A Reader Asks - Does An Increase In Money Supply Cause Inflation?

This seemingly simple question, is not so simple. What is the money supply? How does one measure inflation.

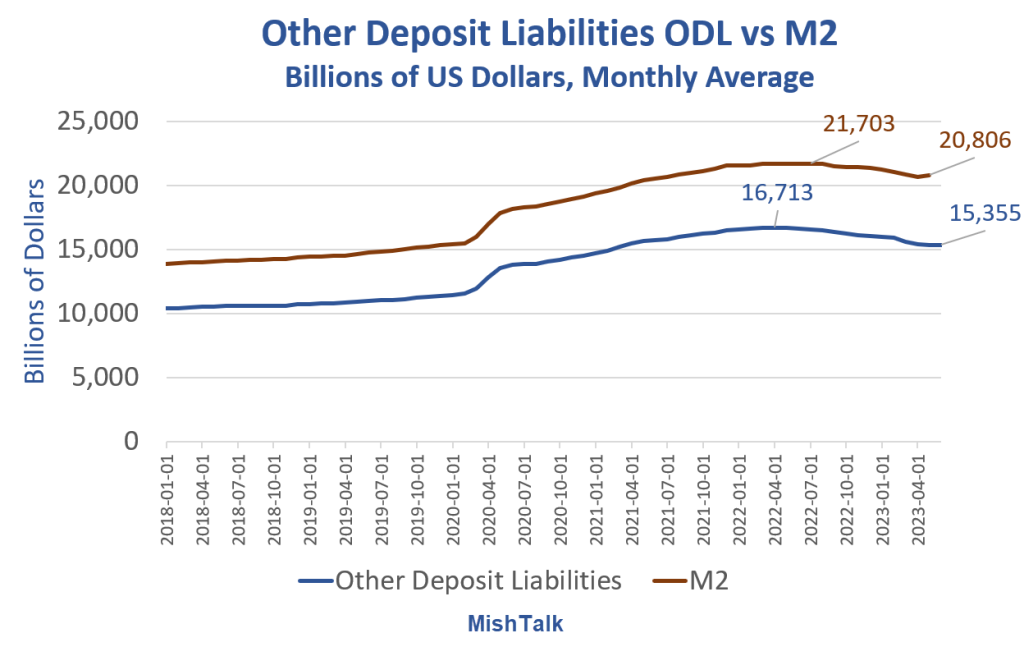

Other Deposit Liabilities vs M2, monthly average via St. Louis Fed

ODL vs M2 Chart Notes

- Other Deposit Liabilities (ODL see description below), is a monthly average.

- M2 is a monthly measure through March.

A Better Definition of Money

The main difference between ODL and M2 is that ODL does not include currency or retail money market funds.

Currency is accepted at an increasingly fewer number of business establishments and simply cannot be used for very large sized transactions. Retail money market funds never became an important medium of exchange. Both are becoming a far less used medium of exchange.

ODL has the additional advantage that it is the main source of funding for bank loans and investments, making ODL both a monetary and credit aggregate. Friedman would not be surprised that the need to change the best definition of what constitutes money would change over the years.

The above three paragraphs from Lacy Hunt at Hoisington Management.

Whether or not one uses M2 or ODL, money supply has generally been decreasing. Why the Fed cannot release M2 more timely is a mystery. It’s July 15, but the latest M2 is for May. One might wonder “What the H is the Fed hiding?”

Definition of Inflation

Some Austrian economists would say increases in money supply do not “cause” inflation, it is the definition of inflation.

If you hold that view, then deflation is the opposite and we are in deflation now.

Some mean the CPI when they refer to inflation. Others, notably the Fed, think the Personal Consumption Expenditures (PCE) price index is the best measure of inflation.

The huge problem with both the CPI and PCE is that it does not include asset prices, especially housing.

Case-Shiller National Home Price Index, Case-Shill 10-City Index data via St. Louis Fed, CPI, Rent, and OER from the BLS. Chart by Mish

OER stands for Owners’ Equivalent Rent, the price one would pay to rent one’s own house unfurnished and without utilities.

We have had two obvious housing bubbles, neither of which constituted inflation to most economists. I find that absurd.

Why all M2 Increases/Decreases are Not Equal

Compounding the discussion is the simple fact that some reasons for M2 rising or falling are far more important than others.

QE expanded M2 greatly. But the main result was lifting of asset prices, especially homes by lowering interest rates.

That is vastly different than M2 rising because of free money stimulus. QE is not directly spendable, free money is.

The CPI Broken Record Continues, Rent Keeps Rising, Otherwise Inflation Is Cooling

For discussion of the CPI, please see The CPI Broken Record Continues, Rent Keeps Rising, Otherwise Inflation Is Cooling

Real Disposable Personal Income and Real PCE

Real Disposable Income and real PCE data from the BEA, chart by Mish.

Real Personal Income Chart Notes

- Real means inflation adjusted by the PCE price index.

- PCE stands for Personal Consumption Expenditures.

- Transfer payments are free money handouts such as Social Security, Medicare, Medicaid, and the three huge rounds of fiscal stimulus.

Excluding transfer payments, real income has gone nowhere. But the huge handouts led to equally huge jumps in income and spending.

The Fed has been struggling with inflation ever since. Demographics adds to the problem.

A huge wave of boomers retirements is in progress. Skilled boomers are now replaced with unskilled Zoomers (generation Z), who do not seem to have the same work ethic.

Do Rising Wages Tend to Increase Inflation?

I discussed the above chart in Do Rising Wages Tend to Increase Inflation?

A huge wave of boomers retirements is in progress. Skilled boomers are now replaced with unskilled Zoomers (generation Z), who do not seem to have the same work ethic.

So, it’s no wonder productivity is in the gutter.

This is the battle the Fed is fighting. Is the Fed winning? For how long?

This brings another aspect of the problem into play.

Productive increases in money supply will not cause consumer price inflation. Free money will. QE tends to create asset bubbles which many do not see as an increase in deflation.

So add it all up, and the answer is “It depends on all of the things discussed above and also what one means by inflation.”

Addendum

A reader commented “I think what most people care about is what does their money buy so let’s simplify the definition.”

It’s still not so simple. Do you own a house already or do you want to buy one?

Are you retired with Medicare paying your insurance or do you buy your own insurance?

The BLS and Fed average it all out ignoring asset bubbles which the reader comment does as well, at least for someone who already has a house, but also someone who has company paid medical care or is on Medicare.

The CPI ignores expenses paid on behalf of someone else (Medicare and company insurance). The PCE includes expenses paid on behalf of consumers but even more radically ignores housing bubbles.

More By This Author:

A 5 Percent Pay Cut is Coming for 37 Million Student Loan BorrowersDo Rising Wages Tend To Increase Inflation?

Export Prices Plunge 0.9 Percent, Import Prices Drop 0.2 Percent

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more