Are Utilities In A Bubble?

Utilities are on a tear. Without accounting for dividends, the Utilities Select Sector SPDR ETF (XLU) is up 17% so far in 2016 and 28% over the past three years, in both cases outperforming the S&P 500 (SPY). Stocks that are supposed to be safe income plays have delivered major capital gains.

It’s not hard to figure out why this is happening. Interest rates have been at historic lows for several years now. As the Fed continues to push back its timetable for raising rates, bond investors are capitulating and turning to Utilities as a source of yield.

This run-up has many people uttering an unusual phrase: “Utilities Bubble”. Could these traditionally safe stocks be dangerously overvalued and setting up for a crash? And if so, how should investors manage their portfolios to mitigate this risk?

Utilities’ Profits Do Not Justify The Stock Performance

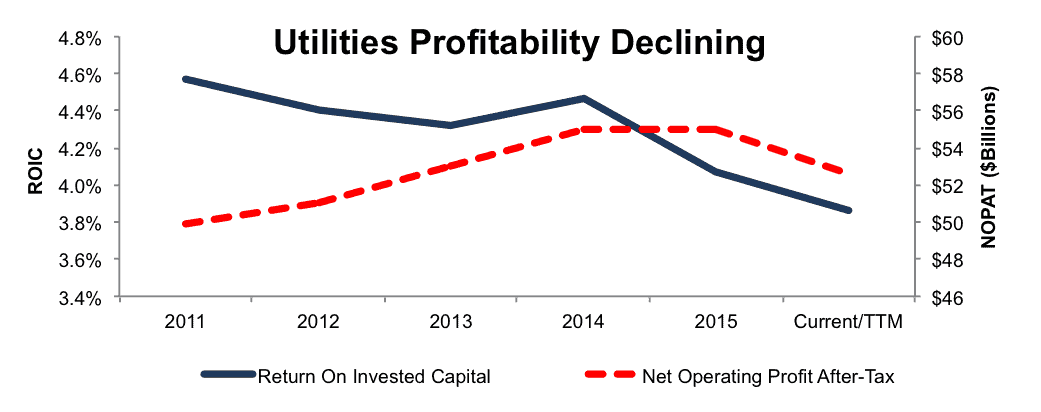

Let’s quickly dispense with one possible counterargument: that the strong run for Utilities stocks is based on improved financial performance and not yield-chasing investors. Figure 1, which shows the trends in average return on invested capital (ROIC) and cumulative after-tax operating profit (NOPAT) for the sector over the past few years, clearly shows that profits are flat to down and not driving stock valuations higher.

Figure 1: Utilities ROIC And NOPAT

Sources: New Constructs, LLC and company filings.

Nor do macro industry trends support hope for growth in future cash flows. In fact, the exact opposite is true.

- Solar panel installations are projected to grow by 119% in 2016.

- The market for energy efficient LED lighting is growing at 45% annually, part of a larger move towards greater energy efficiency in US households.

- With shrinking demand, Utilities will be forced to raise rates on remaining customers, leading to an even higher adoption of solar power and energy-saving devices. According to Barron’s, half of electric-utility executives expect these trends to send their industry into a “death spiral” within the next decade.

Underlying cash flows and industry trends do not support the recent outperformance of Utilities stocks.

Current Valuations Imply Unrealistic Profit Growth

Utilities tend to be one of the slowest growing sectors in the economy. Moreover, with the growing threat to the core business model, you’d expect to see them trading at a discount to the rest of the market.

Instead, when we measure the profit growth implied by the market’s valuation, we see that XLU and SPY have the same exact price to economic book value (PEBV) ratio of 2.8. Based on their valuations, Utilities are expected to grow at the same rate as the rest of the S&P 500, which seems unrealistic.

With inferior profitability, a below par profit growth outlook, and valuations on par with the rest of the market, Utilities pose quite a risk to investors’ portfolios.

