'Biggest Losers', Bullion, & Black Gold All Bid On Boxing Day

Image Source: Unsplash

The S&P 500 is now up over 15% since October 27th. And the Santa rally markets have been experiencing since just before Thanksgiving continues even after he dropped his presents around the world on Monday and faces the Boxing Day hangover.

As Goldman's Chris Hussey notes, a combination of...

-

strong consumer spending in stores (12/14 - Retail sales accelerate in November on sequential basis),

-

a rapid deceleration of inflation (12/22 - Core PCE Inflation falls further), and

-

a dovish tilt from the Fed (12/13 FOMC dots and the market shrugging off the post-FOMC jawboning)

...have all contributed to an extremely market-friendly backdrop for stocks - especially when you consider that US growth remains resilient as captured by the strong November labor reports.

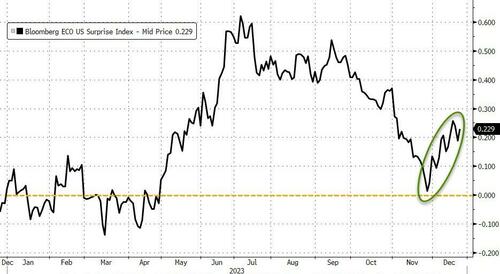

Today's economic data only added to the favorable narrative. The S&P Case-Shiller home price index increased in line with consensus expectations in October. The Chicago Fed National Activity Index jumped back above trend, the Philly Fed Services survey soared back into expansion, and the Dallas Fed manufacturing index for December came in higher than expected.

Source: Bloomberg

Small Caps continued to explode higher today, significantly outperforming the rest of the US majors today (which all managed solid 0.5%-ish gains) amid a low liquidity holiday week. Some late-day selling spoiled the party though...

'Most Shorted' stocks surged back up to erase last Wednesday's 0-DTE-driven pukefest...

Source: Bloomberg

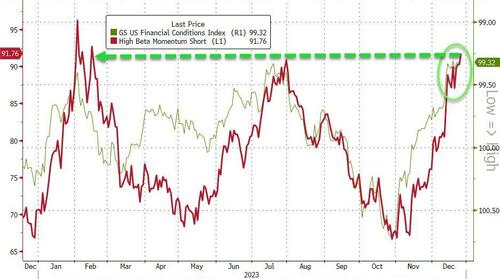

The previous biggest losers continue to dominate the gains as financial conditions have eased dramatically...

Source: Bloomberg

And the dash for trash continues...

Source: Bloomberg

VIX was smashed lower to within a tick of a 12 handle...

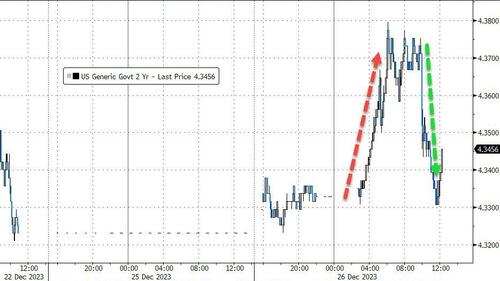

Treasuries were unchanged on the day but not after selling pressure overnight which was erased after a strong 2Y auction...

Source: Bloomberg

The 2Y yield was the biggest swinger...

Source: Bloomberg

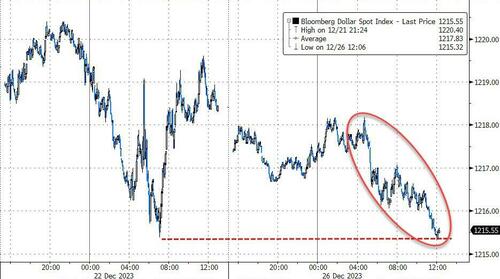

The dollar dipped back to Friday's lows amid very low liquidity in FX land...

Source: Bloomberg

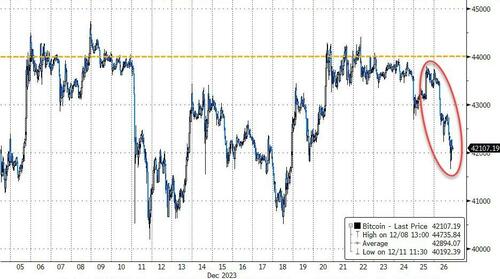

Bitcoin was clubbed like a baby seal, once again seeming stalling out around $44k...

Source: Bloomberg

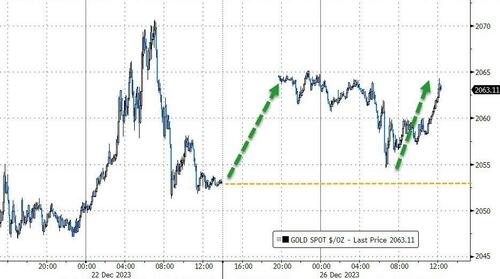

Spot gold prices rallied back above $2060...

Source: Bloomberg

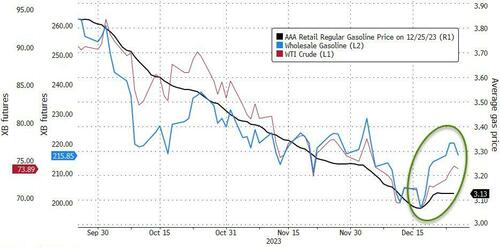

Oil prices surged today with WTI back above $76 for the first time since Dec 1st...

Which appears to have put a local low in the price of wholesale and retail gasoline...

Source: Bloomberg

Finally, this is odd...

Source: Bloomberg

Americans are spending more despite being considerably less confident.

More By This Author:

How Bankers Are Exploiting The Fed's Bailout Program At Your Expense

Yields Slide After Solid 2Y Auction Sees Biggest Stop Through Since June

US Home Prices Surged For 9th Straight Month In October, Led By Miami

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more