A Stock Picking Method That Beats The Market

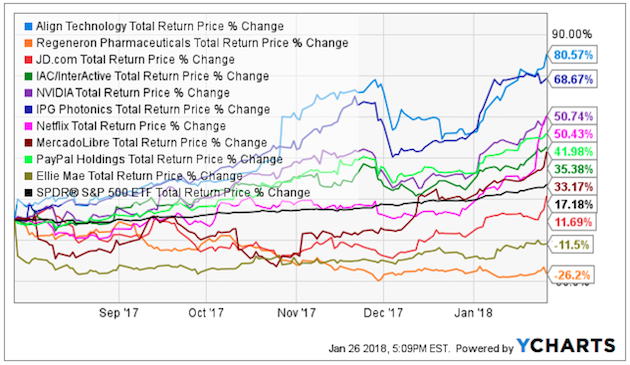

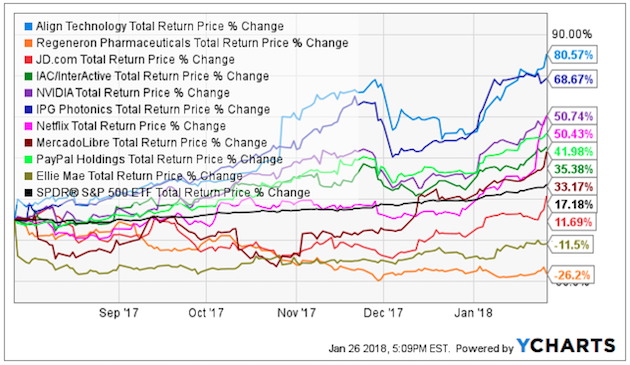

The 6-month performance of Portfolio Armor's top names from July 27th.

Generating Alpha Via Security Selection

Since June 8th, I've been posting Portfolio Armor's top ten names each week. These names are ranked based on my site's estimate of their potential returns over the next 6 months, net of hedging costs. As of Friday, we have actual 6-month returns for the first 9 weekly cohorts. 8 out of 9 of them beat the SPDR S&P 500 ETF (SPY), and the average 6-month performance of each weekly cohort was 22.18% versus 13.07% for SPY. This is further evidence that Portfolio Armor's security selection method, which uses price history as well as option market sentiment, delivers alpha, as I elaborate below.

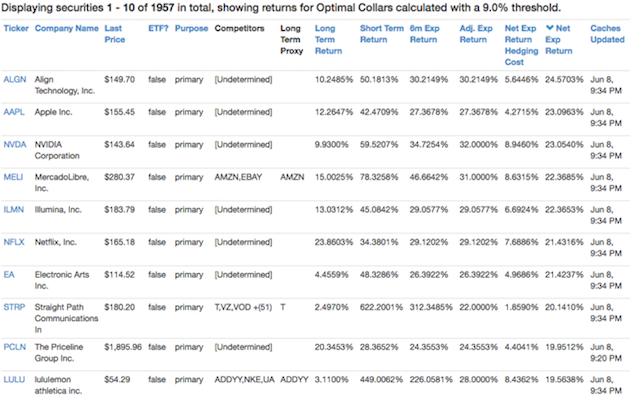

Top Names From June 8th

Let's look at exactly what the top names were each of these weeks, how that data was time-stamped, and how each name did over the next 6 months, starting with the June 8th cohort.

These were the top ten names as of June 8th, presented here at the time: Align Technology (ALGN), Apple (AAPL), Nvidia (NVDA), MercadoLibre (MELI), Illumina (ILMN), Netflix (NFLX), Electronic Arts (EA), Straight Path Communications (STRP), Priceline (PCLN), and Lululemon (LULU).

And here's how they did over the next 6 months:

On average, the top names were up 8.78% over the six month period, versus 9.99% for SPY.

