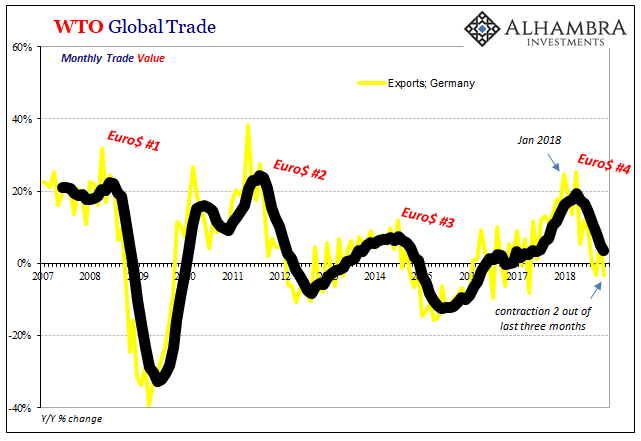

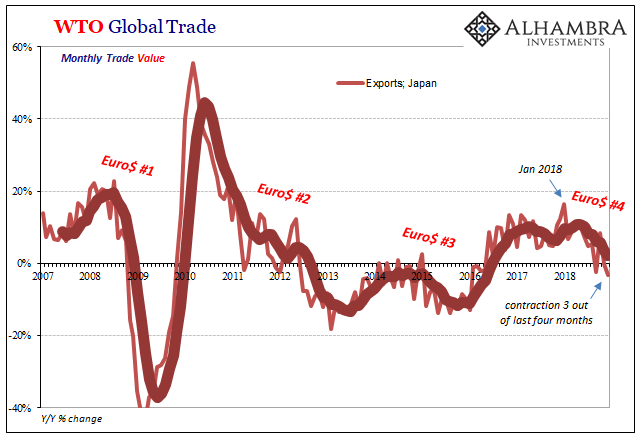

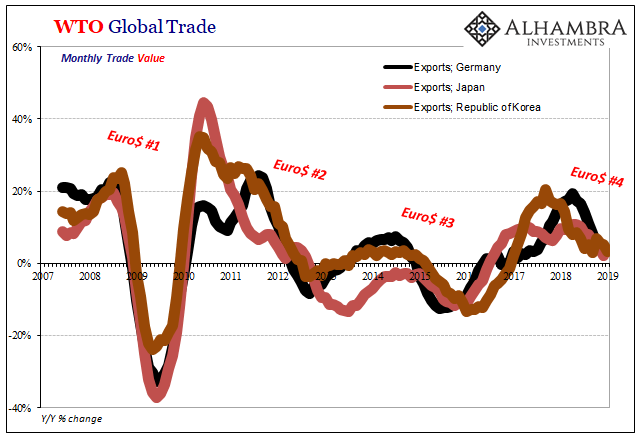

The pathology of Euro$ #4 is the familiar one. When we examine the trade statistics, the direction for the world economy at the end of 2018 is pretty clear. There is hope, always, that perhaps things will turnaround before it gets much worse. However, as is plain on each chart below it doesn’t really work that way; global trade is like a massive ship, once it starts turning in one direction or the other it doesn’t just turn on a dime.

The further the turn in whichever direction, the more it takes to get going back the other way.

