Bear Of The Day: The Estée Lauder Companies, Inc.

The Zacks Consumer Staples sector has fared better than most in 2022, down roughly 7% and widely outperforming the general market.

However, one company in the realm that’s been a slight exception is The Estée Lauder Companies, Inc. (EL - Free Report).

The Estée Lauder Companies is one of the world's leading manufacturers and marketers of skincare, makeup, fragrance, and hair care products. The company's products are sold through department stores, mass retailers, company-owned retail stores, hair salons, and travel-related establishments.

Analysts have been bearish regarding EL’s near-term earnings outlook, pushing it into a Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Let’s take a deeper dive into the company.

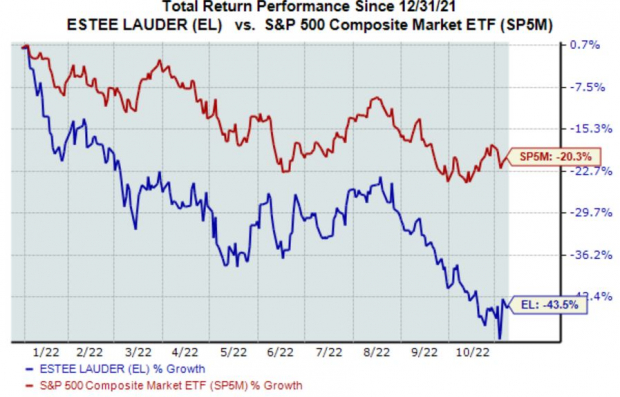

Share Performance

It’s been a challenging road for EL shares in 2022, down more than 40% and widely underperforming the general market.

Image Source: Zacks Investment Research

And over the last three months, shares have continued on their downward trajectory, down more than 20% and again underperforming the general market.

The adverse price action of EL shares tells us that sellers have remained in control, something we’ve seen with many stocks in a historically-volatile 2022.

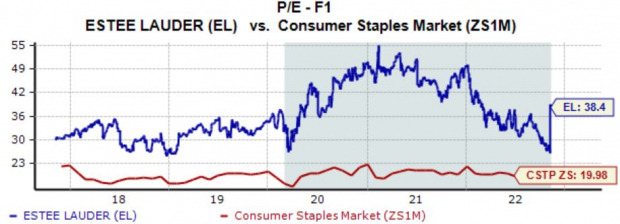

Valuation

The company’s forward earnings multiple sits at 38.4X, on the higher end of the spectrum and perhaps steering away value-focused investors.

Further, the current value is above its five-year median of 34.1X and reflects a 92% premium relative to its Zacks sector average of 19.9X.

The company carries a Value Style Score of an F.

Image Source: Zacks Investment Research

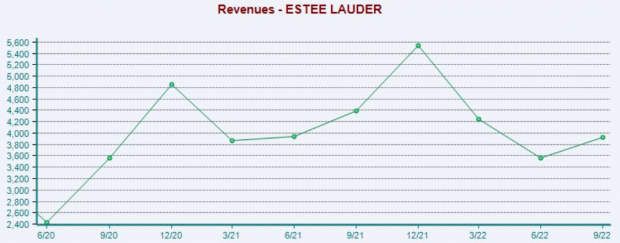

Quarterly Performance

Still, the company carries a strong earnings track record, surpassing the Zacks Consensus EPS Estimate in nine consecutive quarters. Just in its latest print, EL registered a 6.2% bottom-line beat.

Revenue results have also been strong, with EL penciling in seven top-line beats across its last ten quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Negative earnings estimate revisions and steep valuation multiples paint a less-than-ideal picture for the company in the short term.

The Estée Lauder Companies (EL - Free Report) is a Zacks Rank #5 (Strong Sell), telling us it has a weak near-term earnings outlook.

Investors should pivot to stocks that either carry a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy) – these stocks have a much stronger earnings outlook and potential to deliver explosive gains in the short term.

More By This Author:

Walt Disney Lags Q4 Earnings And Revenue EstimatesWhat To Expect From Occidental Petroleum's Q3 Earnings?

October Marks Best Month for Value ETFs Since 1978: Top Funds

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more