A Heavy Duty Recession Indicator

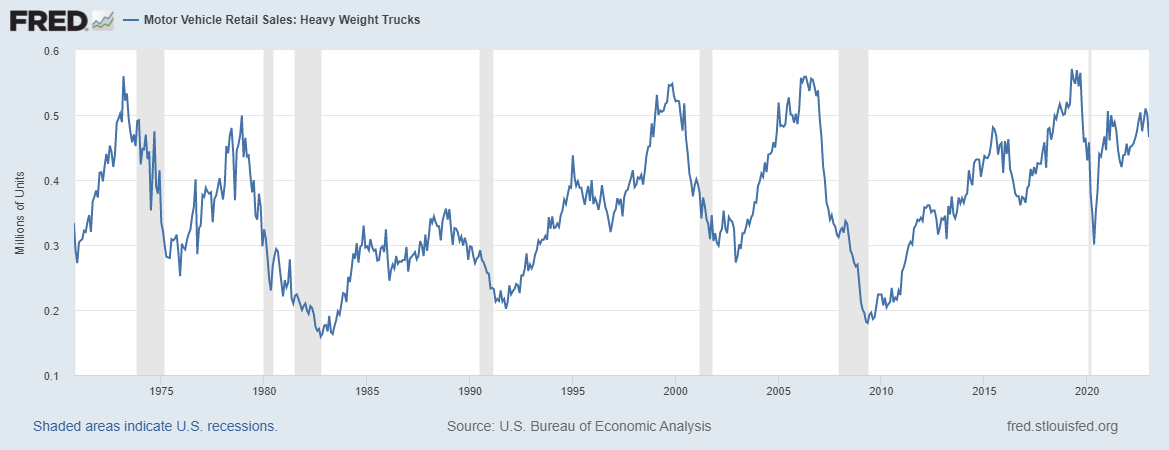

I was reading Bill McBride’s blog, Calculated Risk, recently and came across this post on heavy truck sales as a recession indicator. As Bill notes:

Usually, heavy truck sales decline sharply prior to a recession. Sales were solid in January.

It certainly looks like sales do indeed peak before recession. But how long before recession? Does this really work as a recession indicator?

(Click on image to enlarge)

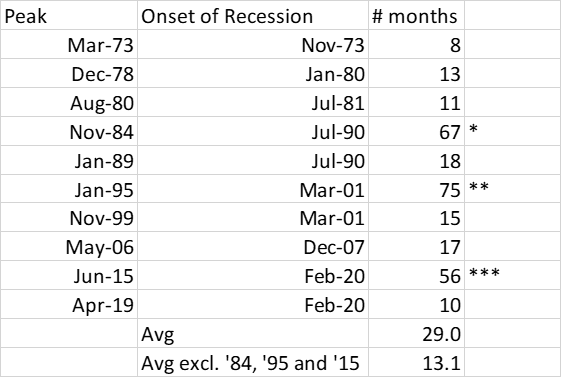

Here’s what I found:

Since 1973 there have been 7 recessions and heavy truck sales fell before each one with a lead time of about 13 months. But there were three episodes where sales peaked and fell at least 25% before resuming the uptrend. I can’t imagine that one would just watch this go down 25% and not act on it, so I’d call those three false signals. I would also note that in the ’73 and ’90 recessions sales didn’t fall quite 25% prior to recession. I’m not sure that matters much but something to keep in mind.

So, it is a useful signal but, like most indicators, isn’t infallible. Predicting the onset of recession is basically impossible but all you really need to do is get close. Using a suite of indicators and market signals is the best you can do.

