Asia Morning Bites For Thursday, July 25

Image Source: Unsplash

Global Macro and Markets

- Global Markets: Treasury markets had a mixed performance on Wednesday, as the front-end of the yield curve continued to outperform the belly and back-end of the curve. 2Y UST yields fell 2.3 basis points to 4.352%, while the 10Y yield edged 3.3bp higher to 4.284%. EURUSD is also down a little more over the last 24 hours, and is currently trading at 1.0839 down from around 1.0850 yesterday. That has helped bring the AUD down below the 66-cent level to 0.6578 where, ahead of the August 6 Reserve Bank of Australia meeting, it looks a bit oversold according to relative strength indicators. Cable continues to hang on to 1.29, despite a fairly volatile day, and the JPY continues to make gains, as USDJPY falls to 153.80. It has been fairly quiet in the rest of the Asia FX space, though USDCNY dropped down to 7.2635, and the KRW has also dropped down to just below 1380. US equity markets had a terrible day on Wednesday. The S&P 500 was down 2.31%, and the Nasdaq fell 3.64% as market sentiment towards the AI trade cooled further.

- G-7 Macro: US PMI data were a bit mixed yesterday. The manufacturing PMI index dropped back below 50 (49.5), indicating a mild contraction, but the service sector PMI made small gains rising to 56.0 from 55.3 and helping to lift the composite index slightly. New home sales for June weren’t much changed from May, though slightly undershot forecasts. Today, the US will publish the advance estimate of its second quarter GDP. This is expected to come in at 2.0% (saar), better than the 1.4% recorded for the first quarter. We will also get the 2Q24 PCE and core PCE numbers, which will give a steer to the June PCE data released tomorrow, though not a foolproof one as there are likely to be some revisions to historical data that mean you can’t just back the number out with any confidence. Durable goods orders for June wrap up the US data for Thursday. Elsewhere, we have Germany’s Ifo business climate index. This had been showing a slight recovery until a couple of months ago when its upturn looked to tail off and turn down again. The market seems to think that it may edge slightly higher again this month, though there is a wide spread of opinion, and the median “guess” is probably just the market herding together for safety.

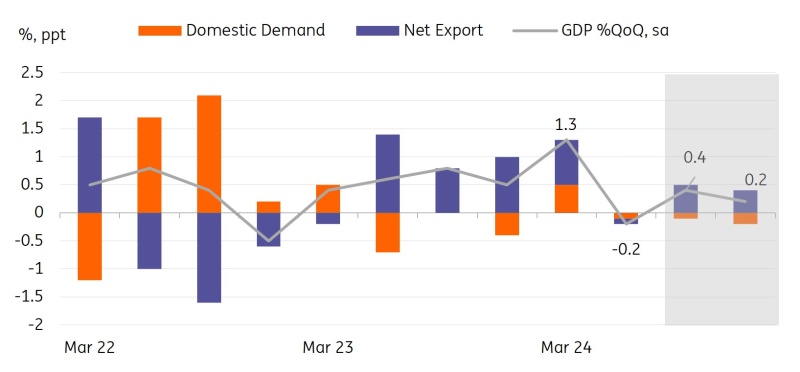

- South Korea: 2Q24 GDP contracted unexpectedly by 0.2% QoQ sa (vs 1.3% in 1Q24, 0.1% market consensus) mainly due to sluggish domestic growth. We had expected South Korea’s GDP to slow sharply, but not to the point of falling into contraction territory. As expected, domestic growth components were weak except for government spending, which rose 0.7%. Private consumption, construction, and facility investment dropped 0.2%, 1.1% and 2.1% respectively, broadly in line with our expectations.

The downside surprise came mainly from trade, as imports grew faster than exports. Export growth moderated to 0.9% (vs 1.8% in 1Q24), which was weaker than was suggested by the monthly customs export data. Meanwhile, import growth rebounded to 1.2% (vs -0.4% in 1Q24). The contribution of net exports turned negative in 2Q24 (-0.1%pt) for the first time since 1Q23. Given the weaker-than-expected 2Q24 GDP, we have revised the annual GDP outlook downwards from 2.6% YoY to 2.3%.

We recently warned that the BoK would face challenges in its monetary policy decision as inflation cools towards 2% and sluggish domestic growth supports a rate cut, but at the same time, concerns about rising household debt are growing. We continue to believe that today's weak GDP data will not put the BoK in a hurry to cut rates in August. We believe that more policy coordination between the government and the central bank is needed to address the issue of house prices and household debt. In the meantime, we maintain our BoK call for a cut in October.

-

Korea's composite business sentiment index fell by 0.6pt to 95.1, but the outlook index rose by 0.3pt to 93.4. The manufacturing CBSI dropped, while non-manufacturing CBSI rose. We believe this month’s survey results are largely driven by seasonal factors. Ahead of the summer holiday season, the non-manufacturing sector is likely to increase sales while manufacturing slows its production.

-

Singapore: The Monetary Authority of Singapore is not expected to change any of its policy settings when they announce this shortly. We expect a slight easing to come at the October meeting if core inflation continues to make progress.

South Korea's GDP unexpectedly contracted in 2Q24

Source: CEIC, ING estimates

What to look out for: South Korea's GDP, Singapore's MAS

July 25th

Vietnam: July CPI, Trade balance, Exports and Imports (By 31st July 2024)

S Korea: 2Q24 GDP

Japan: PPI services

Singapore: July MAS Monetary Policy Statement

Australia: Judo Bank PMIs

India: HSBC PMIs

July 26th

Japan: July Tokyo CPI, Leading index CI

Singapore: June Industrial production

US: U. of Mich. Sentiment

More By This Author:

Bank Of Canada Is Not Afraid Of Diverging From The Fed

Accelerating Wage Growth Is Another Inflation Risk For Hungary

Rates Spark: Why September Looks Like A Good Month For An ECB Rate Cut

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more