Alternative Business Cycle Indicators - Monday, July 22

Most recent forecasts indicate no recession, Q2 nowcasts raised (GDPNow, NY Fed), weekly indicators (Lewis, Mertens, Stock; Baumeister, Leiva-Leon, Sims) growth rates rising, and both NBER BCDC indicators as well as alternative indicators showing positive growth.

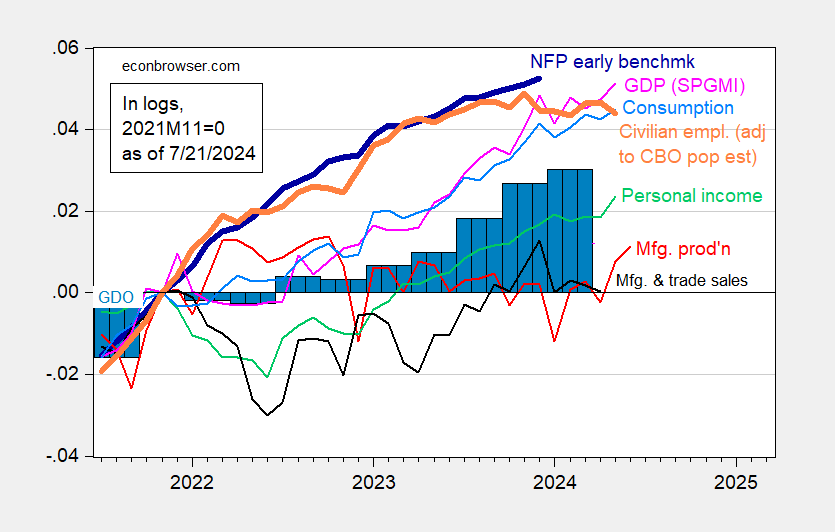

Figure 1: Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted using CBO immigration estimates (orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed, Federal Reserve via FRED, BEA 2024Q1 third release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (7/1/2024 release), and author’s calculations.

Note that the adjusted civilian employment series flattens out because it’s assumed that immigration matches what is incorporated in the BLS series starting in July 2023.

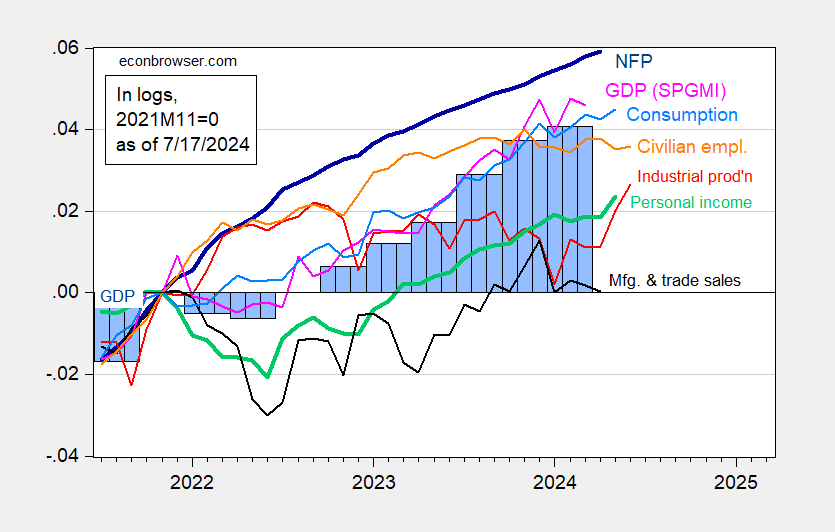

Compare against the NBER BCDC indicators.

Figure 2: Nonfarm Payroll (NFP) employment from CES (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q1 third release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (7/1/2024 release), and author’s calculations.

More By This Author:

Can One Have a Recession Start When Real Household Wealth Is Rising?

Macroeconomic Implications Of Forced Mass Deportation

GDP Forecast: CBO Above WSJ