Bull Market Could Be In For China According To The Wyckoff Method

Image Source: Unsplash

Based on the Wyckoff trading method, China Internet ETF, (KWEB), could be in for a bull run as it nears the completion of the Wyckoff accumulation pattern.

Watch the video below and take advantage of the five outperforming China stocks selected from the KWEB ETF constituents as mentioned in the video on top of KWEB for swing trading or even position trading.

Video Length: 00:12:31

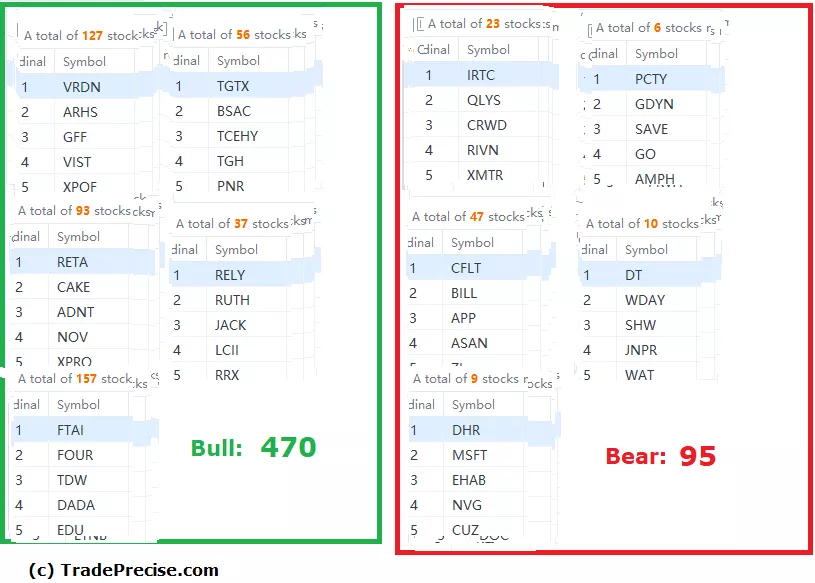

The bullish setup vs. the bearish setup is 470 to 95 from the screenshot of my stock screener below. While the directional bias for S&P 500 (ES) is still to the downside, the number of bullish trade entry setups actually increased from last week.

This is a great sign for the bulls as it could suggest the outperforming stocks as highlighted in the live session could have bottomed out already and are on the markup phase E (e.g. uptrend) despite the index like S&P 500 is likely to have another leg down to at least testing the previous swing low or lower.

More By This Author:

Is Las Vegas Sands The Right Bet For You?

Is IBM The Outperforming Stock To Catch?

Important Levels You Need To Know In Swing Or Day Trading S&P 500

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.