A Depressed Growth Trajectory: The Wall Street Journal July Survey

Forecasters are downbeat relative April survey (Figure 1). And about a third forecast negative Q/Q growth in 2022Q2, but the mean (and median) forecast is for positive growth, as shown in Figure 2 (though there being two consecutive quarters of negative growth are not central to determining whether NBER BCDC declares a recession). About a fifth of respondents predict at least two consecutive quarters of negative growth starting later in 2022-23.

(Click on image to enlarge)

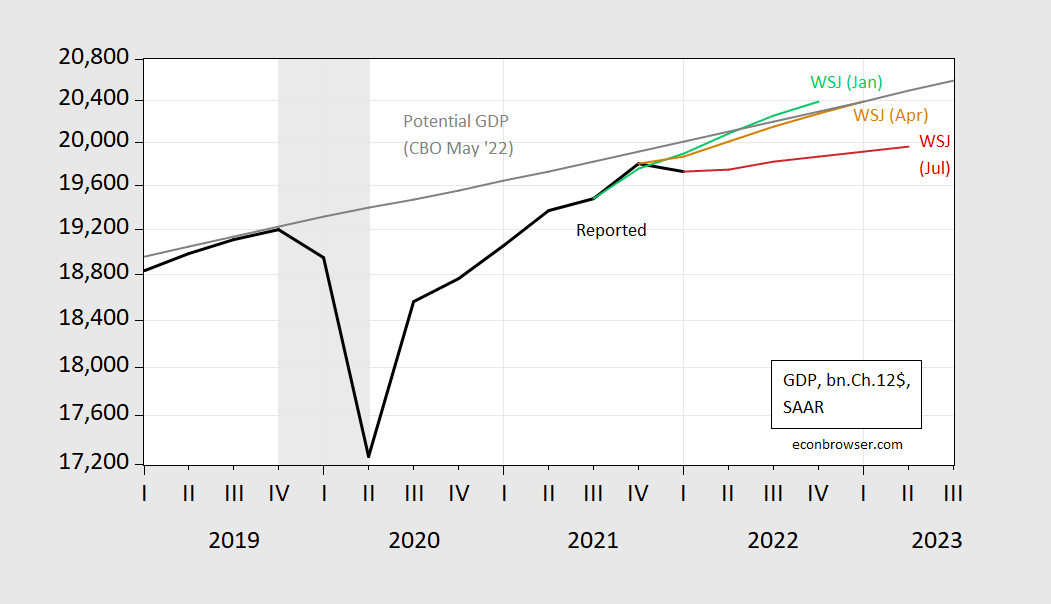

Figure 1: GDP as reported in 2022Q1 third release (black), WSJ January survey (green), April survey (tan), July survey (red), potential GDP (gray), all in billions Ch.2012$, SAAR, all on log scale. NBER defined peak-to-trough recession dates shaded gray. Source: BEA,CBO (July, 2022), WSJ survey, various vintages, NBER and author’s calculations.

The January WSJ survey placed output rising fairly smartly, rising above potential (as estimated by CBO in May). By April’s survey, a little over a month after the expanded Russian invasion of Ukraine and commensurate surge in oil prices, the trajectory was lowered somewhat. As of July’s survey, a substantial drop in the trajectory is predicted by the mean response, with an implied output gap widening to -2.6% by 2023Q2 (based on CBO’s estimate of potential, not the survey respondent’s).

