5% Friday – Down Week Needs 2% Bounce Into The Holiday Weekend

The US markets are closed on Monday and that could be a good thing because they certainly suck when they are open. On June 3rd we finished at 4,100 on the S&P 500 (/ES) and June 10th found us at 3,900, which was down 4.87%, but close enough and now, on June 17th, we're down another 200 points to 3,700 and that's now pretty much 5% on the nose. Usually we're happy with a 1% bounce off a 5% drop but really this is a 10% drop so we need a 2% (of the index) bounce, which would be 80 points (20% of the 400 we lost) on the S&P 500.

That would take us to 3,780 and that would be a massive one-day move in /ES (not that we haven't had them on the way down) so let's not count on it. That means we can't be cute with our hedges and need to stay well-covered into the weekend – even if today does look LIKE a recovery.

We've been going through our Member Portfolios this week and, generally, we've been making bullish adjustments as this still has the smell of a forced bottom. The untouched Money Talk Portfolio, which we reviewed on Tuesday at $200,566 (up 100.6%) has slipped to $192,786 (up 92.8%)as of yesterday's close – as I said at the time, as long as we pick solid stocks with sound, Fundamental Values – we can ride out these little corrections.

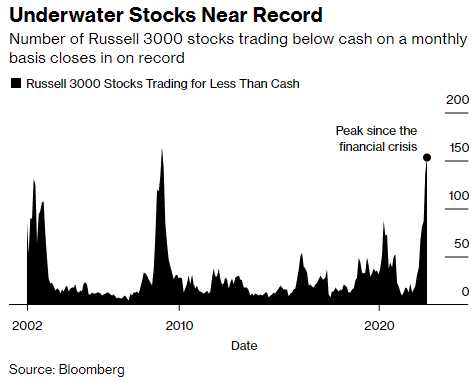

A good measure of market panic is how many stocks are "underwater", which is what M&A people call stocks that are trading below their cash levels (ie. great takeover targets). At the moment, there are 167 stocks on the Russell 3000 that are underwater, beating the previous record of 165 in February of 2009. They represent $55Bn worth of valuations – another clear record.

Trading platform Robin Hood (HOOD) is one example of a company trading below cash as their market cap has fallen below $6Bn at $6.89 but they have $6.2Bn in the bank. HOOD lost $3.6Bn last year and expects to lose $1.3Bn this year – so I'm not saying they are a good one – just pointing out an example. You still have to pay attention to the…

Click here to try Phil's Stock World free. Try PSW's ...

more