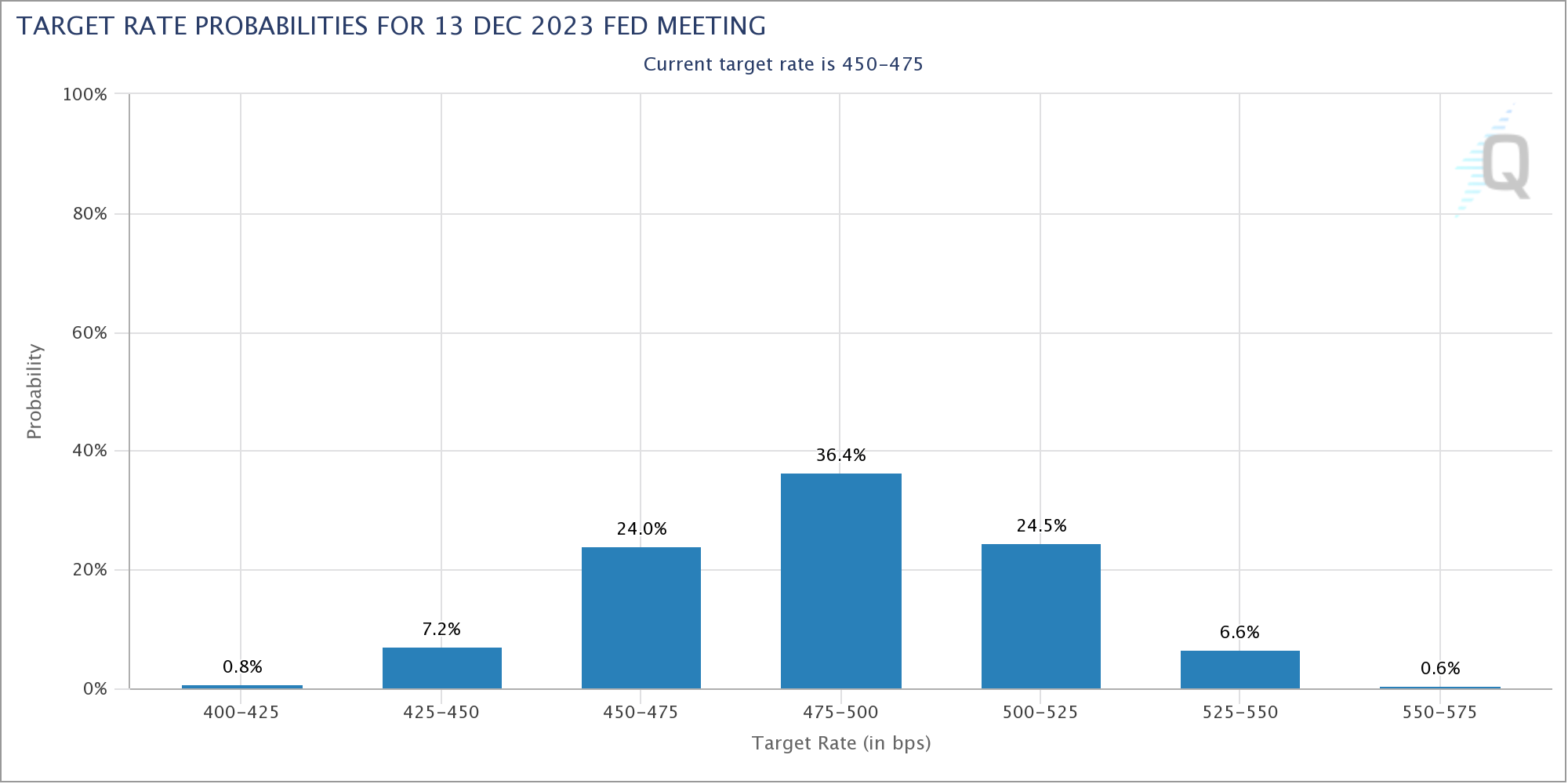

As for today, these heavy truck sales may have already peaked but there is no way to know that now. But even if it peaked in November, the shortest lead time would put recession starting in July and the average would put it in December. The longest wouldn’t have recession arrive until April of 2024. Those dates seem reasonable with the current probabilities in the CME’s Fed Watch Tool which shows the likelihood of rates peaking in May at 5 – 5.25% and the first rate cut in December. That would likely mean recession starts in late 2023 or early 2024. That is also consistent with Eurodollar and SOFR futures markets which show a similar structure of short term rates.

(Click on image to enlarge)

Right now both real and nominal interest rates are still rising so I don’t think recession is imminent. But it will come at some point and we’ll need every useful indicator we can find to try and pinpoint its arrival.

More By This Author:

Weekly Market Pulse: Happy Days Are Here Again!This Is The Soft Landing. What Now?

Weekly Market Pulse: First, Kill All The Speculators

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more