Bond Yields & Bitcoin Jump As Black Gold Dumps'n'Pumps

Image Source: Pixabay

Jobless claims surged on an un-adjusted basis, durable goods orders dumped, consumer sentiment slumped, and inflation expectations jumped... US macro data is not signaling a 'soft landing...

Source: Bloomberg

...but apart from that "the consumer is resilient and look over there at NVDA's earnings". But, despite smashing it on earnings, NVDA actually traded lower (as anxiety over Biden's China crackdown weigh a smidge)...

Stocks took a spill around 1200ET, with some suggesting it was due to the explosion on the US, but managed to maintain some gains ahead of Turkey day. Small Caps outperformed modestly but all the majors traded pretty much in sync amid low liquidity...

Energy stocks are the only sector red on the week, despite the big rebound today as Healthcare and Tech (an unusual pair) lead on the week...

Source: Bloomberg

Apple (AAPL) topped the $3 trillion market cap level intraday ...

Source: Bloomberg

VIX tumbled to a 12 handle close (the lowest for the day before Thanksgiving since 2019)...

Treasury yields were up across the curve today with the short-end underperforming (2Y +3bps, 10Y +1bp)...

Source: Bloomberg

The dollar rallied into the green for the week briefly and then faded back...

Source: Bloomberg

Bitcoin was bid back above $37,000...

Source: Bloomberg

Spot Gold prices fell back below $2,000...

Source: Bloomberg

Oil prices dumped on headlines that OPEC+ was delaying its meeting, then pumped back as analysts suggested that the meeting delay is “counter-intuitively reassuring” as it will help create “cohesion around collective cuts"...

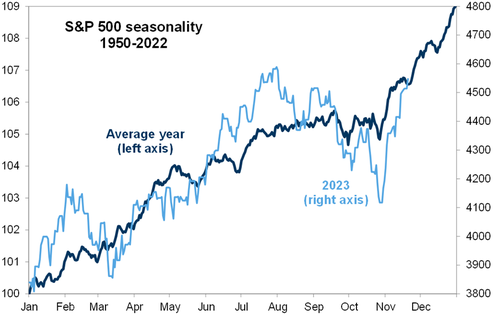

Finally, stocks are playing catch-up to seasonals...

...to the moon!

More By This Author:

A Traditional Thanksgiving Turkey Dinner Is 30% More Expensive Since Biden Took Office

Initial Jobless Claims Unexpectedly Tumbled Last Week

Five Days Of Chaos Over? Sam Altman Returns As OpenAI CEO

Disclosure: None