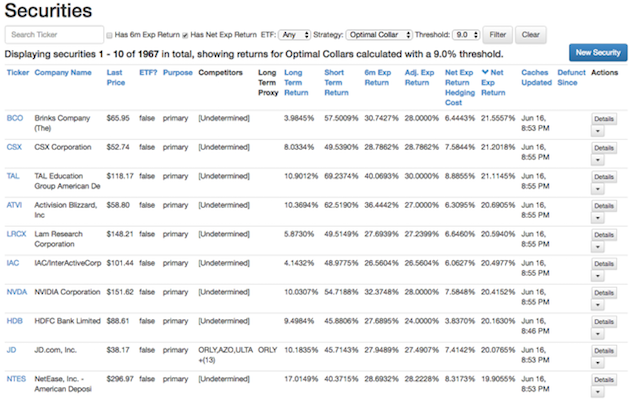

Top Names From June 16th

These were the top ten names as of June 16th, presented here initially: Brinks (BCO), CSX (CSX), TAL Education (TAL), Activision Blizzard (ATVI), Lam Research (LRCX), IAC/Interactive (IAC), Nvidia (NVDA), HDFC Bank (HDB), JD.com (JD), NetEase (NTES).

And here's how they did over the next 6 months:

On average, the top names were up 19.75% over the six month period, versus 10.94% for SPY.

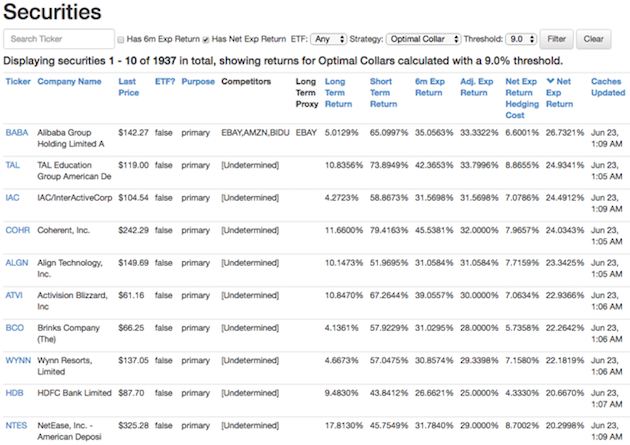

Top Names As Of June 22nd

These were the top 10 names as of June 22nd, presented here initially: Alibaba (BABA), TAL Education Group (TAL), IAC/InterActive (IAC), Coherent (CORH), Align Technology (ALGN), Activision Blizzard (ATVI), Brink's Company (BCO), Wynn Resorts (WYNN), HDFC Bank (HDB), NetEase (NTES).

And here's how they did over the next 6 months:

On average, the top names were up 24.46% over the six-month period, versus 11.27% for SPY.

Top Names As Of June 29th

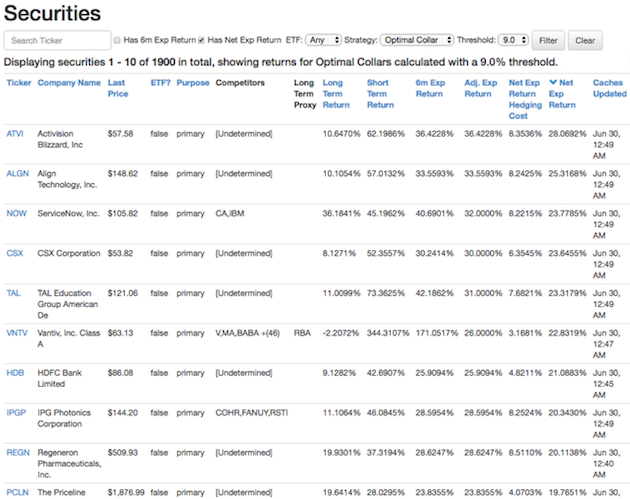

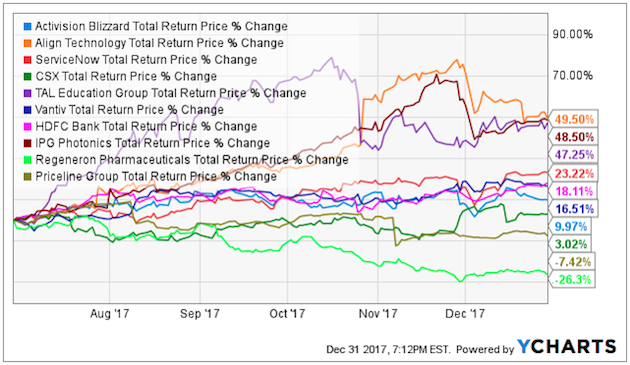

These were the top 10 names as of June 29th, time-stamped here on Twitter: Activision Blizzard (ATVI), Align Technology (ALGN), ServiceNow (NOW), CSX (CSX), TAL Education (TAL), Vantiv, HDFC Bank, IPG Photonics (IPGP), Regeneron (REGN), and Priceline (PCLN).

