Asia Morning Bites For Friday, July 26

Image Source: Unsplash

Global Macro and Markets

- Global Markets: US treasury yields were flat at the 2Y part of the curve yesterday, but they dropped a little further at the back end. 10Y yields fell 4.3 basis points, taking the yield down to 4.241%. This occurred despite some stronger 2Q24 GDP data and also some stronger quarterly core PCE figures. Markets don’t seem to be losing confidence in a September rate cut, though this latest set of data may put thoughts of a July cut to rest. EURUSD has recovered slightly to 1.0850. The AUD fell further yesterday, taking it to the low end of 65 cents before bouncing slightly. It is 0.6541 currently. Cable fell on Thursday, relinquishing the 1.29 level it had been clinging to and falling to 1.2856. The JPY tried to break down through 152 before climbing back to 153.59 as of writing. A number of Asian markets closed were closed yesterday due to typhoons, but USDCNY dropped sharply though has since bounced off its 7.21 lows and is now back to 7.2469, though that is still a decent appreciation for the CNY and may pull a number of other currencies in its wake (such as the MYR) if it can be maintained or improved on. US stocks continued to lose ground on Thursday. The S&P 500 fell 0.51% and the Nasdaq fell 0.93%. US equity futures are indicating a slight increase at today’s open. Chinese stocks had another bad session. The Hang Seng fell 1.77% and the CSI 300 fell 0.55%.

- G-7 Macro: There was good and bad news out of the US on Thursday. On the positive side, 2Q24 GDP registered a 2.8% increase (saar), double the first-quarter growth rate and more than the 2.0% that had been forecast.

-

Personal consumption delivered a healthy 2.3% growth rate. We also got the quarterly core PCE deflator figures for the second quarter. These were less helpful, and showed core PCE inflation of 2.9%, more than the 2.7% expected. We have backed out what this means for today’s June PCE on the assumption that there are no historical revisions (which there probably will be) and that points to a core PCE inflation rate of 2.7% off a 0.3% MoM increase. Just to be clear, revisions to past data mean that this is not a guaranteed outcome. Consumer confidence figures form The University of Michigan are also published today. Yesterday, we also had Germany’s Ifo survey. This disappointed and resumed its decline. Carsten Brzeski analyses what this means for the sick-man of Europe.

-

Singapore: The MAS monetary policy statement came out at 0800. As expected, there were no changes to the SGD NEER slope, centre or bandwidth. Later on, we get June industrial production data, which is expected to show continued weakness, in line with the soggy export figures.

-

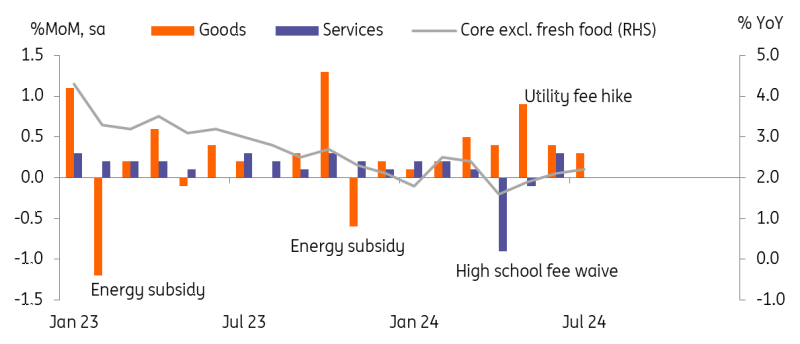

Japan: Tokyo consumer price data showed that headline inflation edged down to 2.2% YoY in July (vs 2.3% in June, market consensus), but the BoJ’s preferred measure, core inflation excluding fresh food, rose to 2.2% in July (vs 2.1% in June, 2.2% market consensus). Utilities jumped to 12.6% y/y in July (vs 6.2% in June, 4.7% in May, -3.0% in April). Utilities have been the main driver of the acceleration in core inflation over the past three months. On a monthly comparison, inflation rose 0.1% MoM sa, its third consecutive increase. This month’s rise was mainly from goods prices (0.3%) while service prices stayed flat.

Given yesterday’s stronger-than-expected PPI services data, 3.0% YoY in June (vs revised 2.7% in May, 2.6% market consensus), we believe that inflationary pressure in services continues to build. It is a close call, but we maintain our view that the BoJ will hike rates by 15 bp and reduce its bond-buying programme at the same time. Markets will also be watching closely for the Bank of Japan's plans to taper its government bond purchases and the pace and scale of those purchases. The market consensus is for the BoJ to start with a cut to 5 trillion JPY and move down to 3 trillion JPY over the next two years.

Tokyo core inflation accelerated for the past three months

Source: CEIC

What to look out for: Japan Tokyo CPI, Singapore Industrial production

July 26th

Japan: July Tokyo CPI, Leading index CI

Singapore: June Industrial production

US: U. of Mich. Sentiment

More By This Author:

Eurozone Loan Growth Shows Signs Of Bottoming Out

US GDP Growth Beats Expectations, But Fails To Dent The Market’s Faith In Rate Cuts

Why We Still Expect A Bank Of England Rate Cut In August

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more