Adobe Stock: The Business And The Numbers

The software sector is on fire lately, and Adobe (ADBE) is no exception. The stock has gained over 25% in the past year on the back of vigorous revenue growth and outstanding profitability.

After such a big rally, it makes sense to be patient when considering a position in Adobe over the short term. Nevertheless, both the business fundamentals and the quantitative indicators look good for investors in Adobe's stock over the years ahead.

A High-Quality Business

Adobe is a world leader in content creation software with Photoshop and Illustrator. Leveraging on such leadership, the company has added new products and features to build additional growth venues and consolidate its leadership position in content creation across multiple platforms. With the acquisition of Omniture, Adobe has also positioned itself as a big player in digital marketing services, an area offering plenty of opportunities for growth.

Over the past several years, Adobe transformed its business model from licensing to a cloud-based subscription model. This business model works very well with clients, because the upfront cost for a subscription service is obviously much lower, and users get access to a solution that is permanently updated. From a financial perspective, subscriptions make revenue more recurrent and predictable over time.

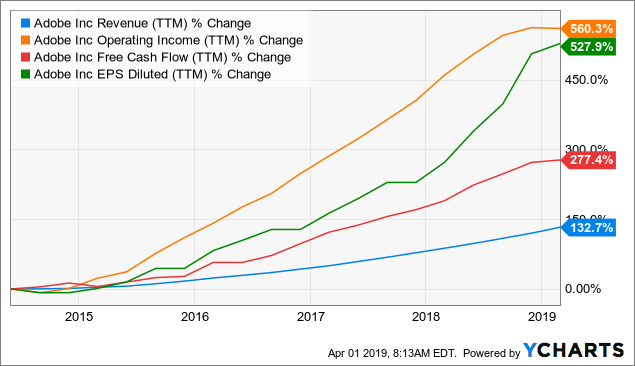

Adobe's strategic direction has produced outstanding returns for investors. Key financial metrics such as revenue, operating income, free cash flow, and earnings per share have increased substantially in the past five years.

Data by YCharts

Financial reports for the first quarter of 2019 confirm that the business is firing on all cylinders and producing solid performance across the board.

Adjusted revenue amounted to $2.6 billion during the quarter, growing by 25% and surpassing Wall Street expectations by $50 million. Adjusted earnings per share came in at $1.71, beating expectations by $0.09 per share.

The digital media segment generated $1.78 billion in revenue, growing 22% on a year-over-year basis. Net new digital media Annualized Recurring Revenue - ARR - was $357 million, and total Digital Media ARR grew to $7.07 billion during the period. In the digital experience segment, Adobe reported Experience Cloud revenue of $743 million for the quarter, which represents a 34% increase year-over-year.

Adobe is a widely profitable business, gross margin amounts to 86% of sales, and the company retains a huge 28% of revenue as net income margin.

Adobe Is Priced For Growth, But Not Overvalued

Adobe's stock is priced for aggressive growth expectations, meaning that valuation ratios are elevated in comparison to current earnings and cash flows. But that does not mean that the stock is overvalued when considering the company's potential for expansion in the long term.

The market is assigning high valuations to companies in the software sector because the industry produces plenty of growth opportunities and attractive profitability. When comparing Adobe versus other industry players, the stock does not look overpriced at all.

The table below compares Adobe versus Salesforce (CRM), Intuit (INTU), and Workday (WDAY) in terms of valuation ratios such as Enterprise Value to EBITDA, forward PE, projected PE versus long-term growth expectations, and price to free cash flow. Adobe is clearly priced at reasonable levels by industry standards.

(Click on image to enlarge)

It's important to keep in mind that valuation is a dynamic concept. Current stock prices are reflecting a particular set of expectations about the business. If the company proves that it can outperform those expectations, then both fundamental expectations and the stock price tend to increase over time, and fundamental momentum can be a powerful upside fuel for the stock.

The chart below shows how earnings expectations for Adobe in both the current year and next fiscal year have significantly increased over the past quarters. As long as this trend remains in place, it could be a powerful tailwind for Adobe's stock in terms of valuation.

Data by YCharts

To put the numbers in perspective, we can take a look at Adobe through the PowerFactors algorithm. This is a quantitative algorithm and it ranks companies according to a combination of factors that include: financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

Adobe is one of the top stocks in the US market based on the PowerFactors ranking. The company has an aggregate PowerFactors ranking of 98.49 and solid numbers across the four quantitative drivers: quality (99.37), value (88.5), fundamental momentum (85.4), and relative strength (80.28).

Only because the numbers look strong, this does not guarantee that Adobe will outperform the market going forward. On average, companies with strong quantitative metrics tend to outperform the market more often than not. However, this does not tell us much about how a single stock will perform over a particular year.

Adobe needs to continue delivering world-class software and services in order to sustain financial performance going forward, and the company operates in a very dynamic industry. Even if the business is strong from a competitive point of view, investors in Adobe need to keep a close eye on the competitive landscape going forward.

In addition, the market is expecting strong growth in revenue and earnings from Adobe. If the company fails to meet those expectations, the stock would be vulnerable to the downside from current valuation levels. In other words, current valuation is not excessive, but it does not provide much of a buffer if the company fails to deliver.

Those risks being acknowledged, Adobe is a high-quality business, and the stock looks well positioned for attractive returns if management keeps executing well in the years ahead.

Disclosure: I am/we are long CRM, WDAY.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

more