Analyzing Trends Across Asset Classes

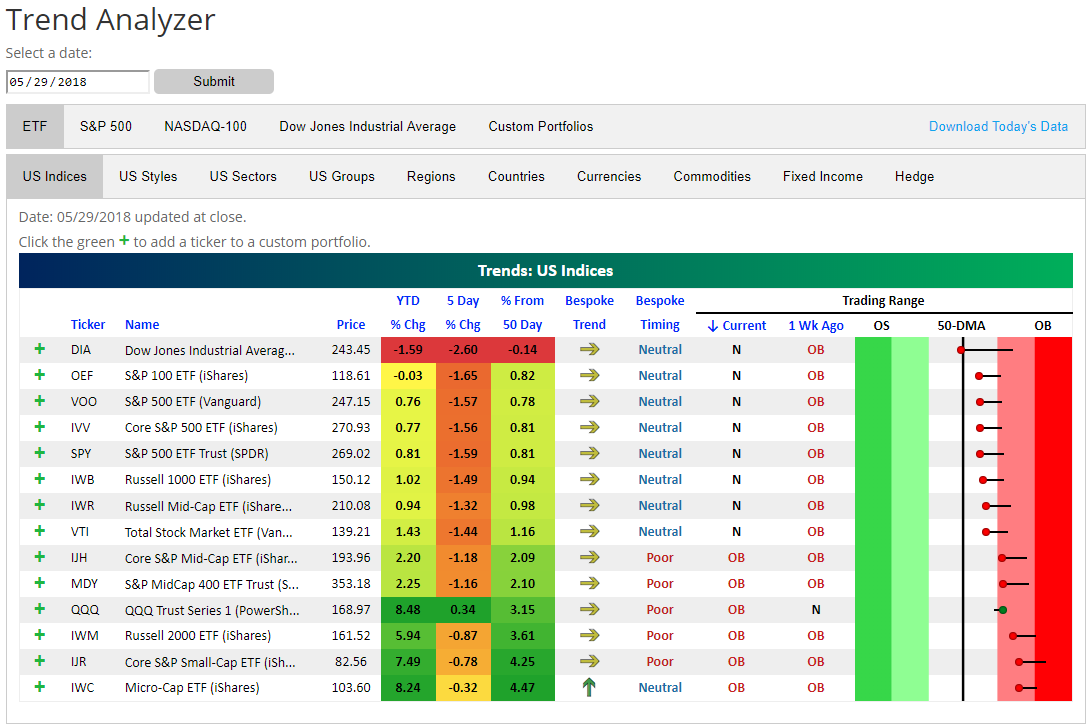

Yesterday’s equity market declines moved large-cap US index ETFs from overbought to neutral territory. Below is a snapshot of key ETFs using our Trend Analyzer tool. You can see that heading into today’s open, the Dow Jones Industrial Average (DIA) was the only one that had broken back below its 50-day moving average.Other large-cap index ETFs like SPY, OEF, and IWB are down more than 1% over the last week, but they remain above their 50-DMAs. The Nasdaq 100 (QQQ) and the small and mid-cap space continues to hold up the best.

Looking at sectors, Energy (XLE) and Financials (XLF) have taken it on the chin the worst over the last week, with XLE down 5.78% and XLF down 4.37%. Even after Energy’s declines, the sector remains above its 50-day moving average, while the Financial sector has moved from above its 50-DMA down to oversold territory over the last week. Along with Financials, the other three sectors that are below their 50-DMAs are Consumer Staples, Telecom, and Materials.Tech and Consumer Discretionary are the only two sectors that remain overbought.

