Bi-Weekly Economic Review: Same Old, Same Old

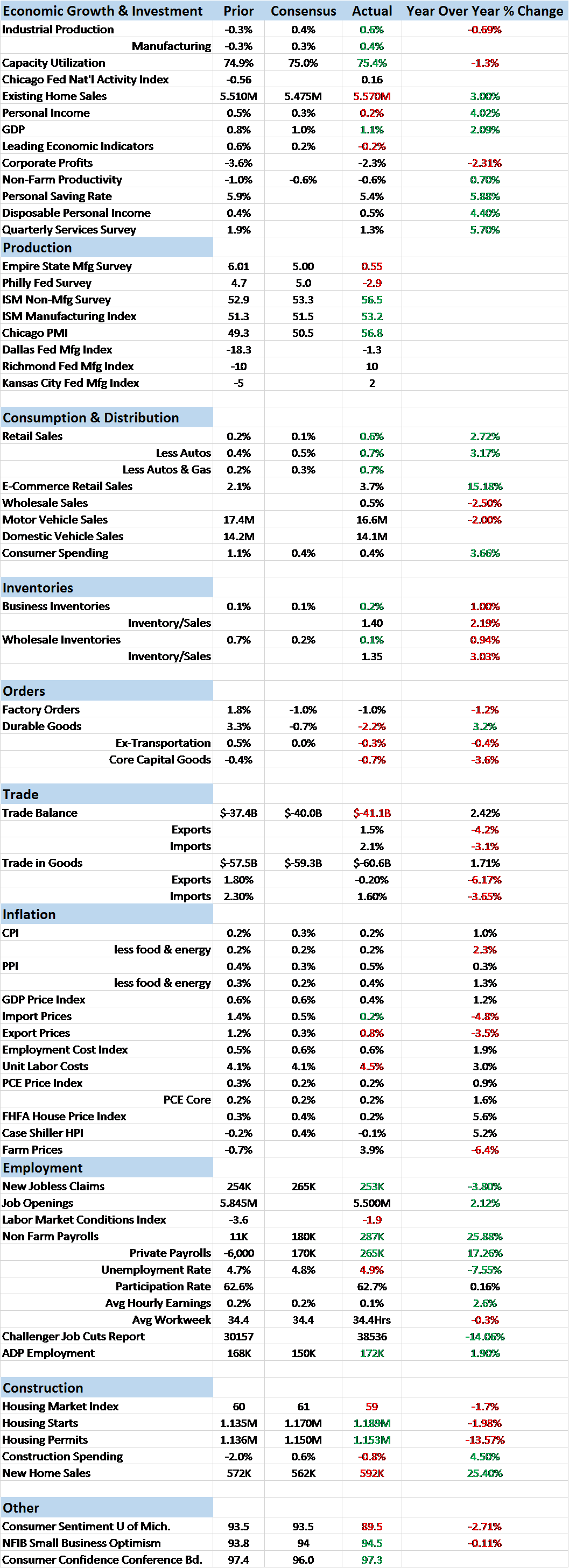

Economic Reports Scorecard

The economic data the last two weeks was deja vu all over again. The US economy has been growing at roughly 2% the last three years and I see no reason – yet – to expect that is going to change any time soon in either direction. Certainly there hasn’t been anything in the data to support that notion even if the data has generally been better than expected. Neither have our market indicators shown any dramatic moves that would indicate a major change in direction or rate of change.

There were the usual surprisingly strong reports. The retail sales report stands out in that regard, coming in not only better than expected but I think just better. Year over year rate of change is improving if still below what I’d call robust and ex-autos is doing even better. Non-store retailers – internet – are particular standouts and I think that is an indication of something bigger happening. My wife is not an economist but she knows how to shop and she recently told me that the “retail era is over”. We were in the car at the time and she pointed out the plethora of vacant retail space for lease. What I have observed is the rising incidence of packages on my doorstep. I also have a 26 year old daughter and can tell you that her generation has an entirely different view of consumption than ours, placing a lot more emphasis on doing rather than buying. There may be a lot more going on here than meets the retail sales report.