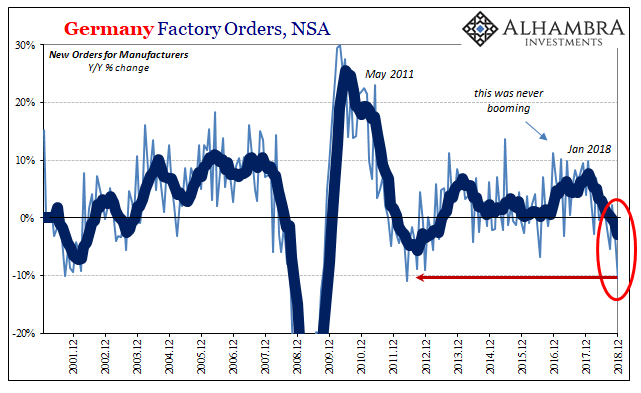

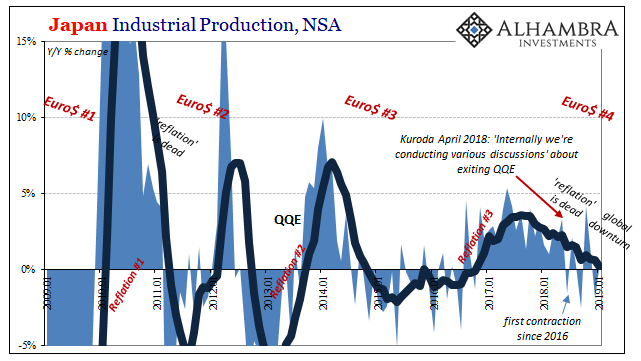

The data is uniform in showing how 2018 was merely the early stages of a downturn; the peak of Reflation #3 taking place around last January. As the year finished up, there were more and more minus signs proliferating especially in key export countries like Germany, Japan, and the Republic of Korea.

In one sense, it is amazing how the same pattern is found in each of these supposedly disconnected economies. The orthodox textbook says that the world is made up of discrete, separated systems with only minor, immaterial links between them. Every country is a closed structure, in theory, which allows the central banks within each one to be, well, central.

Even the most closed of closed system Economists, Paul Krugman, was forced to admit there is a lot that has to be missing from the current state of Economics. What he admitted during 2016, the last Euro$ downturn should have been a gamechanger:

I really want to make four points. The first is that we are now in the world of pervasive economic weakness. In many ways, we are all Japan now. This complicates policy for everyone including Japan. The second is that the linkages among major economies are strong. They are stronger than much conventional economic discussion suggests, largely I would argue because of capital flows. This is very important to speak about. The third, which may be of particular concern here is, we are seeing the difficulty in achieving goals through even very bold and unconventional monetary policy.

Dr. Krugman or anyone else can keep calling them “capital flows” but what they are in reality is a very different global reserve currency – a non-reservable, virtual currency system that has no currency in it.

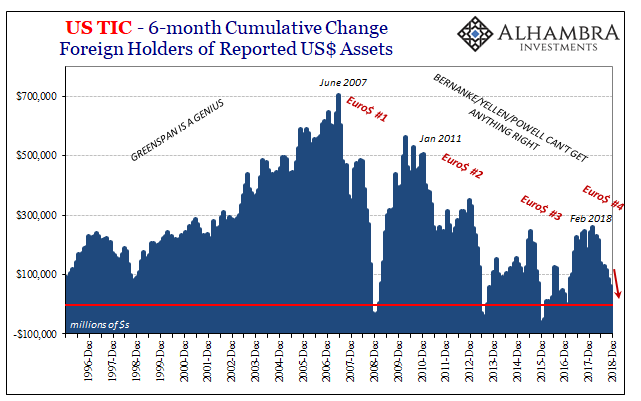

The outlines of the decay of that system are what we find in global trade as well as a bunch of other esoteric statistics (like TIC) that were never meant to be used in this fashion; these closed systems all moving the same way and at the same times.

It doesn’t matter that each country indicated above uses a different local currency for itself, and therefore what it inherently has available for its trade partners. The reason is why a global reserve currency exists in the first place – to intermediate different regimes. No one in Germany needs to find South Korean won to buy from the Koreans. They could use euros and in some cases they do. Primarily, there are eurodollars in the middle.

If it is more difficult and expensive to come up with eurodollars, that isn’t just a problem for Korea selling to Germany it is a problem for the entire global system almost all at once. And as trade goes, marginal economic growth follows. Globalization in reverse, the very idea of it more and more unpopular.

Trade wars haven’t helped, but they are not the cause of the current downturn. Should China and the US settle their differences, that won’t hurt but it won’t solve FICC.

Global trade uniformly appears pretty conclusively to show how we are about a year into the next downward leg. And now that deceleration is clearly entrenched, already spilling over beyond trade into actual production levels in these very places, it just isn’t so easy turn it all around again.

It is the big reason why this up and down or stop/go pattern is the worst possible case. Just when everyone gets a sense that there is (still) something wrong, even Economists like Paul Krugman almost putting their finger right on it, another reflation episode shows up just in time for everyone to go back to sleep. Urgency in 2016 very quickly turned into fantasy globally synchronized growth in 2017; “hey, there really is something wrong” transformed into “never mind” as if all was just forgiven and forgotten.

As 2019 starts out more like 2015 than 2005, the latter being what was expected, we’ve not only lost that last line of thinking which was for a brief moment moving in the right direction, the world has also lost three precious years in between, an enormous amount of lost opportunity that we can never get back. These costs add up; they have already added up to far more than many seem to appreciate.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more