Breaking Down Walmart Stock Before Q3 Earnings

Only 13% from its highs, Wall Street will be watching Walmart’s (WMT) Q3 earnings on November 15, for further insight into consumer spending amid an economic downturn. Walmart stock has held up better than the broader market and investors are hoping a strong third quarter could give WMT stock a boost into positive territory this year.

Walmart’s report will also show if the company can fend off rising competition from Amazon (AMZN) and Target (TGT) during an economic crunch with the latter also reporting earnings next week. To combat the competition Walmart has strived to advance its e-commerce business along with its retail stores.

The Basics

Walmart is well known for its “rollback” prices, which is significant as consumers look to lower costs. However, Wall Street will be scoping the company’s bottom line to see if these exclusive discounts are beneficial to Walmart during the current economic environment with operating costs rising for most businesses.

In addition to running its core supercenters along with Sam’s Clubs domestically, the company has expanded its international operations with a presence in Canada, Chile, China, India, Mexico, Africa, and Central America. Walmart has also made the push into healthcare launching Walmart Health in 2019 to continue diversifying its business which also includes a growing subscription service.

Image Source: Zacks Investment Research

Q3 Outlook

The Zacks Consensus Estimate for WMT’s Q3 earnings is $1.31 per share, which would be a decline of -9% from Q3 2021. Sales for Q3 are expected to be up 5% at $147.41 billion. This may be a slight indication that operating costs are weighing down the company’s bottom line in a tougher overall economic environment.

Earnings estimates are slightly up from $1.30 at the beginning of the quarter. Year over year, WMT earnings are also expected to decline -9% in fiscal 2023, but rise 11% in FY24 at $6.52 per share. Top line growth is expected, with sales projected to be up 5% in fiscal 2023 and another 3% in FY24 to $618.97 billion.

Performance & Valuation

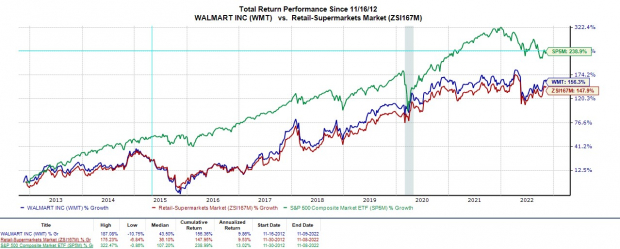

Year to date, WMT is only down -3% to outperform the S&P 500’s -21% and roughly match the Retail-Supermarkets Market’s +1%. Over the last decade, WMT is up +156% when including its dividend to beat its Zacks Subindustry’s +148% but lag the benchmark.

Image Source: Zacks Investment Research

WMT’s historical performance has been very respectable and investors are hoping this continues as the economic downturn is favorable for omnichannel players like Walmart that offer consumers options to cut back on expenses.

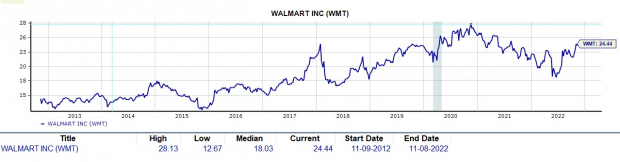

Trading around $139 per share, WMT has a forward P/E of 24.4X. This is well above the industry average of 11.6X but Walmart has shown itself to be a leader. WMT does trade at a discount to its decade-high of 28.1X and slightly above the median of 18X.

Image Source: Zacks Investment Research

Bottom Line

Going into its Q3 earnings WMT lands a Zacks Rank #3 (Hold) and its Retail-Supermarkets Industry is in the top 38% of over 250 Zacks Industries. Walmart could use strong beats on both its top and bottom lines. This could be a catalyst for WMT stock and show the company can continue benefiting in the current market environment.

Wall Street will be monitoring Walmart’s ability to manage rising operating costs as the company’s business model offers many of its products at a discount to its competitors through its “rollback” prices.

Investors may be rewarded for holding the stock as the current economic downturn could shift more consumers to Walmart. Plus, WMT offers a solid 1.57% annual dividend yield at $2.24 per share and the Average Zacks Price Target suggests 7% upside from current levels.

More By This Author:

Wynn Resorts Reports Q3 Loss, Tops Revenue Estimates

The Trade Desk Surpasses Q3 Earnings And Revenue Estimates

Bear Of The Day: The Estée Lauder Companies, Inc.

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more