An Inflationary Mulligan Stew

Last week, Treasury Secretary Janet Yellen seemed to forget for a moment that she was in a new role—one that does not set monetary policy. Against that backdrop, let’s just say Secretary Yellen got her first mulligan.

As a reminder, Yellen said that “it may be that interest rates will have to rise somewhat to make sure our economy doesn’t overheat,” but she quickly pivoted away from that statement later on. The background on Secretary Yellen’s initial comment is that she was asked if the current, and proposed, spending from the Biden administration could create a setting where inflation could need to be reined in.

There is no question the inflation debate is currently gaining momentum in the markets, specifically the fixed income arena. Is inflation looming on the horizon, and will any potential increase prove to be “transitory,” as the Federal Reserve (Fed) believes, or will it be more sustainable? At this stage, there appear to be four undeniable factors that should push inflation higher in the months ahead:

- Base effects—i.e., year-over-year readings will be compared to very low readings from 2020

- Higher commodity prices

- Disruptions in supply chains and low inventories

- Pent-up demand from COVID-19-related re-openings

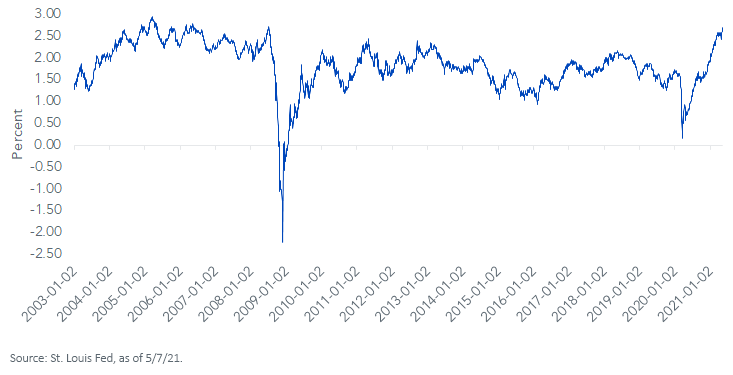

5-Year Breakeven Inflation Rate

So, who is right in this inflation debate? I like to take my cues from the bond market, and as you can see, inflation expectations have been on a rather visible ascending trajectory. Looking at Treasury five-year breakeven spreads, the latest reading of roughly 2.70% has now gone back into territory that is rarely visited…in other words between 2.50% and 3.00%. In fact, as of this writing, the last time the breakeven rate was this high was back in the pre-financial crisis days of 2006.

Conclusion

Against this backdrop, we continue to recommend solutions which are designed to mitigate the effects of potential higher inflation, namely higher interest rates. Oftentimes, investors gravitate toward Treasury Inflation-Protected Securities (TIPS) in this type of scenario, but it is important to keep in mind that TIPS tend to have a longer duration aspect to them.

Our preferred U.S. Treasury-based approach is the Treasury Floating Rate Note (UST FRN) Strategy. These instruments are issued with two-year maturities, are offered monthly and essentially have very little in the way of duration because the interest rate is reset every week with the three-month t-bill auction. Investors may access this strategy through the WisdomTree Floating Rate Treasury Fund (USFR).

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more