Important Levels You Need To Know In Swing Or Day Trading S&P 500

Image Source: Pixabay

Here are the important levels in S&P 500 futures (ES) that you need to know for day trading and swing trading to achieve a high reward-to-risk ratio.

Watch the video below to find out the trading plan for shorting S&P 500 based on the Wyckoff method and the long and short-term directional bias.

Video Length: 00:07:05

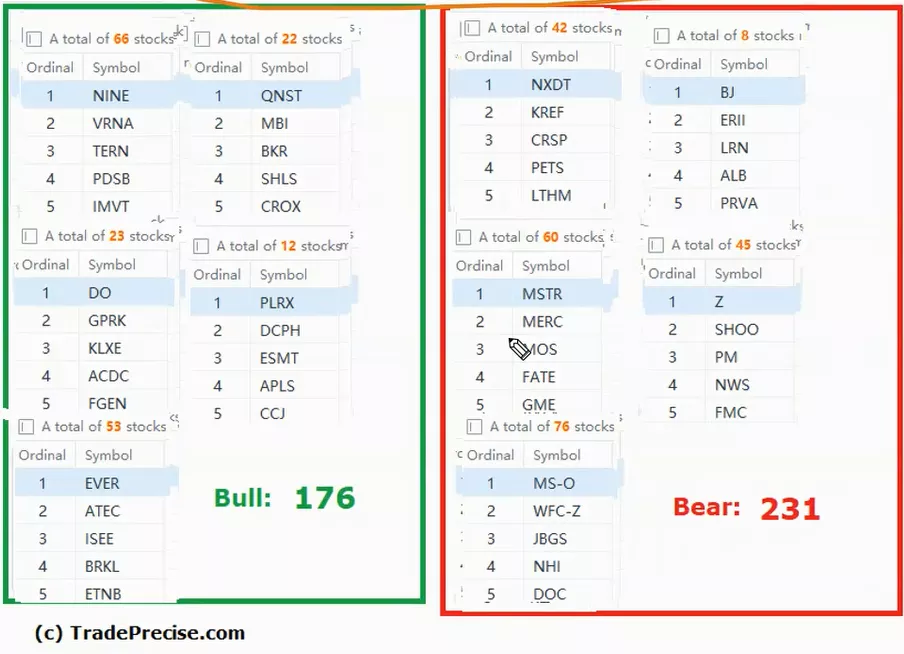

The bullish setup vs. the bearish setup is 176 to 231 from the screenshot of my stock screener below. The directional bias for S&P 500 (ES) is still to the downside. Shorting into strength is preferred when swing trading in the confluence area as mentioned in the video.

For stock trading, there are a handful of outperforming stocks in the home builders, precious metals, and biotech groups. Only the grade A+ trade entry setup will be considered as volatility in the market still does not favor swing trading.

More By This Author:

Is First Solar Still Bullish? Here's What The Chart Shows

Here's How Home Depot (HD) Could Be Ready For The Next Big Move

Honeywell - A Sign Of Strength Rally To Hit All Time High?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.