Here's how they did over the next 6 months:

On average, the top names were up 18.24% over the six-month period, versus 11.68% for SPY.

Top Names As Of July 7th

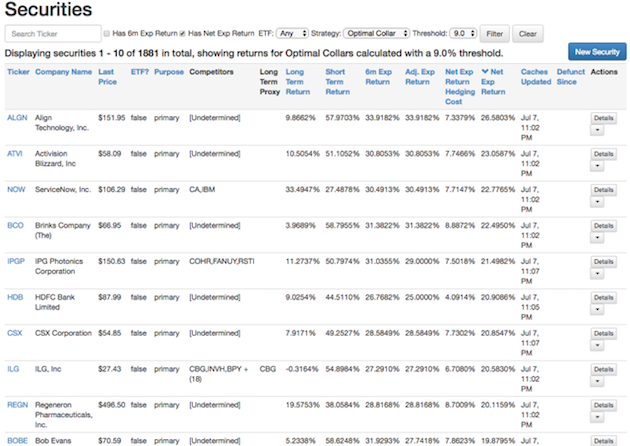

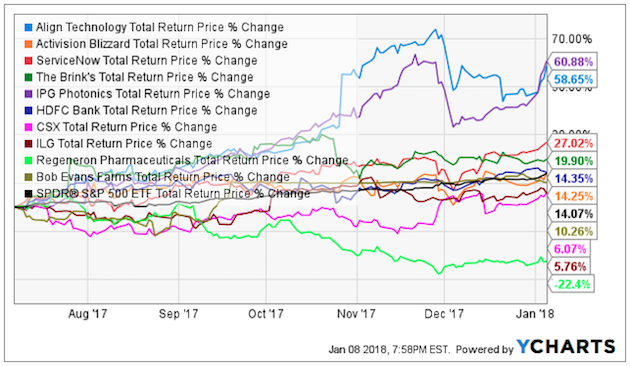

These were the top 10 names as of July 7th, time-stamped here on Twitter: Align Technology (ALGN), Activision Blizzard (ATVI), ServiceNow (NOW), Brinks (BCO), IPG Photonics (IPGP), HDFC Bank (HDB), CSX (CSX), ILG (ILG), Regeneron Pharmaceuticals (REGN), and Bob Evans (BOBE).

And here's how they did over the next 6 months:

On average, the top names were up 19.47% over the six-month period, versus 14.07% for SPY.