While the ex-autos portion of retail sales is doing fine, it is the auto part that shows the up and down nature of this economic expansion. Auto sales, as I mentioned in the last update, appear to have peaked for this cycle and that is probably not good news. Autos and housing have led us the last couple of years so if one of those is faltering – more on housing later – that could be a problem. Industrial production, as reported last week, is still down year over year and that is with autos up 7.8% year over year. Business equipment rebounded a little but is still down year over year. Again, this is with autos doing well; if autos moderate and nothing else comes along to pick up the slack, the manufacturing recession probably has more to go. At least inventory/sales rations appear to be stabilizing, albeit at high levels.

The labor markets have been repeatedly cited by the economic optimists as a positive but we continue to see problems. Jeff and I both are more concerned about the quality of jobs than the quantity but even the quantity may be starting to run into some problems. The JOLTS report showed a sizable drop in job openings in the last report and the labor market conditions index – one often cited by Yellen – continues to trend negative. Jobless claims however are still at the lowest levels of the expansion.

The housing market has been throwing off mixed signals. The housing market index came in slightly less than expected but is still above the 50 level. Housing starts were better than expected but last month was revised down significantly while permits continue to accelerate – in the wrong direction down 13.5% year over year. New home sales on the other hand are up 25% year over year (that report will actually be in the next update; I’m a little late getting this out). In addition, both the Case Shiller index and the FHFA house price index were soft so prices may be peaking which isn’t what one would expect in a robust market with fairly low inventory.

Overall, as I said, the economy continues to plug along at the recent trend. One of the best broad barometers of the economy is the Chicago Fed National Activity index. The most recent report showed the index at 0.16 just slightly over the 0 level that indicates growth at trend. That was actually an improvement over recent readings which have been consistently below zero. But not enough below zero to indicate a recession. In other words, just what I’ve been saying – there has not been much change in the economic growth or inflation profile. It isn’t great, it isn’t terrible but it is apparently enough to get Donald Trump on the Republican ticket and to give Bernie Sanders a near free rein in constructing the Democratic platform. Interesting times indeed.

