As Cleveland-Cliffs Goes Parabolic, Prudence Is Warranted

Kateryna Babaieva/Pexels

Cleveland-Cliffs Goes Parabolic

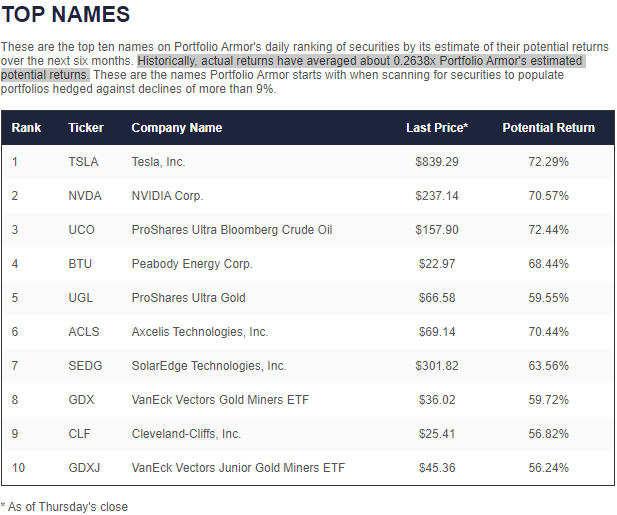

As I mentioned in my previous post on United States Steel Corporation (X), U.S.-led sanctions on Russia in response to its invasion of Ukraine have put upward pressure on steel prices recently, as Russia is one of the world's top steel exporters. Like United States Steel, Cleveland-Cliffs, Inc. (CLF) has been a recent top name in our system, appearing in our top ten on March 3rd, for example.

Screen capture via Portfolio Armor on 3/3/2022.

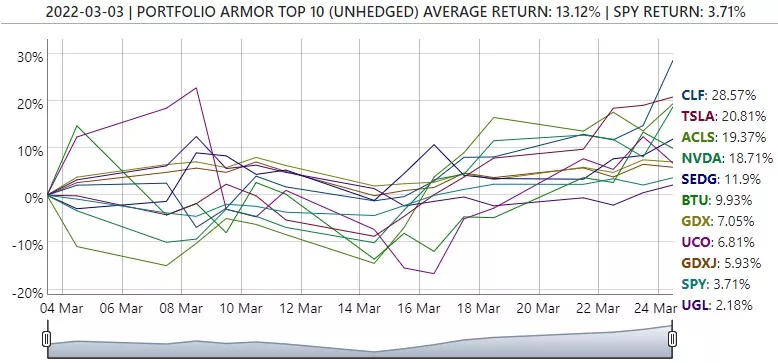

Since then, Cleveland-Cliffs was up 28.57% as of Thursday's close.

To give a sense of how hot Cleveland-Cliffs is, it was up 12.04% on Thursday alone. That's the sort of daily move you're more likely to see in a triple-leveraged ETF; it's not typical for a steelmaker stock at all. Given its advance, caution may be warranted here. Let's look at a cost-effective way you can stay long Cleveland-Cliffs now, while strictly limiting your downside risk.

Locking In Cleveland-Cliffs Gains By Hedging

The simplest way to lock in your gains on a high-performing stock is, of course, to sell your shares. One benefit of hedging instead is that it lets you hold on for some additional gains while limiting your drawdown in the event the stock pulls back. Here's a way to do that with Cleveland-Cliffs.

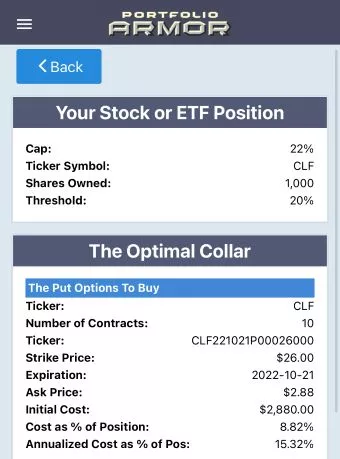

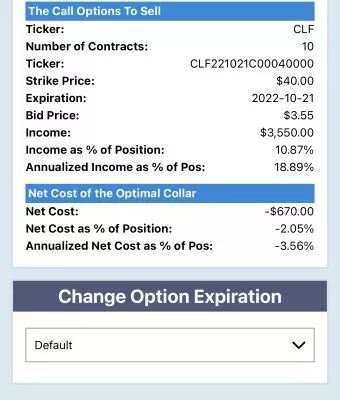

As of Thursday's close, this was the optimal, or least expensive collar to hedge CLF against a greater-than-20% decline over the next several months, while not capping your further upside at less than 22% over the same time frame.

Screen captures via the Portfolio Armor iPhone app.

Note that the net cost of this collar was negative, meaning you would have collected a net credit of $670 when opening this hedge. Since that cost was calculated conservatively (assuming you bought the puts at the ask and sold the calls at the bid), you likely would have collected a slightly larger net credit had you placed both option trades within the bid-ask spread.

Whether you use a hedge like this or simply sell some shares, some prudence here makes sense.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more