A Volatile End To A Volatile Quarter

Image Source: Pexels

It is hard to believe that I wrote this on Thursday — just two sessions ago!

As noted, investors tend to hate uncertainty, and because uncertainty is reflected in volatility, it is somewhat surprising to see VIX around 18 with “Liberation Day” looming next week (April 2nd).

Now, as I type this around Monday morning’s open, the Cboe Volatility Index (VIX) is roughly 24.5.That is quite a move in a very short time, reflecting investors’ wildly changing demand for volatility protection.The flip from relative complacency to acute concern is quite stunning.

Bearing in mind our constant reminder – “VIX is not a fear gauge, it merely plays one on TV” – the current levels indeed do reflect relatively high demand from institutions for volatility protection.It’s not at “get me out” panic levels – those typically require something over 30 — but there is a real undercurrent of concern. It’s amazing how little demand for protection there was last week and how much of it we see today.

But it’s also useful to note that (at least as of now), the VIX futures curve can better be considered flattish than truly in backwardation. Remember, how we’ve previously described backwardation:

It implies an abnormal state, and a commodity that is experiencing shortages tends to be in backwardation. If demand outstrips supply in the short term, but is expected to normalize at some point in the ensuing months, we tend to see a curve in backwardation.

In this case, the commodity in question is volatility protection.

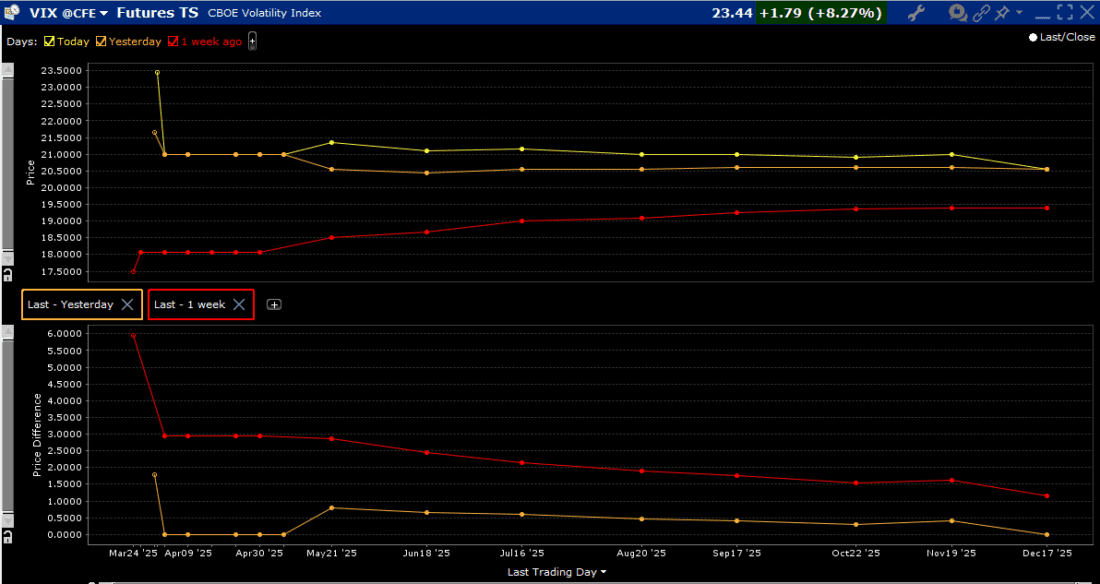

We can see from the chart below that the spot level of VIX is truly inverted vis-à-vis the futures, but the overall curve is largely flattish. A major backwardation is typically a signal of panic. We simply don’t see that here:

VIX Futures Term Structure, Today (yellow, top), Yesterday (orange, top), 1-Week Ago (red, top); with Differences Between Today and Yesterday (orange, bottom), and Last Week (red, bottom)

(Click on image to enlarge)

Source: Interactive Brokers

But they’re still not panicking, so it can be asserted that we’ve not seen true capitulation.

While we have repeatedly hammered home the message that VIX is not constructed as a sentiment indicator (there are plenty of those, and their readings stink, btw), but as the market’s best estimate of S&P 500 (SPX) volatility over the coming 30 days.That estimate is obviously related to sentiment, but index volatility is also influenced by market correlations.Higher correlations tend to result in higher index volatility, and vice versa.We have periodically noted the times when VIX failed to follow the Cboe’s COR1M correlation index lower, and last week we noted the opposite – VIX plummeted even though COR1M remained quite high. As we wrote on Tuesday:

Yet correlations, as measured by the Cboe’s COR1M index, remain elevated… Over the past year, [the current] COR1M levels were accompanied by VIX levels well above the current 17.49.It is indeed possible that the demand for volatility-based hedges has decreased because institutions have de-risked in other ways – moving to lower-beta stocks or raising cash – but this relationship indicates that traders might be more confident than they should be right now.

As the chart below shows, VIX did indeed sink when COR1M came off its recent highs.But it fell to levels that prevailed when COR1M was much lower, presaging a dearth of demand for protection that indeed proved to be premature:

1-Year, VIX (red/green candles), COR1M (blue)

(Click on image to enlarge)

Source: Interactive Brokers

A wildcard for this afternoon’s close is the JPMorgan Hedged Equity Fund’s (JHEQX) put position. A key piece of this fund’s strategy is that they buy protective puts against their long stock positions while selling upside calls and further downside puts to finance the put purchases.Those options expire at the end of each quarter, and they typically roll those positions into new quarterly strikes near the end of the session.Considering that they will be rolling over 35,000 SPX expiring puts with a strike of 5565, it can get very hairy this afternoon. Expiring strikes can act like a slingshot or magnet, depending upon whether active hedgers are long or short.

If hedgers are long an expiring strike, they are incentivized to hedge their gamma/delta exposures by buying if the underlying trades below the strike and selling if it rises above.That is what can cause the magnet effect.On the flip side, those who are short an expiring at-money option are incentivized to do the opposite, effectively selling low and buying high. That is what can cause the slingshot effect. Dealers who take the other side of that trade (dealers typically hedge) are short today, which magnifies the risk of a slingshot.

SPX crossed downward through that strike on this morning’s open, but by midday, the index is flirting with an upside breach.It is hard to expect major fireworks – large dealers are very effective at utilizing hedges other than buying/selling stock – but this is a significant source of concern for traders around today’s quarterly close.

By the way, there is also a lesson here for those who utilize protective puts against their positions: you’re better off hedging with puts that are struck ABOVE your level of concern.In last year’s piece about insuring against a turn of momentum, we offered the following:

Ask yourself honestly how much of a portfolio drawdown you are willing to endure. It might be 5% for some, 20% for others. Think of that as your deductible. [Then] Find a put option with a strike price at or somewhat above the maximum acceptable loss parameter you defined.

Here’s the rub for JHEQX investors: they hedged against the downturn, but didn’t really profit from their hedge.Assuming the expiring put options are rolled this afternoon while they are roughly at-money, they have lost all or nearly all the premium that was paid.Indeed, the net cash outlay was minimized by the sale of other options, but the key benefit of the intended hedge was essentially negated.A hedge that doesn’t actually hedge is of little use, no?

More By This Author:

Those Pesky Consumers And Their Miserable Sentiment

Some Clarity On Tariffs, For Better Or Worse

Former Meme Darling’s Desperate Attempt For Relevance

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options ...

more