4 Asset Model Portfolio

For the week, bonds were down (yields up) and gold was essentially unchanged. Presently, the markets are all about equities, and unfortunately, our portfolio has shunned equities for the better part of the year. We believe this “sure thing” can only go so far, and we don’t view any great edge to the equity markets.

From our data driven perspective, we are NEUTRAL on equities and we believe there has been little edge since early February. For the 22 weeks prior, we were bullish on equities taking positions when most investors were bearish.

We remain bullish on gold and Treasury bonds, and we have been so for 21 weeks now. Our position in gold has given back its gains over the last several months, but despite this, we remain technically and fundamentally bullish on gold. Falling Treasury yields are gold bullish, and this is on over 40 years of data. Our call on bonds has been spot on. Our portfolio has been in 60% cash for most of the year. Tactical asset portfolios, like the 4 Asset Model Portfolio, tend to underperform during equity manias, but they are your best friend when the equity markets are NOT going nuts (which is most of the time). We are not reinventing the wheel as our approach to portfolio management has stood the test of time and has undergone much academic and real world rigor. What I bring to this mix is the market timing aspect, which I feel I do better than most!

We remain neutral on crude oil.

Our portfolio rules state: 60% of the funds are allocated towards equities when there is an equity buy signal. When equities are on a buy signal, the other 40% of the portfolio is divided up equally amongst the other assets. If equities are not on a buy signal, then the other assets get no more than a 20% allocation each. We do not use leverage.

The 4 Asset Model Portfolio spreadsheet is updated through Friday.

Figure 1. 4 Asset Model Portfolio/ spreadsheet

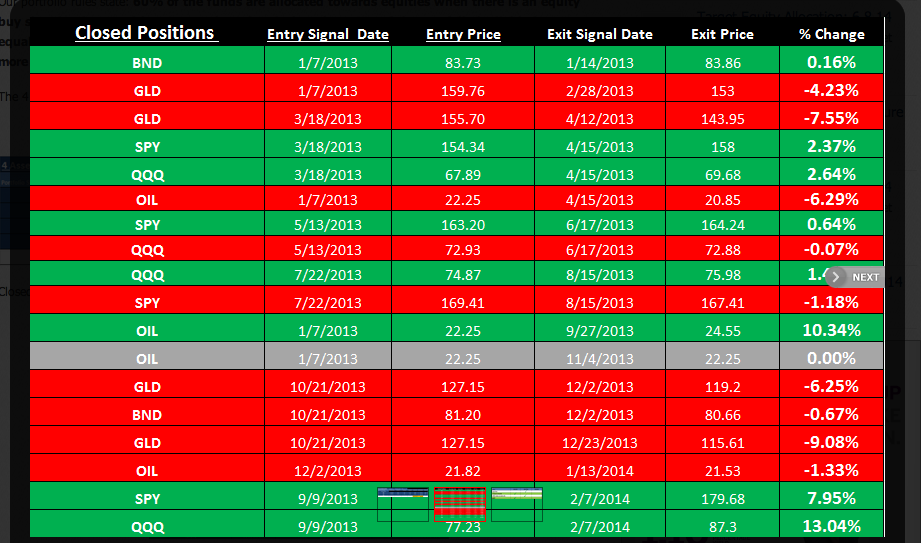

Closed positions from the 4 Asset Model Portfolio are shown in the next spreadsheet.

Figure 2. 4 Asset Model Portfolio/ closed positions

I have put together a table of our 4 assets showing which mode I think we are currently in. As our models tend to be constructed with both fundamental and technical data, a bull signal is registered when both fundamentals and technicals are positive. A bear signal is registered when both fundamentals and technicals are negative. A neutral signal means that only one element of our model is positive. Neutral market signals tend to be ruled by overbought and oversold conditions; the market is range bound. We can be buyers in bear markets as conditions can be ripe for a reversal, so being bullish in a bear is acceptable.

Figure 3. 4 Assets/ Signals

Tactical Beta is Free. Sign Up Now. The information herein is based on sources we believe to be reliable but is not guaranteed by us ...

more