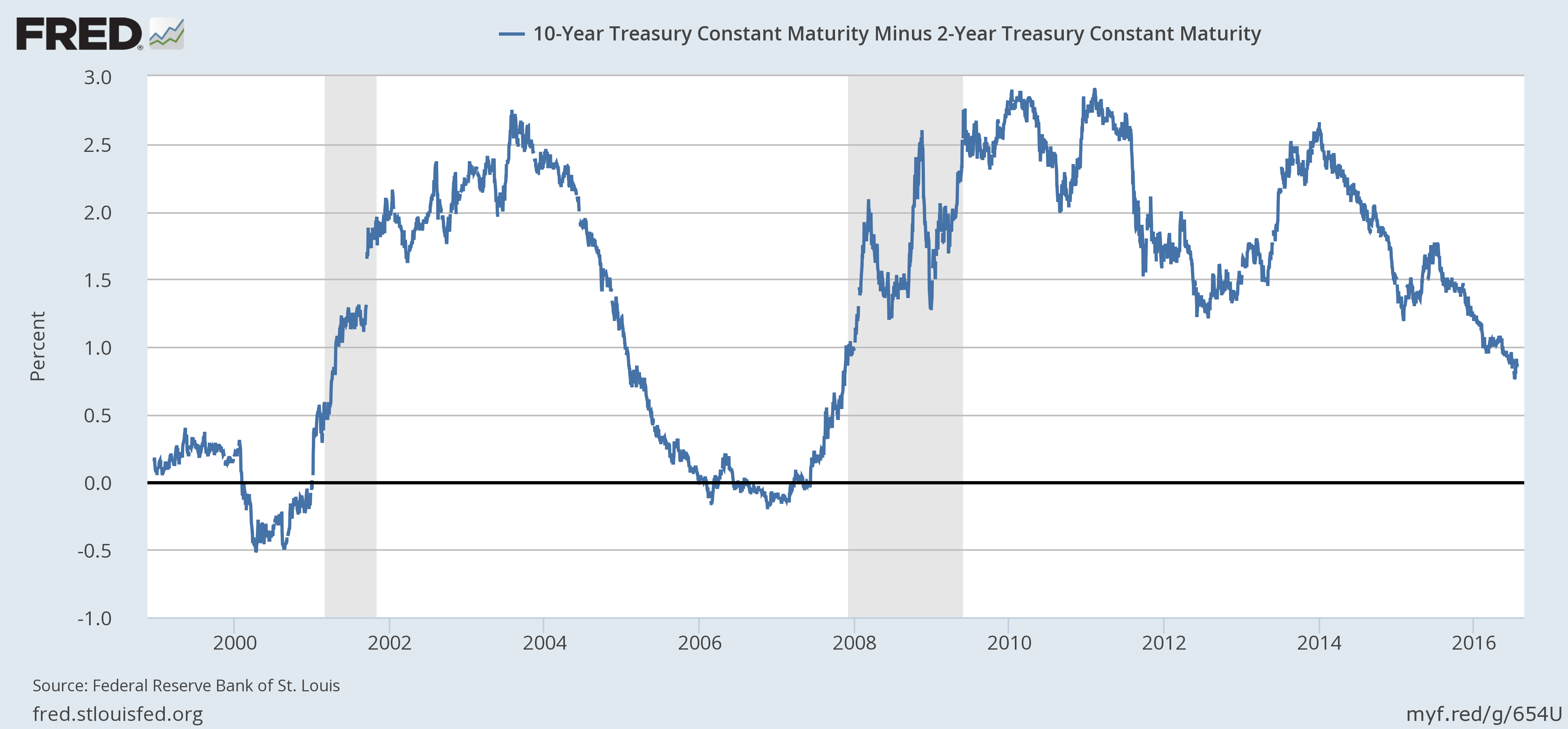

We see nothing in our market indicators to reflect a big change. The yield curve did steepen by 10 basis points since the last update but the overall trend is still obviously flattening.

