Above The 40 – A Stock Market Finally Overbought Again

AT40 = 70.1% of stocks are trading above their respective 40-day moving averages (DMAs) – first overbought day

AT200 = 58.7% of stocks are trading above their respective 200DMAs

VIX = 9.5

Short-term Trading Call: cautiously bullish (one more higher close away from bullish)

Commentary

It took 8 months for the stock market to hit overbought again. AT40 (T2108), the percentage of stocks trading above their 40-day moving averages (DMAs), closed at 70.1% – a hair above the overbought threshold of 70%. After one more higher close I will switch the short-term trading call to bullish.

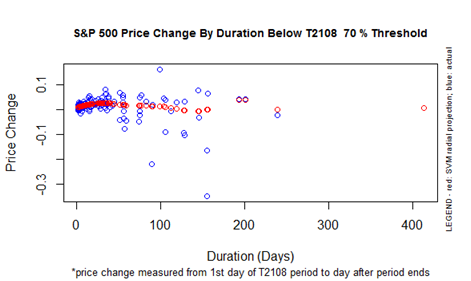

The S&P 500 (SPY) is up an incredible 9.2% since the last overbought period ended (it lasted just one day on January 25, 2017). This performance is a large outlier. Not only has AT40 rarely spent anything close to 160 trading days under 70%, but also only TWO other 70% underperiods have performed as well as this last one did. The chart below shows a projected performance under 5% for a 70% underperiod surviving as long as the the last one.

The last AT40 70% underperiod was an outlier both by duration and performance.

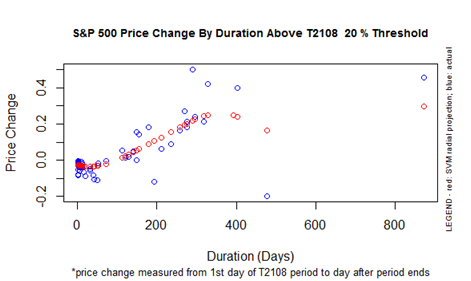

Separately, AT40 has now gone 401 days without trading below the oversold threshold of 20%. This duration ties for third longest trading period without an oversold period. The last oversold period ended on February 12, 2016 in what I dubbed at the time the “JP Morgan Chase Bottom.” The S&P 500 has gained 32% since then. Projected performance suggests that the end of this 20% overperiod might cut this gain almost in half…with a heavy caveat given the sparseness of data that comes with such an outlier occurrence.

S&P 500 historical performance during the T2108 20% overperiod.

Appropriately, the S&P 500 (SPY) marked this overdue overbought occasion with a new all-time high.

The S&P 500 (SPY) looks poised to next tag the top its upper-Bollinger Band (BB) channel.

The Nasdaq closed flatline and just short of a fresh all-time high. The PowerShares QQQ ETF (QQQ) is still struggling to hold onto its 50DMA support. Assuming AT40 confirms a new bullish phase for the market, I will likely load up on QQQ call options. My swing at individual members of the big cap high tech stocks this week had very mixed results.

The volatility index, the VIX, hit 9.6, within a small fraction of a point of the 24-year closing low set in July and the all-time (tracked) closing low of 9.31 on December 22, 1993. My last tranche of call options on the ProShares Ultra VIX Short-Term Futures (UVXY) will expire worthless, and I will reload for hedging against the potential for October to deliver fresh surprises.

STOCK CHART REVIEWS

First Solar (FSLR)

It looks like I locked in profits on my FSLR call options just in time. FSLR began the week by immediately reversing Friday’s breakout and in turn broke 50DMA support. I will not take another swing until/unless the company can close above its 50DMA again.

First Solar (FSLR) is pivoting around its 50DMA but flirting with a confirmed breakdown.

Hanging in the balance is the fate and impact of solar panel tariffs.

IHS Markit (INFO)

On Tuesday, INFO gave what seemed to me a reassuring reaffirmation of guidance. The market disagreed. INFO gapped down below its 50DMA support and kept selling off. Like the dip in July, this selling reversed my gains. I will next look for 200DMA support to hold.

Markit (INFO) took a major post-earnings blow that likely signals it will top out for a while.

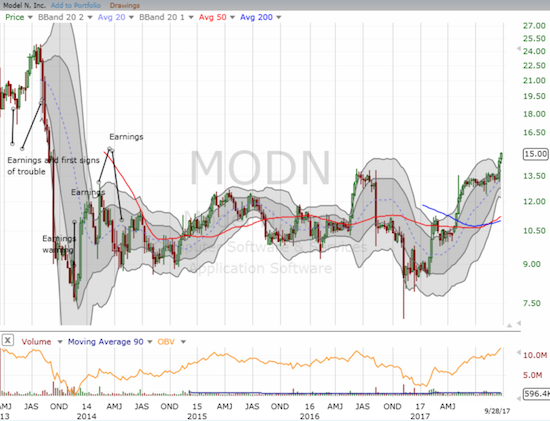

Model N (MODN)

I last wrote about Model N (MODN) almost four years ago. I flagged the revenue management company as a bet on a comeback story. The stock never took off but did deliver a small profit on a rally to the top of what became a very extended trading range. Now, MODN is FINALLY breaking out, and it has my attention again. At $15, MODN sits at a 4-year high. The next earnings report comes around November 6th so there could be a long runway here if the general market remains bullish.

Model N (MODN) finally broke out from a very tight trading range in place since May.

Model N (MODN) was trapped in a longer-term (sloppy) trading range in place since its big collapse in 2013. Is the recovery finally underway?

“Above the 40” uses the percentage of stocks trading above their respective 40-day moving averages (DMAs) to assess the technical health of the stock market and to identify extremes in market sentiment that are likely to reverse. Abbreviated as AT40, Above the 40 is an alternative label for “T2108” which was created by Worden. Learn more about T2108 on my T2108 Resource Page. AT200, or T2107, measures the percentage of stocks trading above their respective 200DMAs.

Active AT40 (T2108) periods: Day #401 over 20%, Day #215 over 30%, Day #15 over 40%, Day #14 over 50%, Day #10 over 60%, Day #1 over 70% (overbought, ending 160 days under 70%)

Daily AT40 (T2108)

Black line: AT40 (T2108) (% measured on the right)

Red line: Overbought threshold (70%); Blue line: Oversold threshold (20%)

Weekly AT40 (T2108)

Disclosure: Long INFO, long UVXY call options.

Follow Dr. Duru’s commentary on financial markets via more