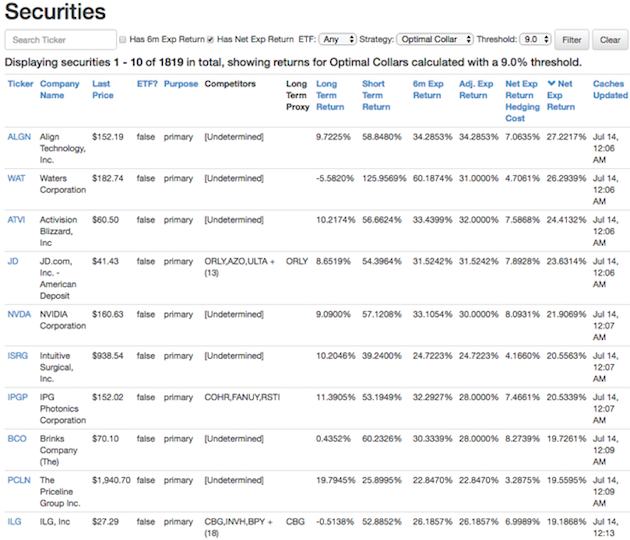

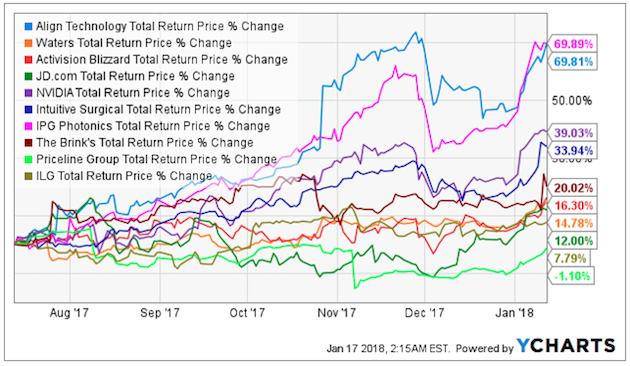

Top Names As Of July 13th

These were the top 10 names as of July 13th, time-stamped here on Twitter: Align Technology (ALGN), Waters (WAT), Activision Blizzard (ATVI), JD.com (JD), Nvidia (NVDA), Intuitive Surgical, IPG Photonics (IPGP), Brinks (BCO), Priceline (PCLN), and ILG (ILG),

And here's how they did over the next 6 months:

On average, the top names were up 28.25% over the six-month period, versus 14.85% for the SPY.

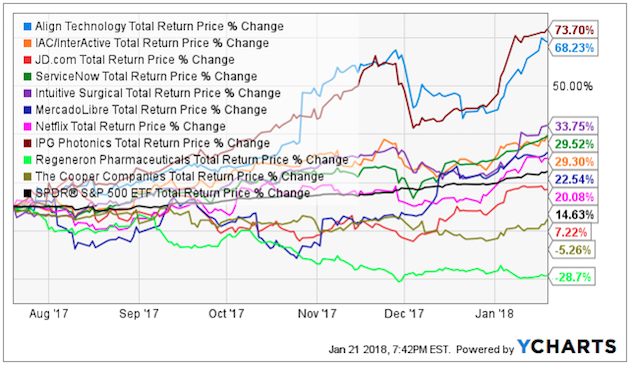

Top Names As Of July 20th:

These were the top 10 names as of July 20th, presented here on Twitter at the time: Align Technology (ALGN), IAC/InterActive (IAC), JD.com (JD), ServiceNow (NOW), MercadoLibre (MELI), Netflix (NFLX), IPG Photonics (IPGP), Regeneron Pharmaceuticals (REGN), and Cooper (COO).

And here's how they did over the next 6 months:

On average, the top names were up 25% over the six-month period, versus 14.62% for the SPY.

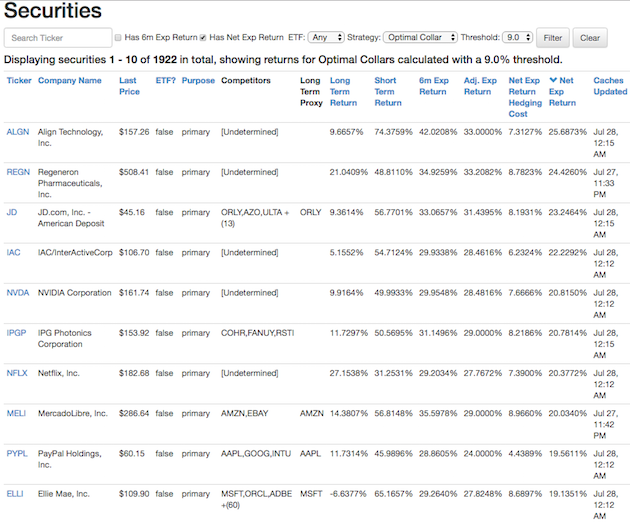

Top Names As Of July 27th

These were the top names as of July 27th, the most recent cohort to complete 6 months, presented time-stamped on Twitter here: Align Technology (ALGN), Regeneron Pharmaceuticals (REGN), JD.com (JD), IAC/Interactive (IAC), NVIDIA (NVDA), IPG Photonics (IPGP), Netflix (NFLX), MercadoLibre (MELI), PayPal (PYPL), and Ellie Mae (ELLI).

And here's how they did over the next 6 months:

The top names were up 33.52%, versus 17.1% for SPY.