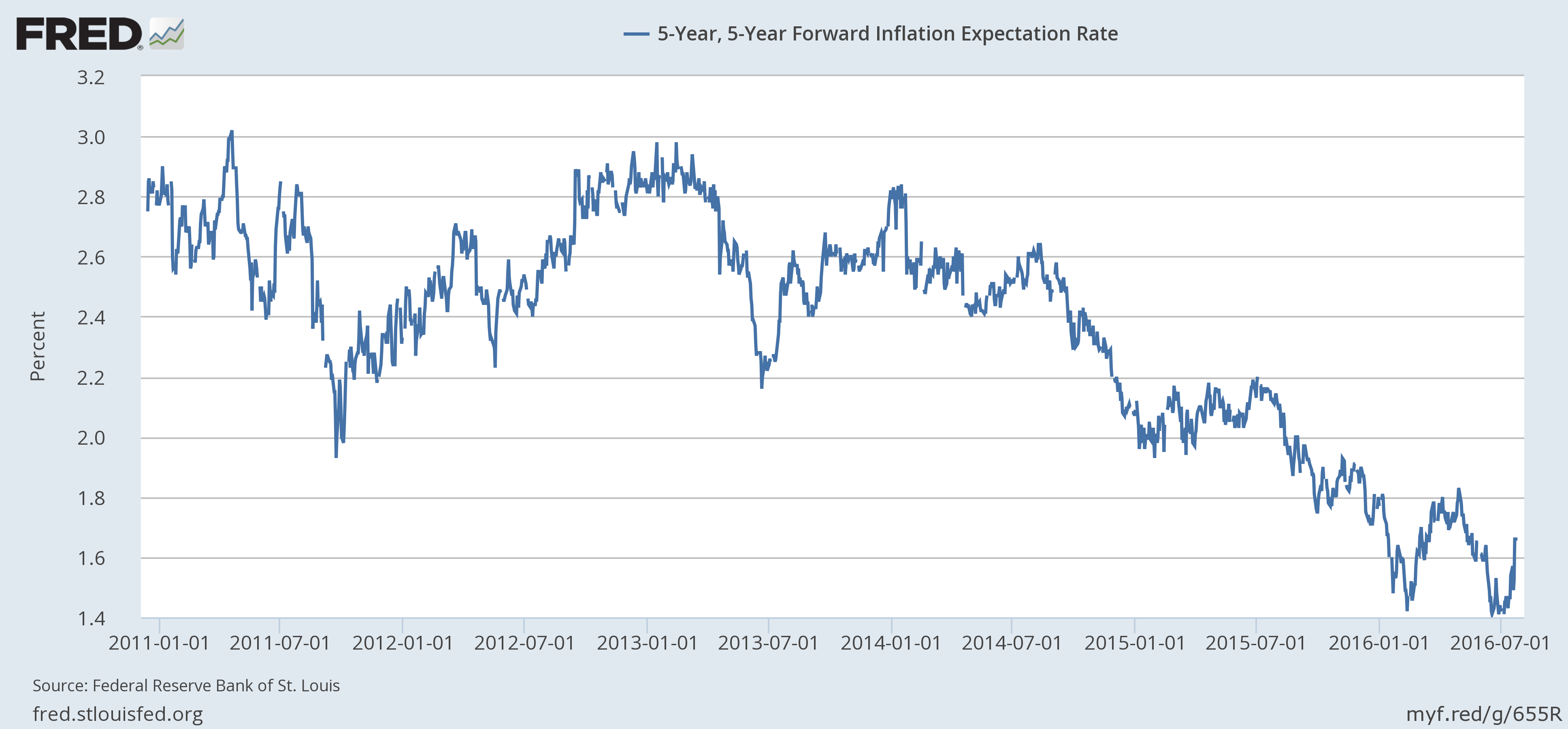

Inflation expectations did rise over the last two week

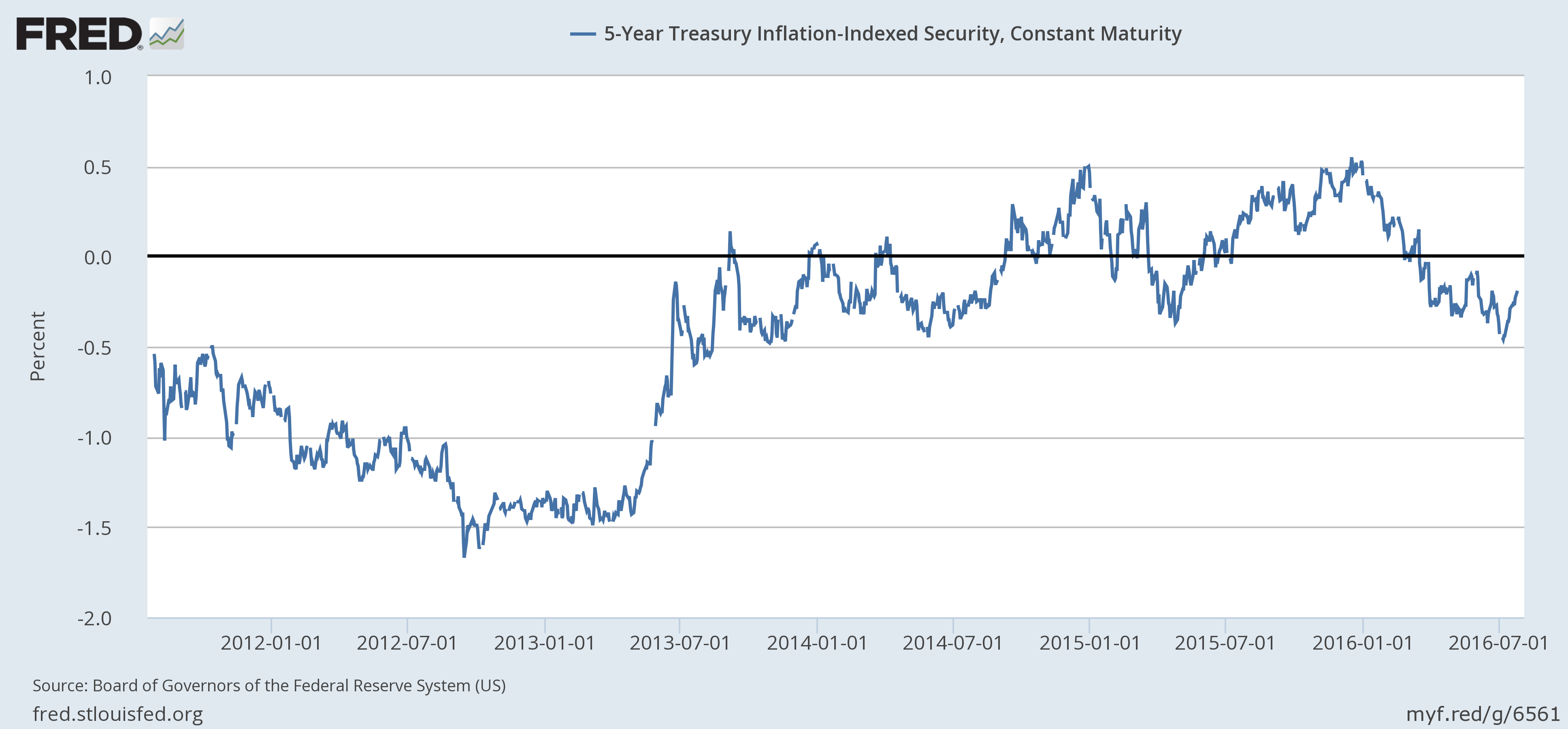

And real rates rose as well, an indication that there has been a slight rise in real growth expectations

It doesn’t appear to me though that the trend on either of these has changed, just so much noise based on some slightly better than expected data and Fed jawboning.

