USD/CAD Weekly Forecast: Dollar Rises On Eased Trade Worries

Photo by Michelle Spollen on Unsplash

The USD/CAD weekly forecast shows increased demand for the dollar amid easing global trade tensions.

Ups and downs of USD/CAD

The USD/CAD pair had a bullish week as the dollar strengthened and the Canadian dollar weakened. The dollar strengthened despite downbeat economic data as investors remained optimistic about the recent trade truce between the US and China.

Figures on inflation revealed weaker price pressures, increasing chances of a Fed rate cut in September. Meanwhile, retail sales came in slightly above estimates. However, sales dropped significantly from the previous month.

On the other hand, the Canadian dollar fell as oil prices dropped. Oil dipped after Trump announced a likely nuclear deal with Iran, increasing oversupply worries.

Next week’s key events for USD/CAD

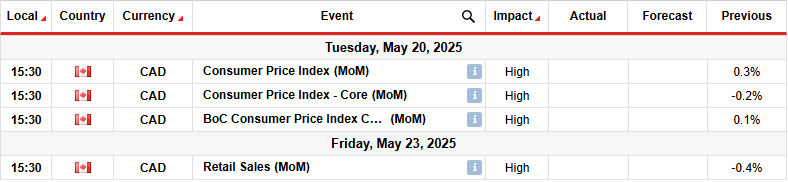

Next week, Canada will release major reports showing the state of inflation and consumer spending. In the previous reading, inflation increased by 0.3%. A bigger-than-expected figure will lower expectations for a Bank of Canada rate cut in June. Policymakers would opt to continue the pause they started in April. However, a soft figure will increase bets of a rate cut. At the moment, traders are pricing a slightly over 50% chance of a cut on June 4th.

The retail sales report will show the state of consumer spending, also shaping the outlook for BoC rate cuts.

USD/CAD weekly technical forecast: Bulls aim for the 1.4100 resistance after takeover

USD/CAD daily chart

On the technical side, the USD/CAD price has broken above the 22-SMA, signaling a bullish sentiment shift. At the same time, the RSI trades above 50, suggesting solid bullish momentum. Previously, the price was dropping fast until it neared the 1.3801 support level. Here, price action slowed, and candlesticks became smaller.

Moreover, as the price edged lower, the RSI edged higher, indicating a bullish divergence. This was a clear sign that bears were exhausted. However, bulls still have to push the price higher to confirm a new direction. A break above the 1.4100 would strengthen the bullish bias. Moreover, it would allow USD/CAD to climb and challenge higher resistance levels. However, if this does not happen, bears might return to push the price below the SMA and resume the previous decline.

More By This Author:

USD/CAD Price Analysis: Fed Under Pressure Amid Easing Economic IndicatorsAUD/USD Forecast: Aussie Drifts South Despite Strong Jobs

AUD/USD Price Analysis: Aussie Rallies On Strong Wage Data

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more