A Big Move In Small Stocks

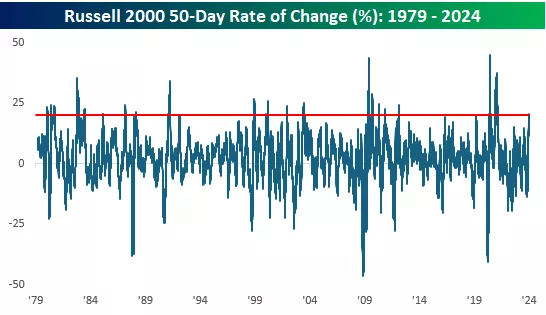

It has now been 50 trading days since US markets made their Q4 lows on 10/27/23. One of the more impressive rallies has been the 20%+ gain in the small-cap Russell 2000. That move ranks as the largest 50-day rally in the index since 2020 and one of only 21 periods in the index’s history since 1979 that it rallied that much or more in a 50 trading-day period. Before the experiences during the early days of COVID, there was one occurrence in March 2019, but before that, you have to go back to 2012.

In terms of the index’s performance following these prior 50-day rallies, the chart below shows the median performance of the Russell 2000 in the weeks and months after the index first crossed the threshold of a 20%+ rally in a 50-trading day span. Whether you look at the very short-term (one week) or over the long-term (one year), the Russell’s median performance following these surges has been considerably better than the index’s long-term average returns for all periods since 1979. Of course, past performance is no guarantee of future results, but we think this is helpful to know nonetheless.

More By This Author:

Bitcoin Getting Back Up There

European Golden Cross

Sentiment Signals Mixed

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more