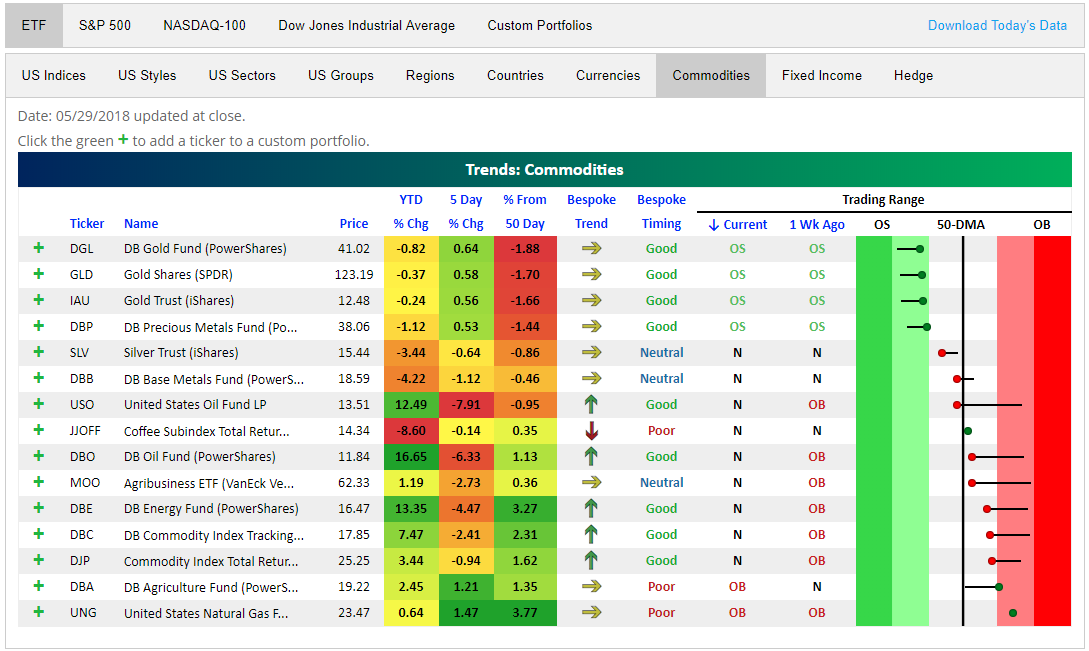

Oil has gotten crushed over the last week, with USO and DBO both falling sharply.USO has moved from overbought to below its 50-DMA.As energy-related commodity ETFs have seen mean reversion to the downside, we’ve seen gold ETFs start to experience mean reversion to the upside. DGL, GLD, and IAU are all up over the last week and they’re getting close to moving from oversold to neutral territory.

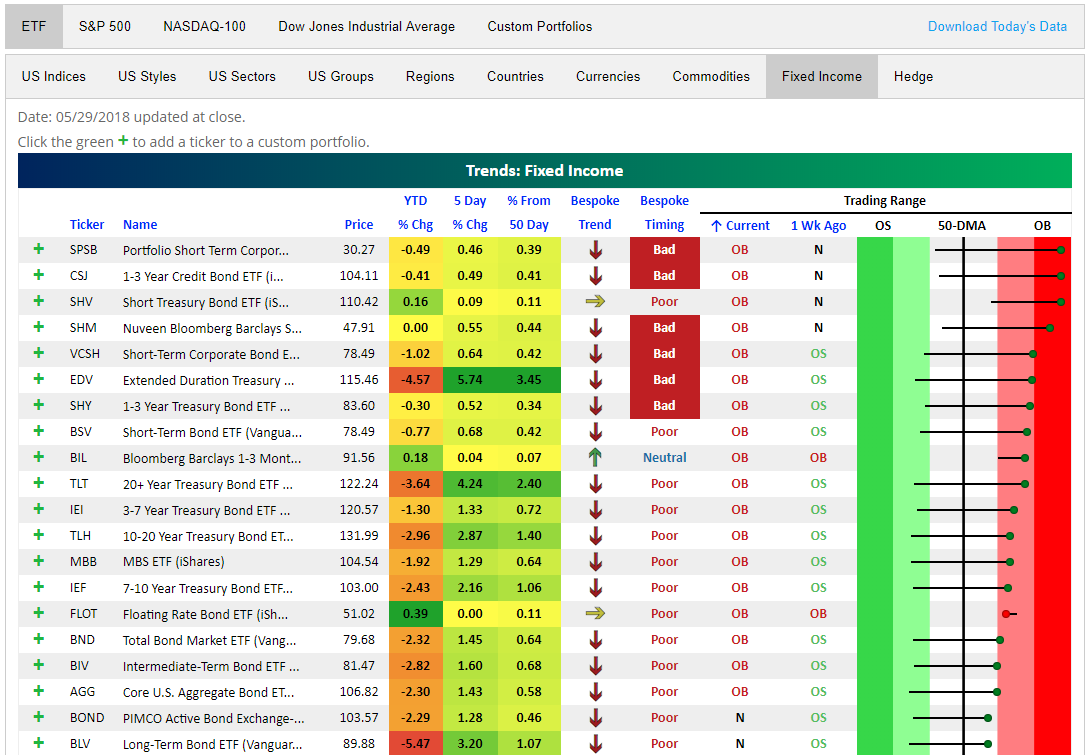

Finally, below is a snapshot of the fixed income ETFs that are currently the most extended to the upside. As you can see, ETFs across the fixed income space have caught a huge bid over the last week, with many moving from oversold to overbought levels. Given longer-term downtrends that are still in place, this gives them a “Bad” timing score based on our proprietary scoring system.You can read more about our Bespoke Trend and Bespoke Timing ratings at the bottom of our Trend Analyzer page.