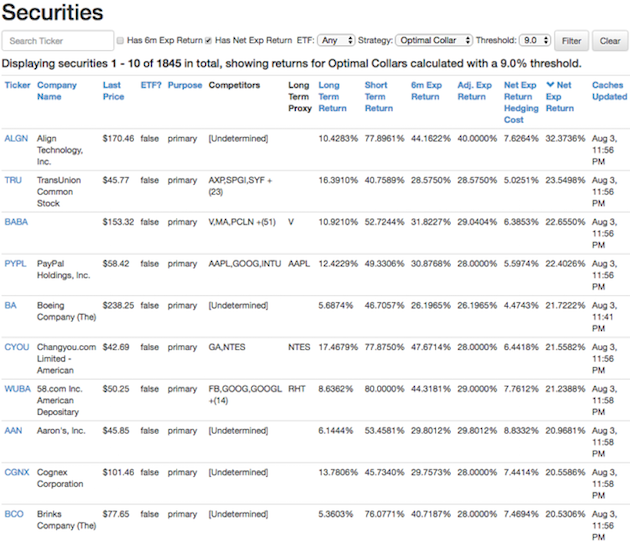

Top Names

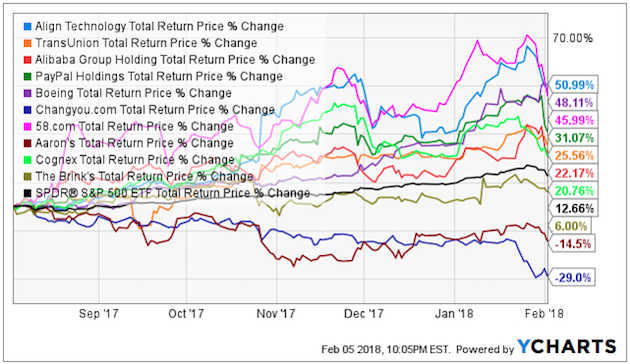

These were the top 10 names as of August 3rd shared here on Twitter at the time : Align Technology (ALGN), TransUnion (TRU), Alibaba (BABA), PayPal (PYPL), Boeing (BA), Changyou (CYOU), 58.com (WUBA), Aaron's (AAN), Cognex (CGNX), Brinks (BCO).

Top Names Performance

The top names were up 20.72%, on average, versus 12.66% for SPY. This is the 8th week in a row, and 8th week out of 9 that Portfolio Armor's top 10 names outperformed the market over the next 6 months.

Adding It Up

Let's add up each weekly top names cohort's average performance versus that of SPY, and divide by 8 to get the average performance of both over these time periods:

| Starting Date | Portfolio Armor 6-Month Performance | SPY 6-Month Performance |

| June 8th | 8.78% | 9.99% |

| June 16th | 19.75% | 10.94% |

| June 22nd | 24.46% | 11.27% |

| June 29th | 18.24% | 11.68% |

| July 7th | 19.47% | 14.07% |

| July 13th | 28.25% | 14.85% |

| July 20th | 25% | 14.62% |

| July 27th | 33.52% | 17.1% |

| August 3rd | 20.72% | 12.66% |

| Average | 22.02% | 13.02% |

So Portfolio Armor's top ten names averaged 22.02% over the average of these 6-month periods, versus SPY's average of 13.02%, an average outperformance of 9% over 6 months.

Consistent With Previous Test Results

The recent real-time results above are consistent with the results of backtests my team and I ran for this security selection method several years ago. What we did was run Portfolio Armor's daily screen every trading day from the beginning of 2003 until the end of October in 2013, and then see what the performance was over the next 6 months. Some of those days, there were fewer than 10 names that passed the site's two screens, so the average number of top names was 9.4 per day, rather than 10. In total (multiplying 9.4 by the number of trading days from 1/2/2003 to 10/31/2013), that was 25,412 tests. The average return for our top names over the next 6 months was 6.84%, versus 4.52% for SPY. The absolute numbers for both Portfolio Armor's top names and SPY were lower during the average 6 month period of the backtests than in the real-time examples above from the recent bull market, but in both cases the outperformance is consistent.

Impressive!

Thanks, Alpha.