A New Bull Run Could Be Triggered Based On Market Breadth

Based on the market breadth assessed in the 3 conditions to be fulfilled, a new bull market could begin according to the stat in the past 20 years.

Watch the video below to find out how you could confirm the bull run with the most important element as mentioned in the video and at what circumstances could the bull scenario be violated (these are important).

Video Length: 00:15:21

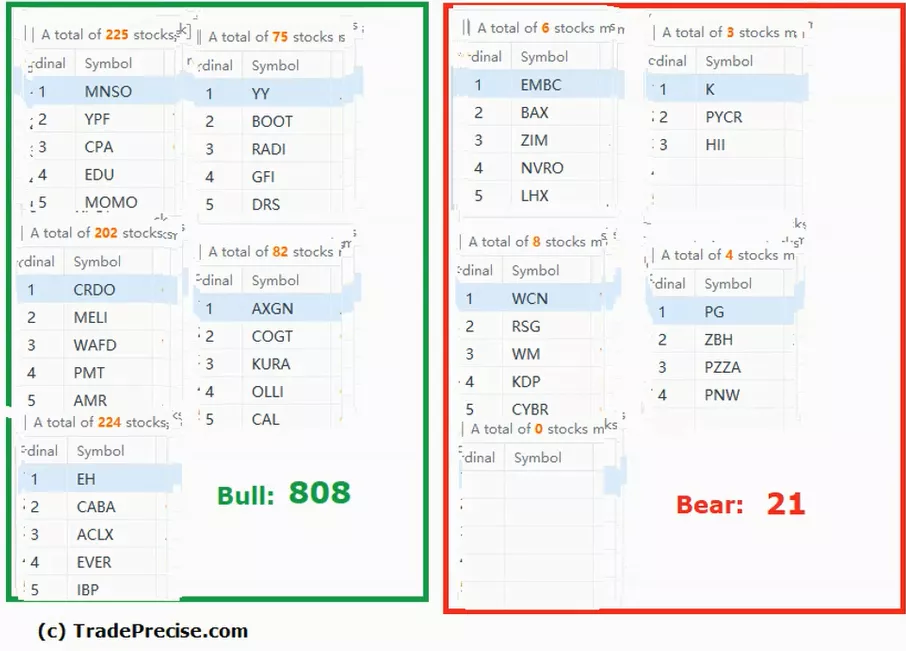

The bullish setup vs. the bearish setup is 808 to 21 from the screenshot of my stock screener below. This is another positive sign, which is inline with the improving market breadth to support the bull case.

As the market is short-term overbought, watch out for a pullback and judge the characteristics of the reaction to anticipate the next move. Meanwhile, a trailing stop for trade management is great to protect your profit if you have been trading those outperforming stocks covered in the Weekly Live Group Coaching session for the past few weeks.

More By This Author:

Could VIPS Continue Its Bullish Momentum After 140% Rally Since October?

Does Alibaba Have What It Takes To Rally 200% Back To Its All-Time High?

Bull Market Could Be In For China According To The Wyckoff Method

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.