Yields Slide After Solid 2Y Auction Sees Biggest Stop Through Since June

Image Source: Pixabay

With few traders around, there was some concerns that based on an (erroneous) MLIV assessment, today's 2Y auction "may result in an auction tail). And as usual, that particular assessment proved to be dead wrong, because moments ago the US Treasury concluded the final sale of 2Y paper in what was a stellar auction.

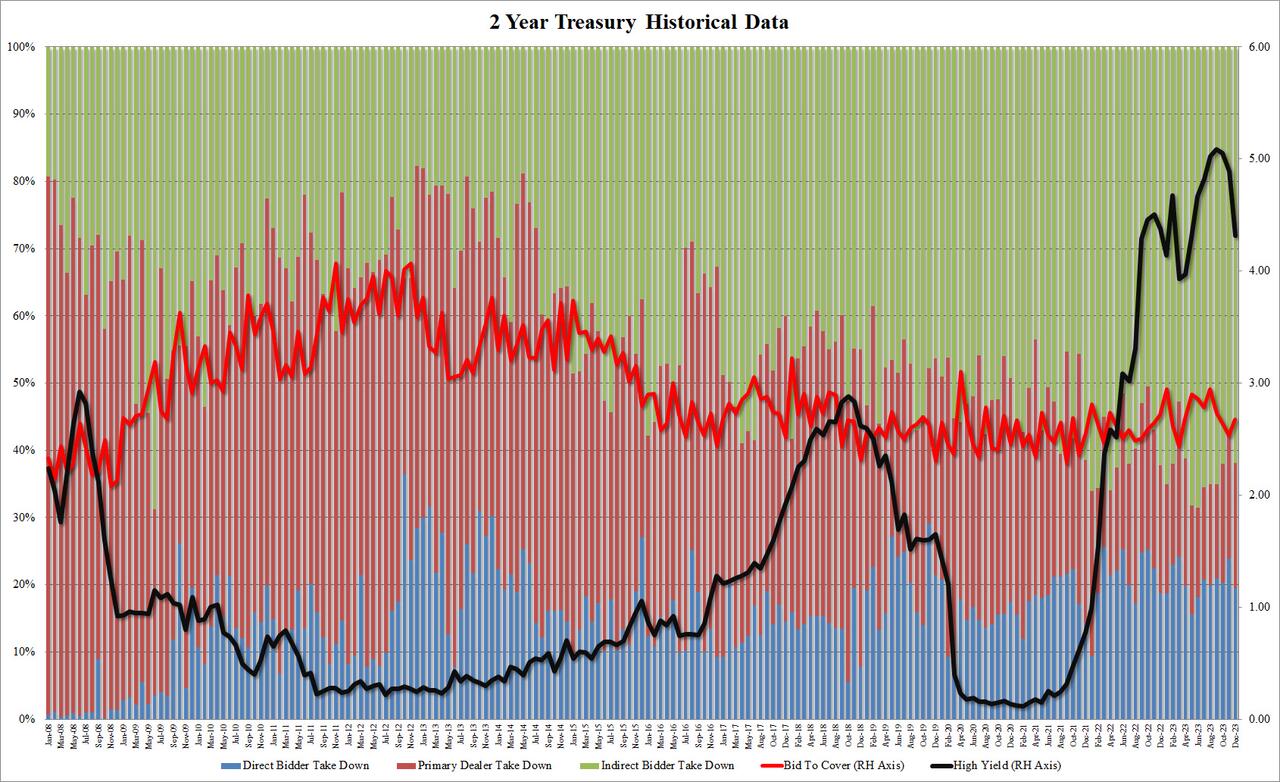

The high yield of 4.314% was sharply lower compared to last month's 4.887% and a far cry from the 5.085% cycle high hit in September; the auction also stopped through the 4.321% When Issued by 0.7bps, the biggest stop through for this tenor since June.

The bid to cover was also solid, rising from 2.536 to 2.679, if still below the 6-auction average 2.747.

The internals were very also solid, with Indirects awarded 61.9%, a solid rebound from last month's 57.4% if also below the recent average of 63.9%. And with Directs taking down 19.5%, a drop from last month's 23.9%, Dealers were left holding 18.6%, below last month's 18.8% but above the 6-auction average 15.4%.

(Click on image to enlarge)

Overall, this was a solid auction, which can be clearly seen in the sharp drop in rates across the curve and especially on the short-end where yields quickly dropped by 2bps.

(Click on image to enlarge)

More By This Author:

How Bankers Are Exploiting The Fed's Bailout Program At Your ExpenseUS Home Prices Surged For 9th Straight Month In October, Led By Miami

Yuan Overtakes Yen For 4th Place In Global Payments

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more