A Reversal Day Often Marks The Short-Term Bottom

A reversal day often marks the short-term bottom. Now we watch tomorrow to see if the new 52-week lows drop down to a harmless level.

(Click on image to enlarge)

Feeling a little bit better about stocks? I am hoping that we see market consolidation in this sideways range. The consolidation could last for a number of months. My guess is that before the market can challenge for new highs, it needs to re-test the 2600 level.

(Click on image to enlarge)

There was no flight into gold stocks during this market sell off. I don't really know why, but I think it may be because of the weak M2 growth rate. I am open to other explanations.

Of the 45 ETFs I monitor each day, GDX was the weakest today.

(Click on image to enlarge)

The challenge now is to figure out what the best performing sectors will be over the next few months. At the moment, I honestly don't know. But here are some candidates.

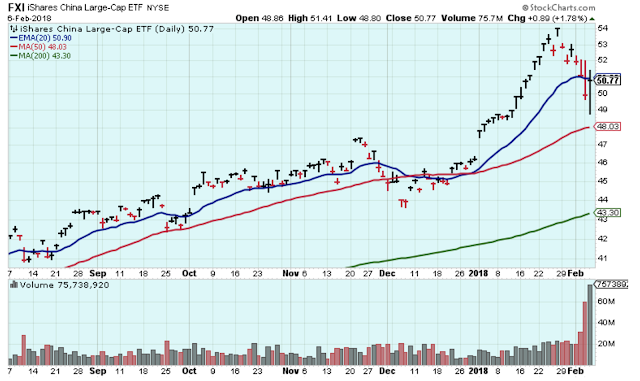

The China large-caps didn't even touch the 50-day average. Very bullish.

(Click on image to enlarge)

Large cap US retailers, also looking very strong.

(Click on image to enlarge)

Biotech retraced to the break out level, and then hung in there quite well. Bullish looking to me.

(Click on image to enlarge)

Home Construction could be a broken chart, maybe done in by the higher long-term interest rates? I am avoiding this group.

(Click on image to enlarge)

Emerging market stocks look healthy.

(Click on image to enlarge)

Outlook Summary:

Higher inflation and higher rates are now a headwind for US stocks.

The long-term outlook is positive.

The medium-term trend is down.

The short-term trend is down.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more

I'd like to see Dennis Gartman come out and announce he's buying dollars right as it approaches overhead resistance, and I'd like to see him say "I shall be selling gold." Then I can load up on $GLD and $GDX again.

:-)

$GDX loks terrible. I wouldn't be surprised to see gold make a return to the 1200's soon.

I've read that some investors have been abandoning their positions in #preciousmetals to help fund their move to #crytocurrencies. Any truth to that?

I've heard that, but I'm not sure if that's really having any effect. Gold has had every chance to rally with the weakness in crypto, the dollar, and the equities, yet it has been headed downward.

I agree @[Louis Jackson](user:25529).

I would love to know why gold is so weak. I am open to all suggestions.

I thought gold was rebounding today?

Check out @[Michael Kahn](user:5052)'s 3 Reasons To Be Chearful:

www.talkmarkets.com/.../reasons-to-be-cheerful--theres-three

And @[Frank Holmes](user:27728)'s "Fear Creeps Back Into Stocks, Shining A Light On Gold"

www.talkmarkets.com/.../fear-creeps-back-into-stocks-shining-a-light-on-gold

I'm not sure overall, but I'm guessing the dead cat bounce in the $ is pushing it down. And $ looks like it could bounce to the $92 area.