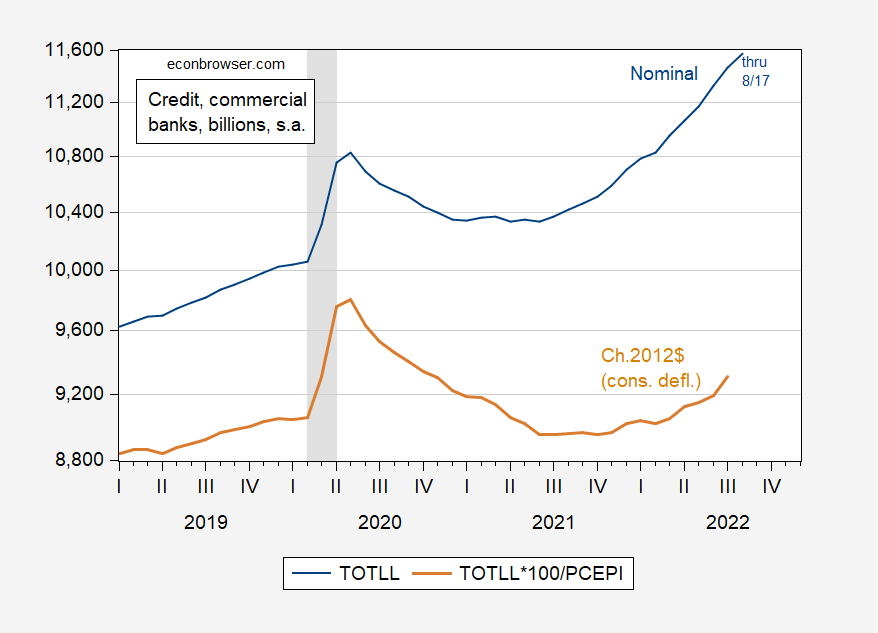

Bank Lending, Thru Aug. 17

Or, a post for Steven Kopits.

Figure 1: Loans and Leases in Bank Credit, All Commercial Banks, in billions $, s.a. (blue), and in billions Ch.2012$, s.a. (tan), both on log scale. Real series PCE price index deflated. NBER defined peak-to-recession dates shaded gray. Source: Federal Reserve via FRED, series TOTLL, BEA via FRED, NBER, and author’s calculations.

In the run-up to the 2007 recession, nominal and real lending growth were decreasing. As of July (for real) and August 17 (for nominal), growth rates are rising. (Note that because I have plotted both series on a log scale, an increasing slope denotes a rising growth rate; this is an attribute of logs that Jim Hamilton has highlighted in the past).

I welcome any cogent arguments, based on data, for why we should consider ourselves in August (or in H1) in a recession, from the usual suspects.

More By This Author:

GDP, GDO, GDP+, Hours And IncomeWeekly Economic Activity Measures For The Week Ending Aug. 20

Nonfarm Payroll Employment And Implications Of The Preliminary Benchmark Revision