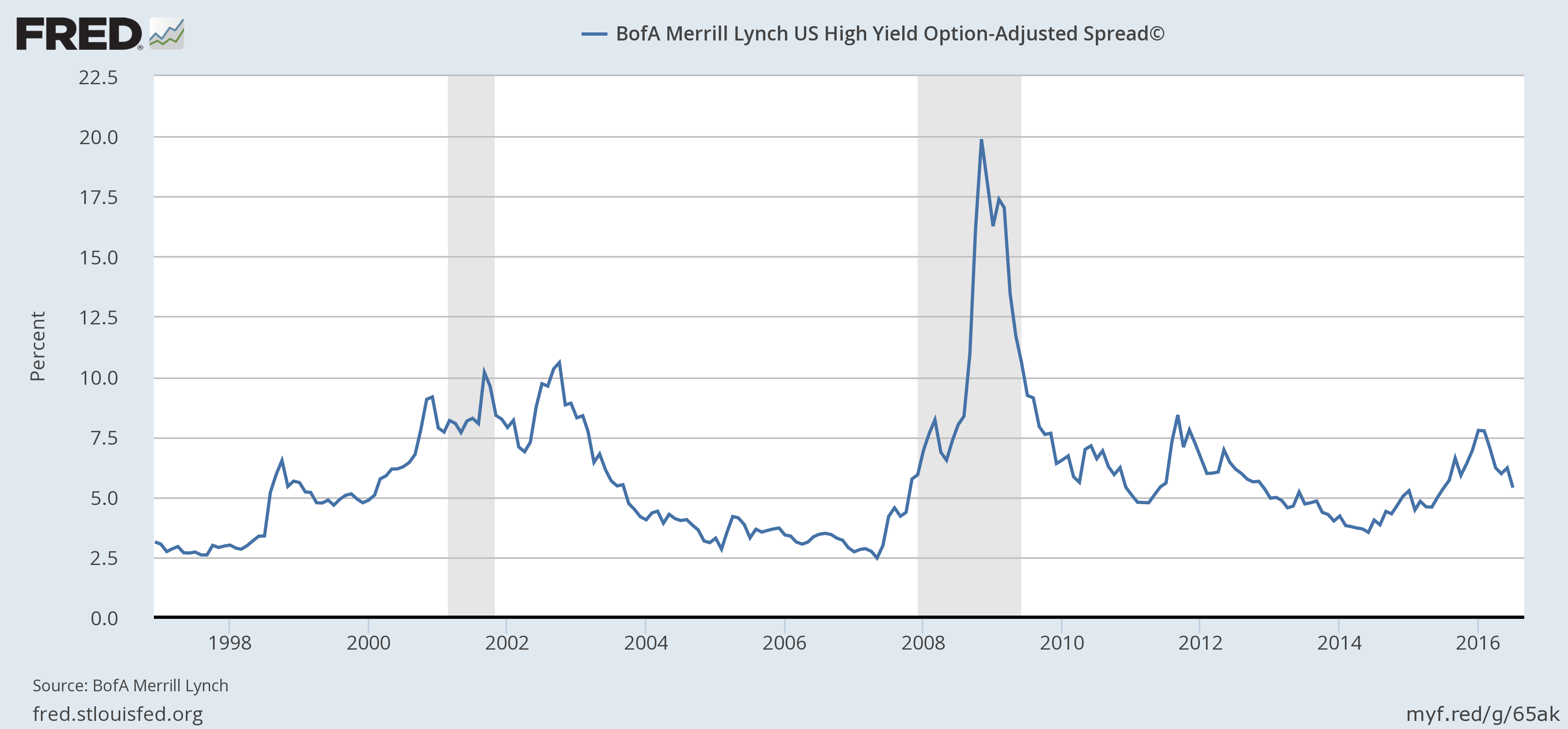

Credit spreads have narrowed further but are still indicating some stress:

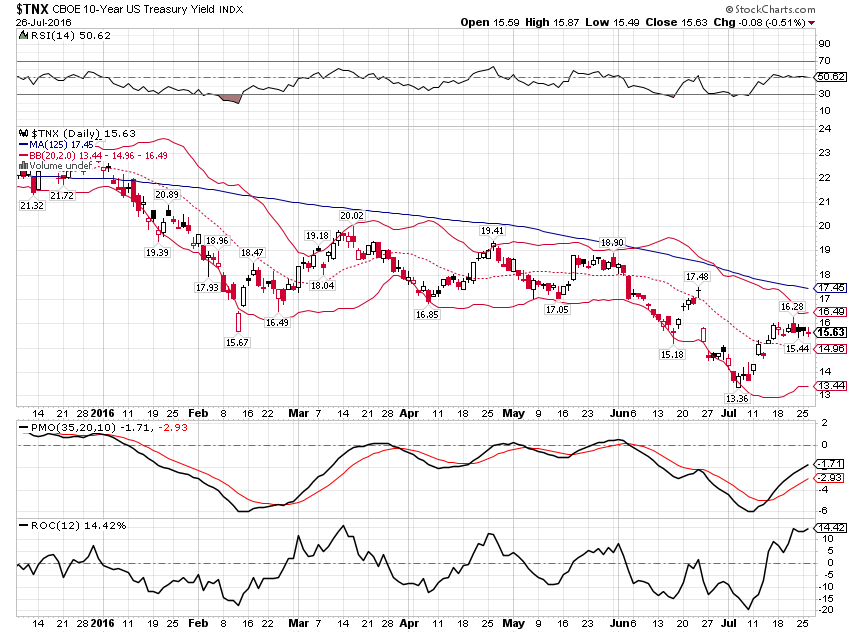

The 10 year Treasury yield, as would be expected from the above, has risen over the last couple of weeks. But the trend is very obviously still down and this looks, so far, like nothing more than a small correction of the larger downtrend.

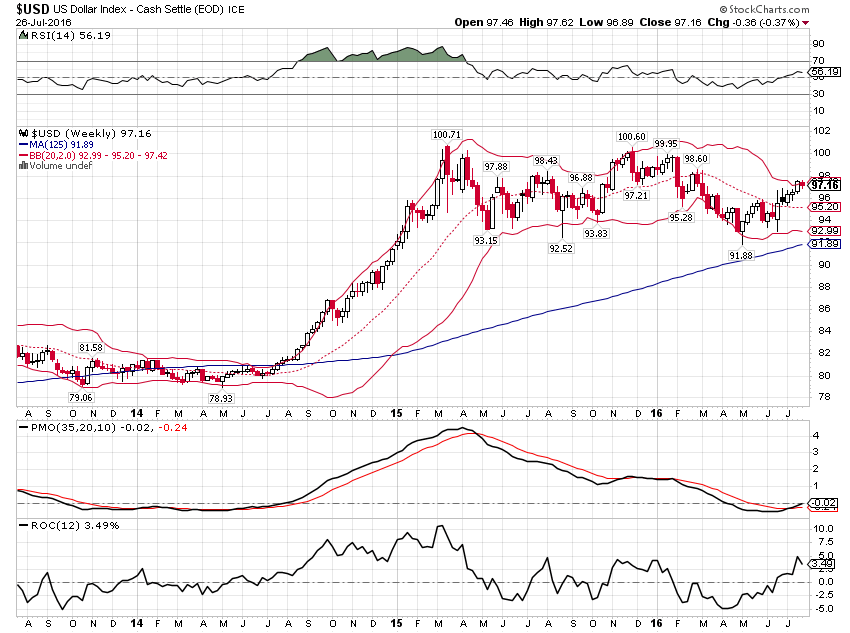

The dollar also reflects a slight shift to optimism about growth but in the bigger context doesn’t mean much.