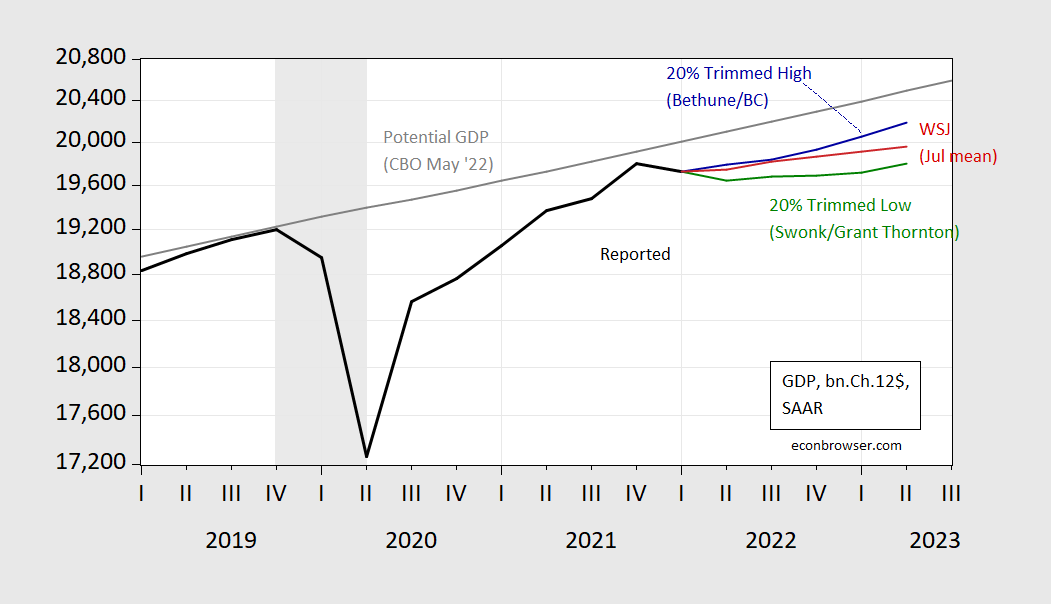

There is some notable dispersion in forecasts. This is hinted at in Figure 2, which shows the 20% trimmed upper and lower observations (ranking based on the 2022 Q4/Q4 growth rate).

(Click on image to enlarge)

Figure 2: GDP as reported in 2022Q1 third release (black), Diane Swonk/Grant-Thornton (green), Brian Bethune/Boston College (blue), July survey mean (red), potential GDP (gray), all in billions Ch.2012$, SAAR, all on log scale. NBER defined peak-to-trough recession dates shaded gray. Source: BEA,CBO (July, 2022), WSJ survey, NBER, author’s calculations.

The mean response implies positive growth in Q2. The median (not shown) looks similar for 2022, (although the median respondent also believes that there will be two-quarters of negative growth, starting in 2023Q1).

Brian Bethune at Boston College is at the top of the 20% trimmed sample, with 2% for 2022 Q4/Q4). Diane Swonk at Grant Thornton predicts a negative reading on Q2 growth (-1.7% SAAR), with lackluster growth thereafter, so that 2022 Q4/Q4 growth is only -0.5%.

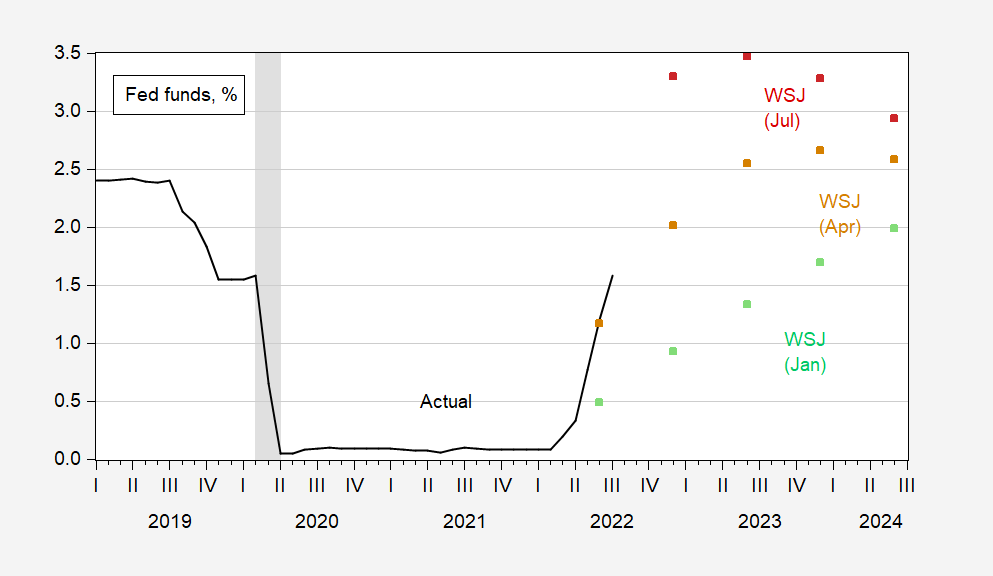

The downgrading of growth prospects is unsurprising; the narrative of rising Fed funds rate to reduce perceived inflationary pressures shows up in the forecasts for interest rates:

(Click on image to enlarge)

Figure 3: Effective Fed funds rate (black), WSJ January survey (green ssquare), April survey (tan square), July survey (red square), all in %. NBER defined peak-to-trough recession dates shaded gray. Source: Federal Reserve via FRED, WSJ survey, various vintages, NBER.

More discussion of the survey results in the WSJ article.

More By This Author:

China Q2 Takes an (Expected) DiveAnother Quarter Of Negative Growth?

Business Cycle Indicators, Mid-July

Disclosure: None.