A Year After Trump Launched His Trade War Canada Remains Largely Unscathed

Image Source: Unsplash

The past year featured so many moving parts in the Canada-US trade relations, that it is necessary to look back to determine what actually took place and where we are today.

Trump wasted no time in slapping 25% tariffs on Canadian imports on Feb 1,2025, the one major exception was 10 % tariff on oil imports .Headlines throughout Canada declared that the country faces an existential threat,a recession was on its way and everywhere Canadians were wringing their hands in worry as our most important trading partner has just become our foe in the new world of protectionism. Trump seemed to upset the bilateral trade relationship as never experienced before. The Federal election in April turned largely on whom Canadians believed could best stand up to the Americans at this crucial point in our long bilateral history,

U.S. tariffs hit autos and parts, lumber, agriculture, and metals. No wonder Canadians felt so vulnerable.In response, Canada announced retaliatory tariffs of 25% on $150 billion worth of US imports, starting just a fewdays later. Economists immediately lowered economic forecasts. Trade flows were disrupted, as both countries assessed these sets of tariffs. Supply chains were under stress as importers on both sides of the border stockpiled in advance of these and expected tariffs yet to come . In particular, steel and aluminum trade hit so many manufacturing companies that governments at all levelsfeared a surge in inflation and a great number of job losses.

Commonly, trade wars feature lots of exemptions as domestic political pressures carve out exemptions. When the fog ofthis war cleared, the effective tariffs were very much lower from those boasted at the time of their announcements. Without relating all the back-and-forth involving trade officials in both countries and, in particular, the pressure exerted by the American business community, the actual level of US protectionism regarding Canada is relatively small. The effective tariffs in place today can be summarized as follows:

- On Canadian energy and natural resources, , actual tariffis 10%, effective 8%;

- On automotive products, actual tariff is 25%, effective 2.5%-4%; most North American vehicles meet the 75% requirement to be produced in the region and are thus exempt;

- .On steel and aluminum, actual tariff 50%, effective 35% due to selective exemptions but still the highest;

- On agriculture, the actual tariff 25%, effective 2% since most products are covered by the USMCA, free trade deal; and

- On softwood lumber, actual is 45%, effective 15-20%, a blended rate of tariffs and countervailing duties existing for many years.

Overall, some 85% of all bilateral trade is covered under the North American free trade agreement, USMCA. So, all eyes will be on the negotiations on its renewal later in 2026.

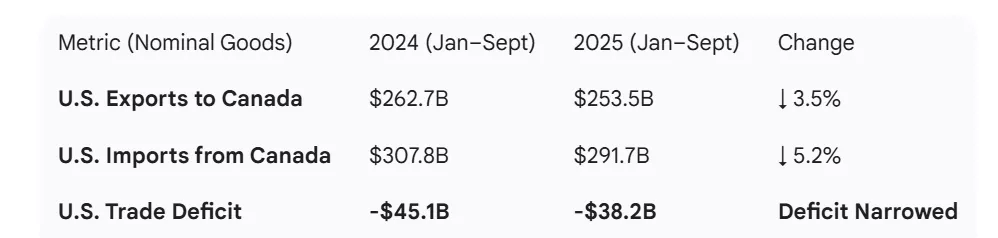

The Trump administration had set up tariffs to alter the trade balances more in favour of the US. yet in the case of Canada US deficits persist. On balance, the trade flows were slightly altered, but hardly enough to write home about. It seems that a whole lot of anxiety in Canada, and in selective industries in the US, was unnecessary. The Americans are prepared to pay more for selective metals, such as steel and aluminum.

Source: Gemini AI

Overwhelmingly, Canadian energy, oil and natural gas, occupied the largest segment of the bilateral merchandise trade. And, those Canadian exports are subject to a low tariff, and more importantly, the US has no alternative supply available for its customers in the western and mid-western states. So far this year, Canadian energy exports headed to the U.S have remained stable .The low tariff rate is readily being absorbed within the cross border industry.

Summing up, Canada ( and Mexico, not discussed here) both have not suffered anywhere near the expected impact of the Trumpian trade assault. Above all else, the USMCA exempts over 80% of bilateral trade.Trump has walked back tariffs from the initially, set at 25% and in some sectors as high as 50%. Effectively, Canadian producers are subject to tariff rates of under 10%, and that added cost is not burdensome, as once feared. An American First strategy of freeing the US dependence from its two immediate neighbours is failing . The continental interdependence remains intact, and the adjustments required by Canada are manageable.

More By This Author:

The Impact Of A Dynamic Labor Market On The Israeli EconomyEconomists Did Not Get It Wrong When It Comes To Assessing The Impact Of Tariffs

China Just Did An End Run Around The U.S.