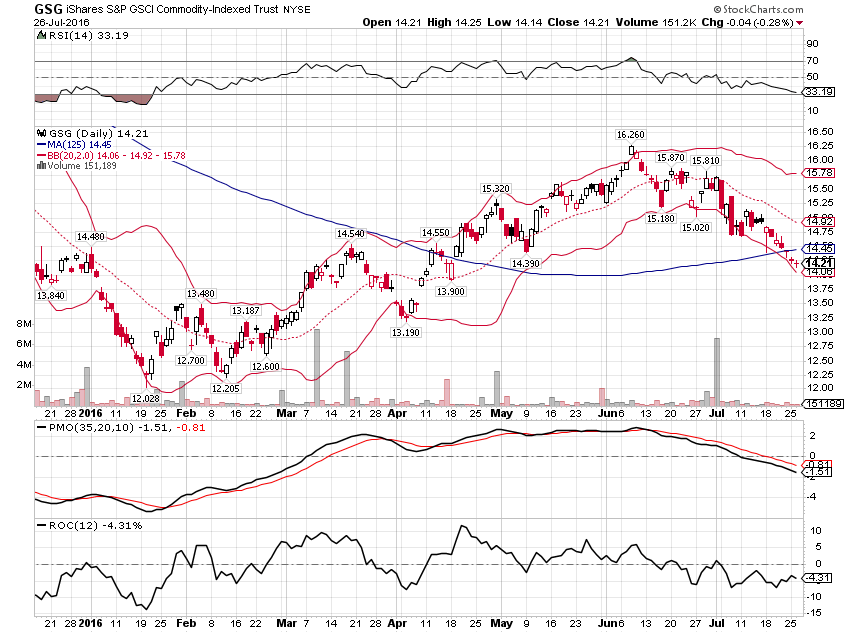

A higher dollar also means lower commodity prices which is usually a positive. But remember most of the stress earlier this year was caused by the turmoil in the energy sector caused by lower oil prices. One hopes that oil companies have adjusted to lower prices – at least the ones that could – but if the dollar keeps rising and commodities falling there may be another shoe to drop in the mining/energy sectors. I don’t expect the dollar strength to continue but that might depend on what the Fed has to say later this week.

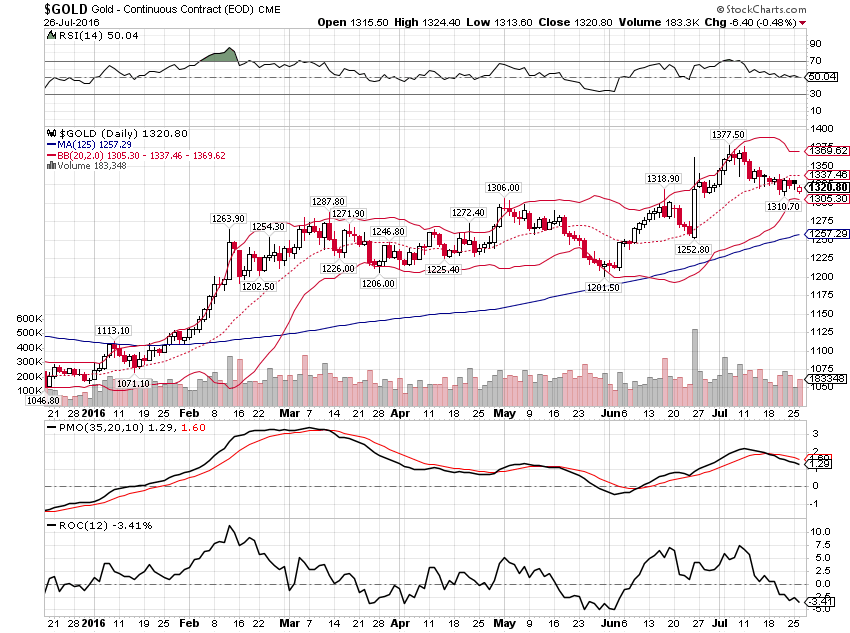

Gold pulled back too but the uptrend looks intact to me. Capital flowing into gold is not a positive sign for future growth.

There has been a slight uptick in growth and inflation expectations since the last update but overall I don’t think there has been much change in the economic outlook. I’m not sure the Fed will see it that way in their meeting though. They still want to raise rates if for no other reason than to have room to cut them when the next recession arrives. A recession that will probably arrive sooner than if they don’t hike rates but at least they’ll be able to cut them when it does. Or something like that; no one said logic was the Fed’s strong suit. In any case, they may see the recent minor uptick in activity – and a stock market near all time highs – as a good reason to prepare the market for another rate hike. Of course, their “preparation” will probably impact the market so much they’ll chicken out when the time comes but that probably won’t stop them from trying. Oh what a tangled web we weave when first we practice to forward guidance.

Disclosure: This material has been distributed for ...

more