Average Software Stock Now Down Since Tariff Tantrum Lows

Image Source: Pixabay

The DeepSeek sell-off late last January followed by the tariff tantrum in early April caused US stocks to plummet. From peak to trough, the S&P 500 fell 19% on a closing basis, just shy of bear market territory, while the Tech-heavy Nasdaq 100 fell 23%.

Once the Trump administration reined in its horns on tariffs, the market flew higher. The six months following the tariff-tantrum low on April 8th was one of the strongest six-month moves in the market's history (+35%), but equities have basically been flat since that six-month move that ended last October.

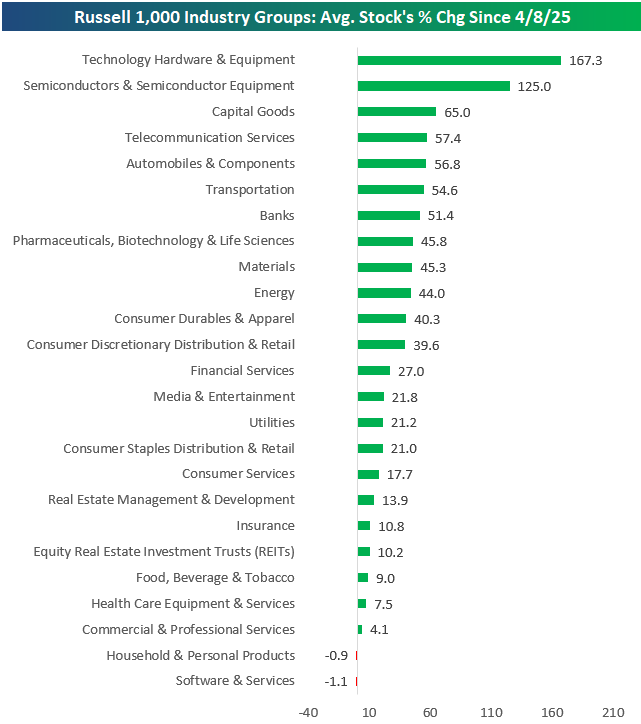

The average stock in the Russell 1,000 is still up roughly 37% since the April 8th tariff-tantrum low, but performance across industry groups has been eye-opening.

As shown below, after the sell-off we've seen in software names recently due to the perceived threat from AI, the average stock in the Software & Services group is now down since the April 8th low! The average Household & Personal Products stock is also down since then, but these stocks have actually been flying in the last couple of weeks as software sells off.

Amazingly, while software is in the red since Trump's tariff turmoil, the two groups where stocks are up the most are in the hardware space. Tech Hardware & Equipment stocks are still up an average of 167% since 4/8/25, while Semis are up 125%. That's basically double the next best group -- Capital Goods (+65%).

About 23% of Russell 1,000 stocks are lower today than they were at the close on 4/8/25.

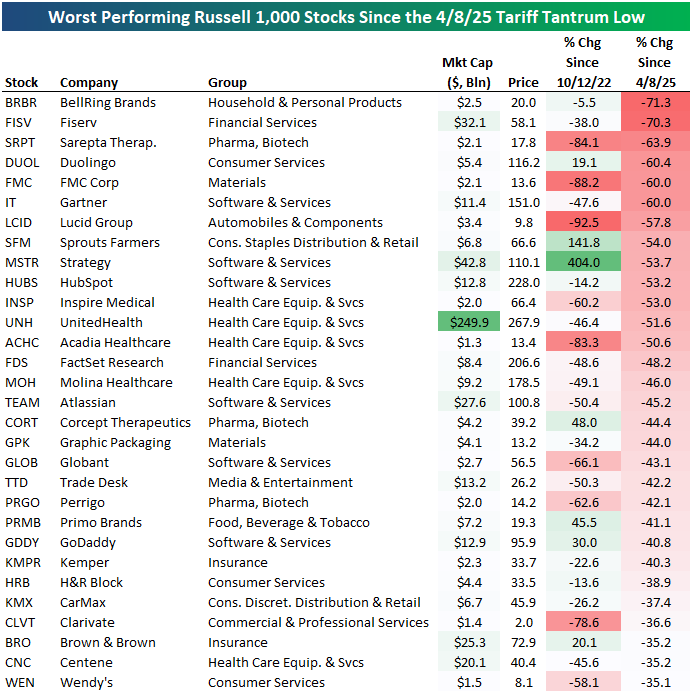

Below are the 30 stocks in the index that are down the most:

More By This Author:

Walmart: The First Trillion Dollar Big BoxPrecious Search Interest

Software Bear Market

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more