AUD/USD Weekly Forecast: Bearish Sentiment As RBA Cut Looms

Image Source: Unsplash

- The AUD/USD weekly forecast points south as market participants bet on an RBA rate cut.

- Data during the week revealed stronger wage growth in Australia in Q1.

- The dollar had a strong week on lingering optimism over the US-China trade truce.

The AUD/USD weekly forecast points south as market participants bet on an RBA rate cut next week.

Ups and downs of AUD/USD

The AUD/USD price had a bearish week despite upbeat employment figures from Australia. Data during the week revealed stronger wage growth in the first quarter. Moreover, a separate report showed a bigger-than-expected increase in employment. However, despite the positive figures, traders maintained bets of a rate cut next week, weighing on the Australian dollar.

Meanwhile, in the US, inflation figures were cooler than expected, increasing pressure on the Fed to lower borrowing costs. However, sales figures came in slightly better than expected. The dollar had a strong week on lingering optimism over the US-China trade truce.

Next week’s key events for AUD/USD

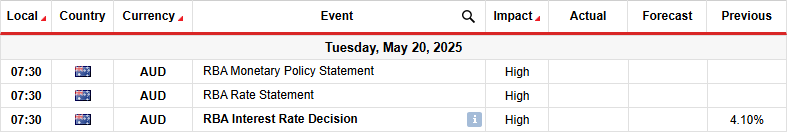

(Click on image to enlarge)

Next week, market participants will focus on the Reserve Bank of Australia policy meeting. Despite strong employment data during the week, traders have maintained their bets for a 25-bps rate cut.

RBA policymakers are more focused on inflation, which has been easing. At the same time, Trump’s tariffs downgraded global growth, forcing most central banks to consider faster easing cycles.

Traders will also focus on the messaging about future rate cuts. Although the central bank might cut next week, market participants are pricing fewer cuts this year due to the solid labor market.

AUD/USD weekly technical forecast: Bulls struggle to find footing after a breakout

(Click on image to enlarge)

AUD/USD daily chart

On the technical side, the AUD/USD price has paused below the 0.6500 key psychological level after breaking out of its consolidation area. The price has pulled back to retest the 22-SMA while the RSI trades slightly above 50, suggesting a bullish bias.

Initially, the price was caught in a range between the 0.6150 support and the 0.6351 resistance level. Bears were the first to attempt a breakout. However, they failed to sustain a move lower. Soon after that, bulls gained enough momentum to break above the range resistance.

However, the breakout was weak, marked with small-bodied candles. Moreover, bulls have not found their footing above the range area. A break above the 0.6500 key level would make a higher high, strengthening the bullish bias. Otherwise, the price will remain in consolidation.

More By This Author:

USD/CAD Weekly Forecast: Dollar Rises On Eased Trade Worries

USD/CAD Price Analysis: Fed Under Pressure Amid Easing Economic Indicators

AUD/USD Forecast: Aussie Drifts South Despite Strong Jobs

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more