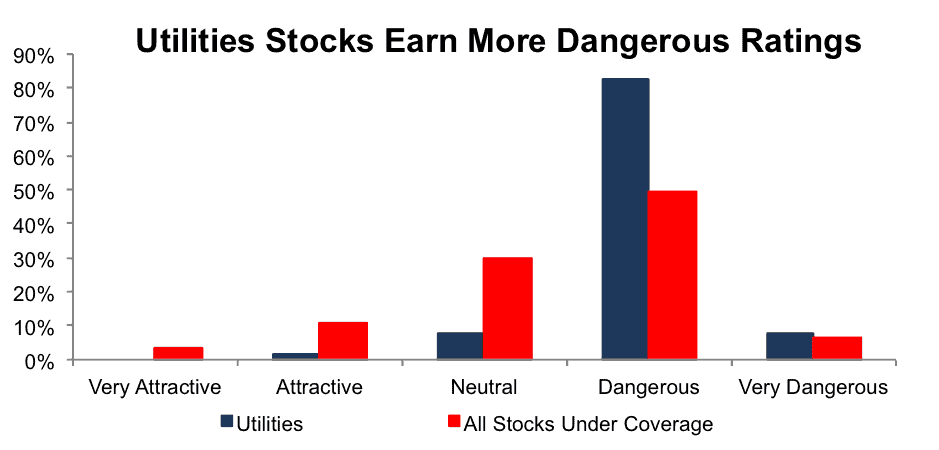

Figure 2: Ratings Breakdown

Sources: New Constructs, LLC and company filings.

Figure 2 shows that the Utilities sector has a much higher concentration of Dangerous and Very Dangerous rated stocks than the rest of the market. In fact, only one stock in the sector earns our Attractive or Very Attractive rating, whereas every other sector has at least nine companies that are Attractive-or-better.

Low Rates Can’t Keep Propping Up Utilities – Dividend Yields Are At Risk

There are two ways for the bubble in Utilities to end. The simplest mechanism would be if interest rates started rising again. This trend would push investors back into bonds and cause the price of Utilities to fall back to a level that better reflects their cash flows and risks.

However, even if interest rates stay low for an extended period of time, Utilities investors are still at risk.

The high dividends that have attracted so many investors to this space are unsustainable. The 75 Utilities companies that we cover have had negative free cash flow in four of the past five years, with a cumulative cash burn of almost $150 billion over that time. The profits simply aren’t there to cover the high dividends that investors prize.

In addition, rising equity values for Utilities offsets the advantages that cheap debt has for their cost of capital. Even with interest rates at record lows, the weighted average cost of capital (WACC) for Utilities companies has been rising this year as equity becomes a larger and larger portion of their capital structure.

Where To Turn In The Sector

Unfortunately, many advisors and portfolio managers are stuck with a mandated exposure to the Utilities sector, forcing them to search for a way to hit targeted allocations without jeopardizing client portfolios. While there is only one stock that earns our Attractive-or-better rating in the sector, there are a couple that are not egregiously overvalued.

UGI Corporation (UGI) is the most profitable stocks in the sector, with an ROIC of 8%. It’s also the cheapest with a PEBV of 0.9. In addition, it has delivered three consecutive years of positive free cash flow, which suggests its dividend could be sustainable. On a fundamental basis, it clearly appears to be the best in the sector. Unfortunately, its 2.1% dividend yield might be on the low side for those that require income from their investments.

PPL Corporation (PPL) is another Utilities stock that has some margin of safety. It has a much higher dividend yield of 4.2%, and, like UGI, it has delivered positive free cash flow for three consecutive years. In addition, its price to economic book value of 1.6 is well below the industry average. In part, this seems to be due to overstated concerns about the company’s exposure to the UK, even though it is highly hedged to protect against the drop in the pound. Investors needing exposure to the sector should take advantage of this comparatively cheap valuation.

Photo Credit: Martin Thomas (Flickr)

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or ...

This was a great article. Utilities may be lagging it sounds like. Take a look at this tweet to see what I mean: twitter.com/360research/status/761624145650192385

Absolutely right.