Do Rising Wages Tend To Increase Inflation?

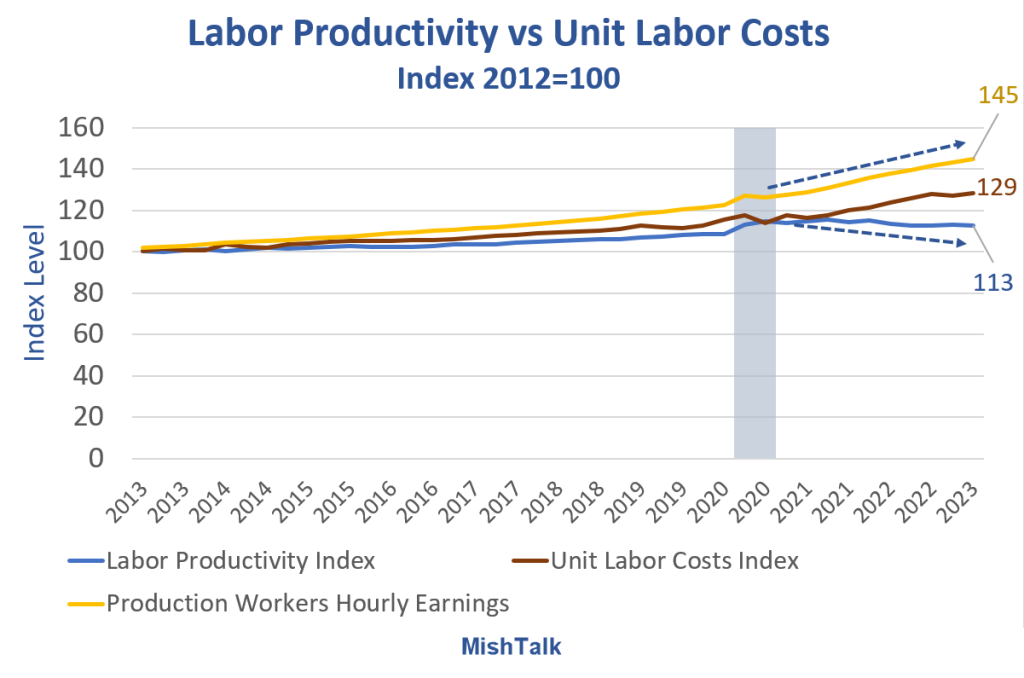

Labor productivity, costs, and hourly earnings data from BLS, chart by Mish.

The Fed may be making progress on inflation, but that progress is unlikely to stick if costs keep rising more than productivity.

Labor Productivity vs Costs Long Term

Production and nonsupervisory wages started accelerating pre-pandemic, unit labor costs rose sharply after the recession.

Why Are Wages Rising Faster than Unit Labor Costs?

I suspect the answer is more part-time work and more hourly work without benefits. Illegal immigrants likely receive no benefits.

Stagflation and Greenspan’s “Great Moderation”

Fed Chair Alan Greenspan is credited for what economists now call “The Great Moderation”, a period of steady disinflation (lower and lower price increases).

Productivity minus costs rose from 2002 to 2008. Then, despite declining productivity, the Fed struggled to raise inflation, at least as measured by the CPI.

Case Shiller National and 10-City Home Price Indexes, Rent, and OER

Case-Shiller Home price indexes via the St. Louis Fed. CPI, OER, and Rent data from the BLS.

OER stands for Owners’ Equivalent Rent. It’s the price one would pay to rent one’s own house, unfurnished, without utilities.

The allegedly low inflation from 2010 to 2020 was a mirage. Inflation was rampant, but the Fed (economists in general), foolishly ignore housing prices in their measure of inflation.

The Fed missed massive inflation in housing and assets, and asset prices are still bubbling.

The CPI Broken Record Continues, Rent Keeps Rising, Otherwise Inflation Is Cooling

For discussion of the CPI, please see The CPI Broken Record Continues, Rent Keeps Rising, Otherwise Inflation Is Cooling

Free Money

Nothing is more inflationary than paying people to do nothing.

Q: Who did that?

A: The government, three times fighting the Covid pandemic and the results speak for themselves.

Real Disposable Personal Income and Real PCE

Real Disposable Income and real PCE data from the BEA, chart by Mish.

Real Personal Income Chart Notes

- Real means inflation adjusted by the PCE price index.

- PCE stands for Personal Consumption Expenditures.

- Transfer payments are free money handouts such as Social Security, Medicare, Medicaid, and the three huge rounds of fiscal stimulus.

Excluding transfer payments, real income has gone nowhere. But the huge handouts led to equally huge jumps in income and spending.

The Fed has been struggling with inflation ever since. Demographics adds to the problem.

A huge wave of boomers retirements is in progress. Skilled boomers are now replaced with unskilled Zoomers (generation Z), who do not seem to have the same work ethic.

So, it’s no wonder productivity is in the gutter.

This is the battle the Fed is fighting. Is the Fed winning? For how long?

Judging from the CPI, it may appear the Fed is winning the inflation battle, but asset prices are still soaring. Home prices have barely begun to fall. And wage growth vs productivity is hardly encouraging.

Add it all up and it’s not quite right to suggest a Fed victory over inflation.

More By This Author:

Export Prices Plunge 0.9 Percent, Import Prices Drop 0.2 Percent

Ripple Crypto XRP Surges 90 Percent After A District Court Rules Against The SEC

Producer Prices Hold To Narrow, Fed Pleasing Range, For 9 Months

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more