Boeing Soars

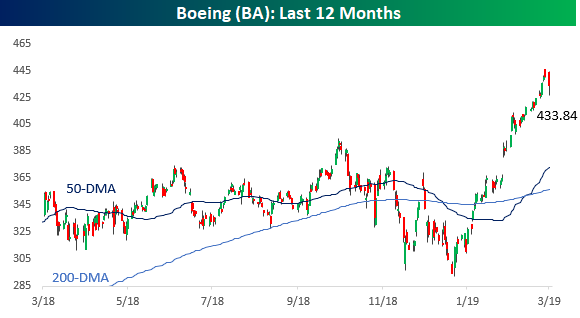

To say that Boeing (BA) shares have had a good start to 2019 would be like calling the 747 a puddle jumper. With a gain of over 50% from its late 2018 low and a YTD gain of over 36% through last Friday’s close, it has been one of the strongest starts to a year (through 3/1) for a current DJIA component in decades.

(Click on image to enlarge)

Making its move even more noteworthy is that with a share price of more than $400 and the fact that the Dow is a price-weighted index where each component’s weighting in the index is based on its share price, BA’s rally has had a ‘jumbo’ impact on the overall index.BA’s weight in the DJIA currently stands at 11.5%, while its weighting in the S&P 500, which is a market cap weighted index, is less than 1%. As a result, through Friday’s close, the DJIA had gained 2,807 points so far in 2019 and BA accounted for 812 of them. That works out to 29% of the DJIA’s entire gain this year! Without BA’s rally, the DJIA would only be up about 8% this year versus its 11.5% gain through Friday. Behind BA, the next closest stock in terms of its impact on the DJIA this year has been Goldman Sachs (GS) which has accounted for 216 points of the DJIA’s YTD gain (7.7%).

As mentioned above, BA’s strong start to the year is one of the best for current DJIA components going back to 1995. Of the 30 current members, there have been just four prior occurrences where a stock rallied more than 30% YTD through the close on 3/1, and two of those were in the stock of Apple (1998 & 2005) well before it was even added to the DJIA. The only two other occurrences were Intel’s (INTC) 41% gain in 2000 just after it was added in late 1999 and then Microsoft (MSFT) the next year in 2001 when it rallied 37%. The key difference between those two occurrences and Boeing, though, is that because of their share prices at the time, they didn’t have nearly the positive impact on the overall index when they rallied.

While bulls have nothing to complain about regarding BA’s big rally this year, the impact of high price stocks on the DJIA cuts both ways. Barring any future stock splits, even just a 10% correction in shares of BA would clip the DJIA by more than 250 points.

(Click on image to enlarge)

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more