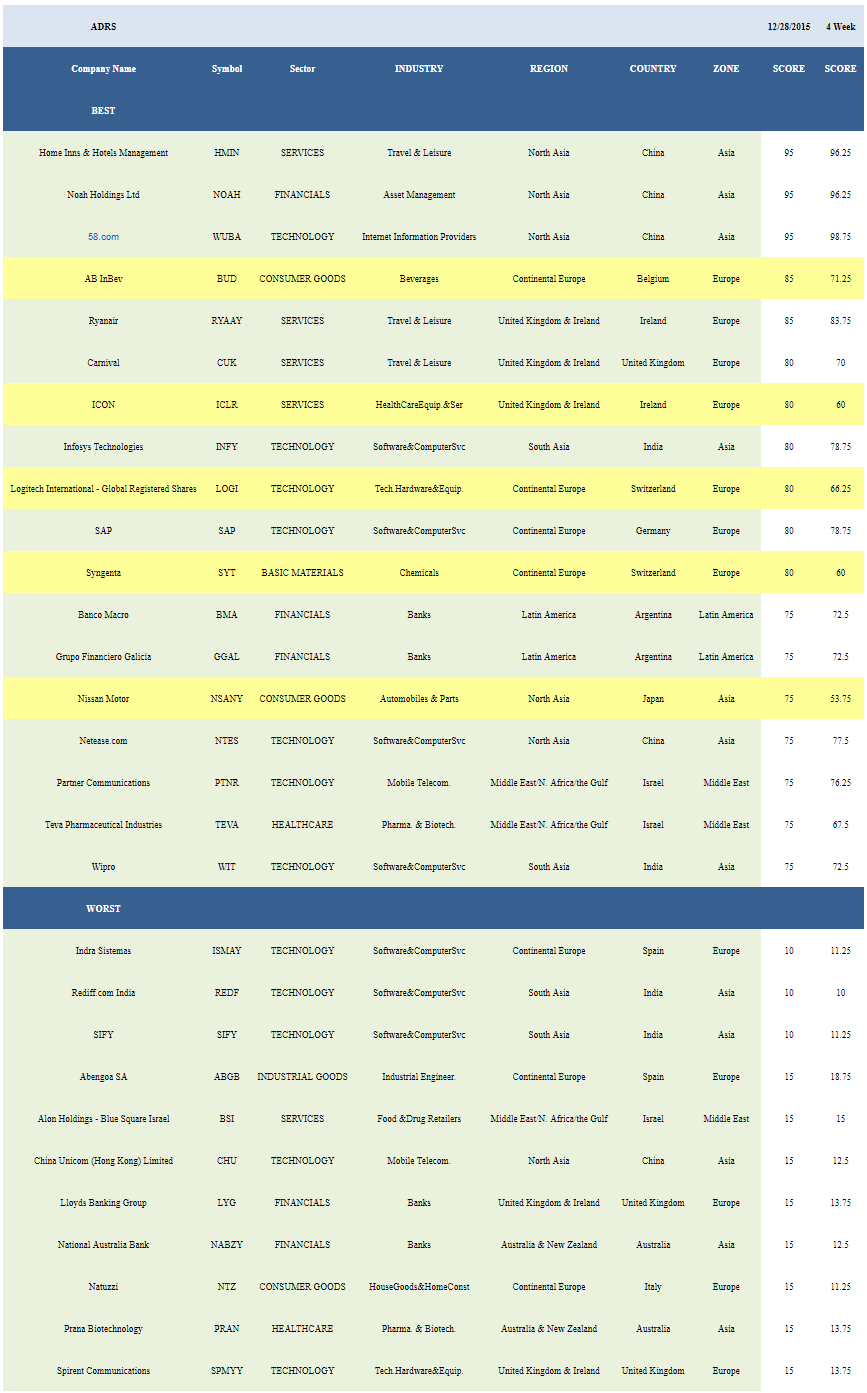

ADRs Best & Worst Report - December 28, 2015

- The best sector across ADRs is services.

- The top regions are MENA, North America, U.K./Ireland

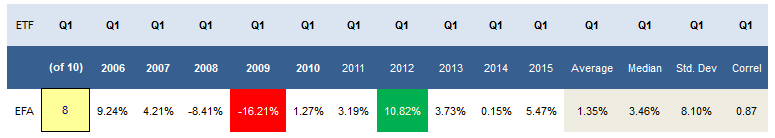

The MSCI EAFE has posted gains in 8 of the past 10 Q1s, returning a median 3.46% in the period. The EAFE's correlation to the SPY during this period is 0.87.

Source: Seasonal Investor Database

The average score across our ADR universe is 45.28 and that's above both the four and eight week average score of 43.28 and 43.41, respectively. The average ADR is trading -28.61% below its 52 week high, -6.78% below its 200 dma, has 4.21 days to cover held short, and is expected to post EPS growth of 10.76% next year.

(Click on image to enlarge)

The strongest sector across our ADR universe is services (HMIN, RYAAY, ICLR, CUK, VLRS, DEG, AHONY), Healthcare (TEVA, PSDV, LUX, SNN, RHHBY, SVA, RDY, NVO) and consumer goods (BUD, NSANY, TTM, REXMY, NSRGY, HMC, BTI) also score high. Industrial goods and technology score in line with the average ADR. Financials, utilities, and basic materials score below average.

The top zones are the Middle East (PTNR, TEVA) and North America (PSDV, RY, BCE). The strongest regions include MENA, North America, and UK/Ireland (RYAAY, ICLR, CUK, ARMH, NGG, RUK, SNN, PUK, REXMY, BTI). Ireland (RYAAY, ICLR), Bermuda (SIG, SFL), Switzerland (LOGI, SYT, RHHBY, NSRGY), Taiwan (SPIL, TSM, ASX), and the United Kingdom (CUK, ARMH, NGG, RUK, SNN, PUK, REXMY, BTI) are the best countries to overweight in portfolios.

Disclosure: None.

can you share what your methodology for creating scores for ADRs is? I write about ADRs

Was surprised not to see Amazon on the list of service sector stocks. AMZN is up an amazing 123% year to date. It does seem to be stuck below the $700 level but with holiday season under its belt and next quarter earnings around the corner we may well see Amazon jump through its comfort zone. lots of analyst opinions have weighed in and the opinions are very encouraging: 13 strong buys, 24 buys, and only 6 holds. Do you think Amazon is overpriced or a buy at this point? ($689 at close yesterday)