ADP Downside Surprise

ADP private nonfarm payroll (NFP) employment down -32K vs. +5K Bloomberg consensus. Mfg employment down 6K.

(Click on image to enlarge)

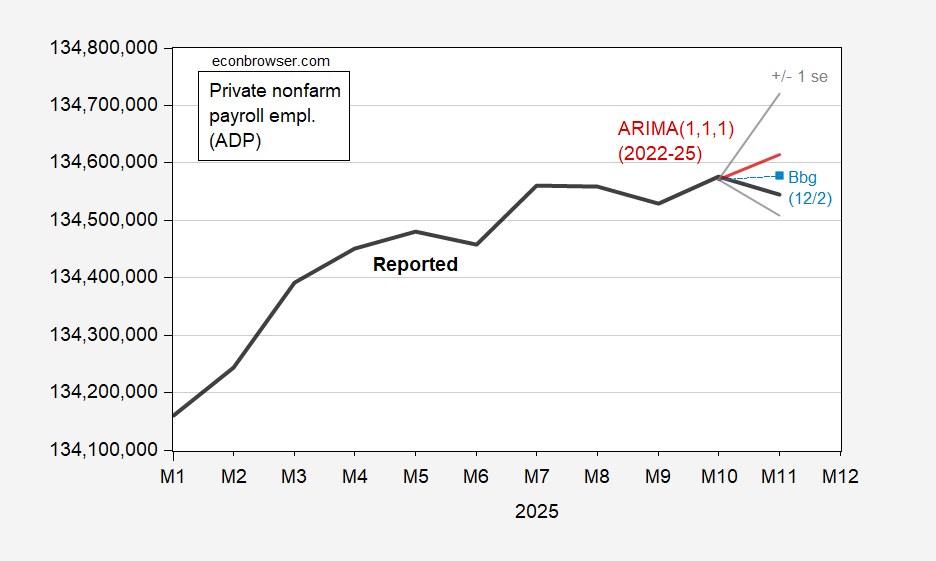

Figure 1: ADP private nonfarm payroll employment, November release (bold black), ARIMA(1,1,1) forecast based on 22M01-25M10 (red), +/- 1 std error (gray), Bloomberg consensus of 12/3 (light blue square), all s.a. ARIMA estimated over 2022-2025M10 data. Source: ADP via FRED, Bloomberg, and author’s calculations.

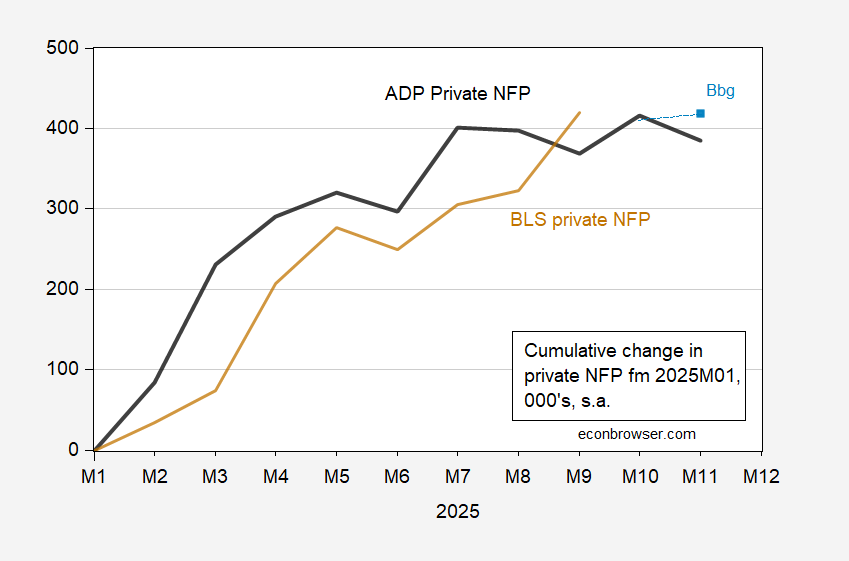

You can do an ocular regression to tease out the implications for the corresponding BLS series (over 2022M01-25M09)

(Click on image to enlarge)

Figure 2: ADP private nonfarm payroll employment, November release (bold black), Bloomberg consensus of 12/3 (light blue square), BLS private nonfarm payroll employment (brown), all s.a. Source: ADP via FRED, Bloomberg, and author’s calculations.

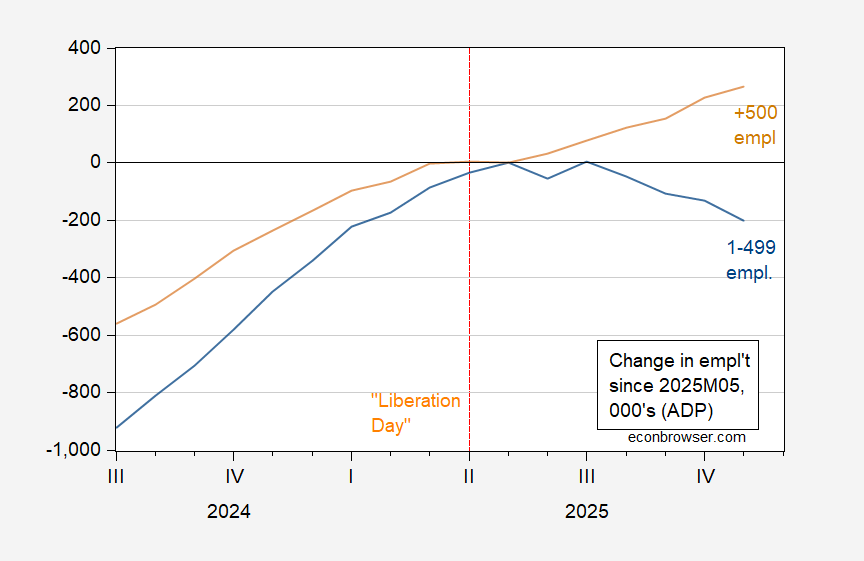

The divergence between small and large firm employment continues into November.

(Click on image to enlarge)

Figure 3: Cumulative change in ADP private nonfarm payroll employment for firms with less than 500 employees (blue), for firms greater than 500 employees (tan), from 2025M01, all s.a. Source: ADP via FRED, and author’s calculations.

Whether this presages a recession as it did in 2008, or not (say due due differential effects of deportations and removals, and/or tariffs for large vs. small firms) remains open.

More By This Author:

Consensus Vs. ARIMA (1,1,1): ADP Private Nonfarm PayrollRecession With Decreasing Employment And Increasing GDP?

Private Credit, AI, And Financial Stability