Accelerating Wage Growth Is Another Inflation Risk For Hungary

Image Source: Pexels

Average Hungarian wage growth accelerated markedly in May, contrary to expectations. Real wage growth is back in double-digit territory, which poses a further underlying inflation risk once the propensity to save wanes.

The latest figures from the Hungarian Central Statistical Office (HCSO) brought a significant positive surprise on wages. Average wage growth accelerated to 14.8% in May, breaking the previous slowing trend. This was the strongest year-on-year increase in wages since the start of the year. As a result, the expectations at the beginning of the year have not yet been confirmed. Wage growth is much stronger than the change in the guaranteed minimum wage (+10%). What's more, we thought that the rapid increase seen at the beginning of the year was just a carry-over effect, but with wage growth accelerating, this may no longer be the case. We also note that, according to company surveys at the beginning of the year, firms were expecting wage increases in the 5-10% range, but these plans were overtaken by the reality of the labour market.

Although, in principle, we see an easing of labour market tightness, as the number of full-time employees on an annual basis remains lower than a year earlier, looking at one-month changes, we see a gradual increase in the number of employees from January 2024. Firms' demand for labour continues to provide workers with good bargaining positions, with new entrants and job changers able to negotiate increasingly higher wages. The dynamic rise in average wages in the national economy may also be supported by the retreat of the shadow economy. This is also reflected in labour-related tax revenues in the budget, while high wage dynamics are not reflected in consumption and, thus, in the development of VAT revenues.

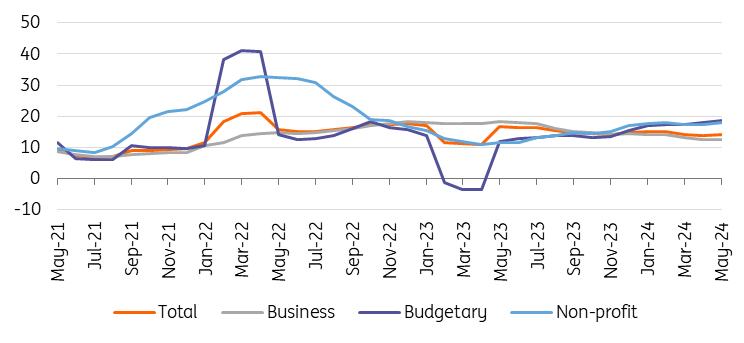

Hungarian wage dynamics

3-month moving average, % YoY

Source: HCSO, ING

Looking at the May data in more detail, the high average wage growth is mainly driven by pay settlements in the public and non-profit sectors. In both cases, the increase in teachers' salaries plays an important role. The annual rate of wage growth in the public sector is 18.5%, and in the non-profit sector, 19%. By contrast, the average wage increase in the corporate sector is 'only' 13.5%, but here, too, there has been a significant acceleration compared with the wage outflows of previous months. The latest figure far exceeds expectations at the beginning of the year that wage dynamics in the private sector could fall into the single digits by the middle of the year.

As much as high wage dynamics can bring about positive changes in the real economy, they also signal risks. We believe that wage growth in the competitive sector could remain in double digits. When it comes to the economy as a whole we see this year’s average wage growth in the 12-13% range. This, together with an easing of household caution and a stronger propensity to consume, could also increase the pricing power and willingness of companies. This, in turn, raises the issue of a possible price-wage spiral. In our view, the National Bank of Hungary should monitor wage developments as well as services inflation in its future interest rate decisions. It was, therefore, a surprise that the central bank did not express its concerns regarding the wage growth in its July rate decision and, despite its careful and patient approach, cut rates in July.

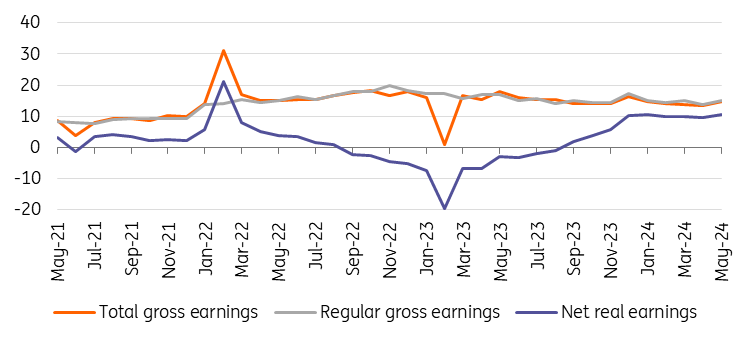

Nominal and real wage growth (% YoY)

Source: HCSO, ING

As for the private sector, one sector is worth highlighting: for the first time in a long time, the manufacturing sector recorded above-average wage growth. This is partly explained by one-off bonus payments and a significant reduction in the workforce, presumably involving the dismissal of lower-paid workers, so that the composition effect pushed up the average.

The gap between the average and median wage has also continued to narrow, partly as a result of the increase in the minimum wage and the retreat of the economy. Moreover, regular earnings are also growing dynamically, so it was not just one-off payments that kept the pace of wage growth high in May. Although inflation has started to pick up, the more dynamic pace of average wage growth has brought annual real wage growth back into the double digits after some acceleration.

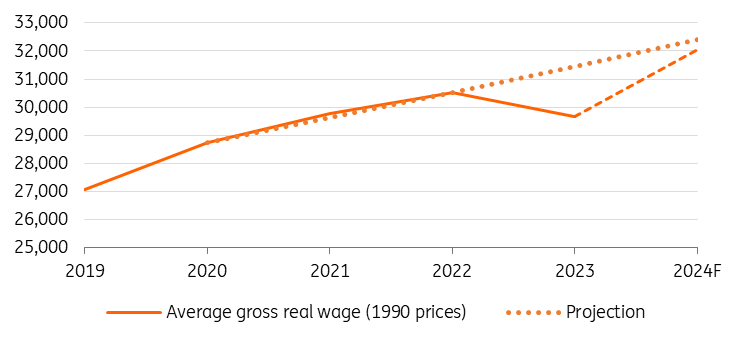

The level of average gross real wages

1990 CPI adjusted, HUF

Source: HCSO, ING

We see average wage growth of around 12-13% this year and average inflation of 4.1% in 2024. Against this backdrop, real wage growth could reach 8%. While this looks very strong, it would only mean that, on top of last year's fall in real wages, the purchasing power of average wages would be around 5% higher than the real wage level in 2022. In other words, there is more of a catching-up process after the fall in 2023, as the purchasing power of the average wage is still expected to remain below the non-crisis projection.

More By This Author:

Rates Spark: Why September Looks Like A Good Month For An ECB Rate CutFX Daily: Bank Of Canada To Double Down On Divergence

Asia Morning Bites For Wednesday, July 24

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more