AUD/USD Was Stuck On The Low End Of Near-Term Losses As Friday Markets Flatlined

Image Source: Unsplash

- The AUD/USD currency pair was seen cycling just north of the 0.6550 mark on Friday.

- The lack of Australian data to chew on left the AUD/USD duo in the lurch.

- Next week will feature double-header showings from the RBA and the Fed.

The AUD/USD currency pair was seen churning just above the 0.6550 mark on Friday as markets prepared for next week’s double feature from the Reserve Bank of Australia and the US Federal Reserve. Both central banks are broadly expected to hold interest rates steady as investors will primarily focus on when rate cuts will come.

According to the CME’s FedWatch Tool, money markets were recently thrown a curve ball, and bets of a June rate cut from the Fed have eased to 60%, down from 70% at the start of the week.

Next week also brings Australia’s latest labor and employment figures on Thursday, and median market forecasts expect Australia’s Employment Change in February to add 30,000 new jobs, while the Unemployment Rate is forecast to tick down to 4.0% from 4.1%. Preliminary Judo Bank Australian Purchasing Managers Index figures for February are also scheduled for early Thursday.

Broader markets will be focusing on next Wednesday’s Fed rate statement, where the US central bank is also expected to update the Fed Dot Plot summary of interest rate expectations. The near-term end of the Dot Plot curve is expected to tick up to 5.5% from the current 4.6%.

With markets pinning hopes on at least three 25 basis point rate cuts from the Fed in 2024, investor sentiment has been at odds with the Fed’s own rate outlook for the entire year. The Fed projected three rate cuts through 2024, while money markets priced in an eye-watering six or seven rate cuts through the year, totaling nearly 200 basis points in rate trims for the year.

As the US economy continues to churn at a healthy clip and inflation remains stubbornly sticky, markets have had little choice but to slash rate cut expectations, and rate futures traders appear to be half-heartedly hoping for a June rate cut.

AUD/USD Technical Outlook

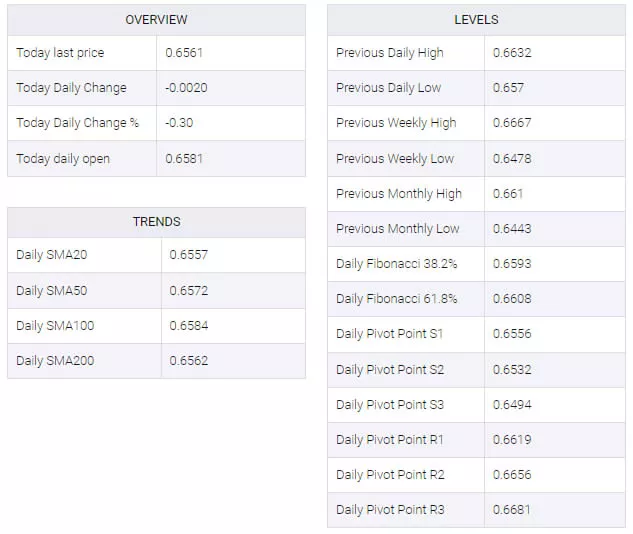

The AUD/USD currency pair spent most of the trading week on the low side, backsliding into the 200-hour Simple Moving Average (SMA) near 0.6580 on Thursday. The 50-hour and 200-hour SMAs started a bearish crossover near the 0.6585 mark as intraday price action tilted into the bearish side. The pair flubbed a brief bullish push into the 0.6640 figure early in the week.

Friday’s third of a percent decline saw the Aussie clattering into the 200-day SMA against the US dollar near the 0.6560 mark, and momentum was seemingly tilted into bear country as the pair failed to find bullish momentum after a rebound from the last swing low into the 0.6450 handle.

AUD/USD Hourly Chart

(Click on image to enlarge)

AUD/USD Daily Chart

(Click on image to enlarge)

AUD/USD Technical Levels

More By This Author:

Canadian Dollar Settled Flat Against The Greenback On Friday As Markets Buckled Down

USD/JPY Steady, But On The Low End As Investors Knuckle Down For US CPI Inflation

Canadian Dollar Fell Against The Greenback After Wildly Mixed NFP