3 Awful Things That Could Happen To The Market This Week

We've seen the market into headwinds before, often to no avail. And, every slowdown since April of last year has been shrugged off sooner or later before stocks got too deep into trouble. The recent lull may well meet the same non-fatal fate.

On the other hand, there are some things that are very near completion that would signal bigger trouble for the broad market than we've seen in a while. Here's a look at the biggest three possibilities we've got our eye on.

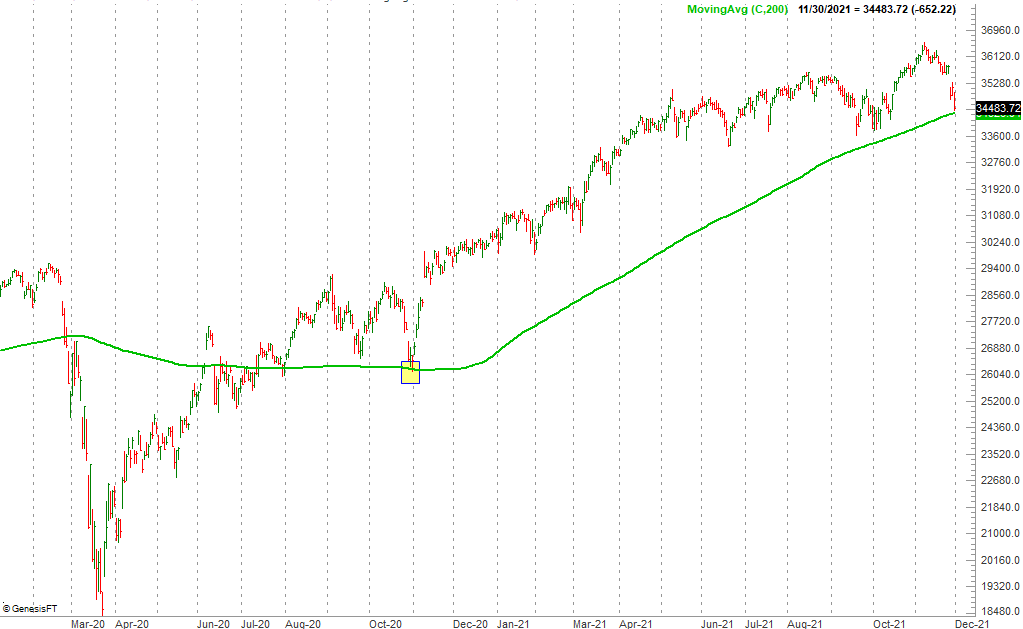

1. The Dow Jones Industrial Average could break below its 200-day moving average line for the first time since early last year

If you don't know, moving averages are (still) one of the most powerful and telling technical tools a trader can employ. And, the grand-daddy of them all is the 200-day moving average line. It's successfully identified a slew of beginnings and end of major trends.

With that as the backdrop, the Dow Jones Industrial Average (DIA) is plotted below, along with its 200-day moving average line in green. For the first time since April of last year the Dow could fall under this pivotal moving average; the test from October of last year (highlighted) was successful, meaning it ended with a bullish reversal. We may not be so lucky this time though.

As of Wednesday, the 200-day moving average line's value is 34,327.

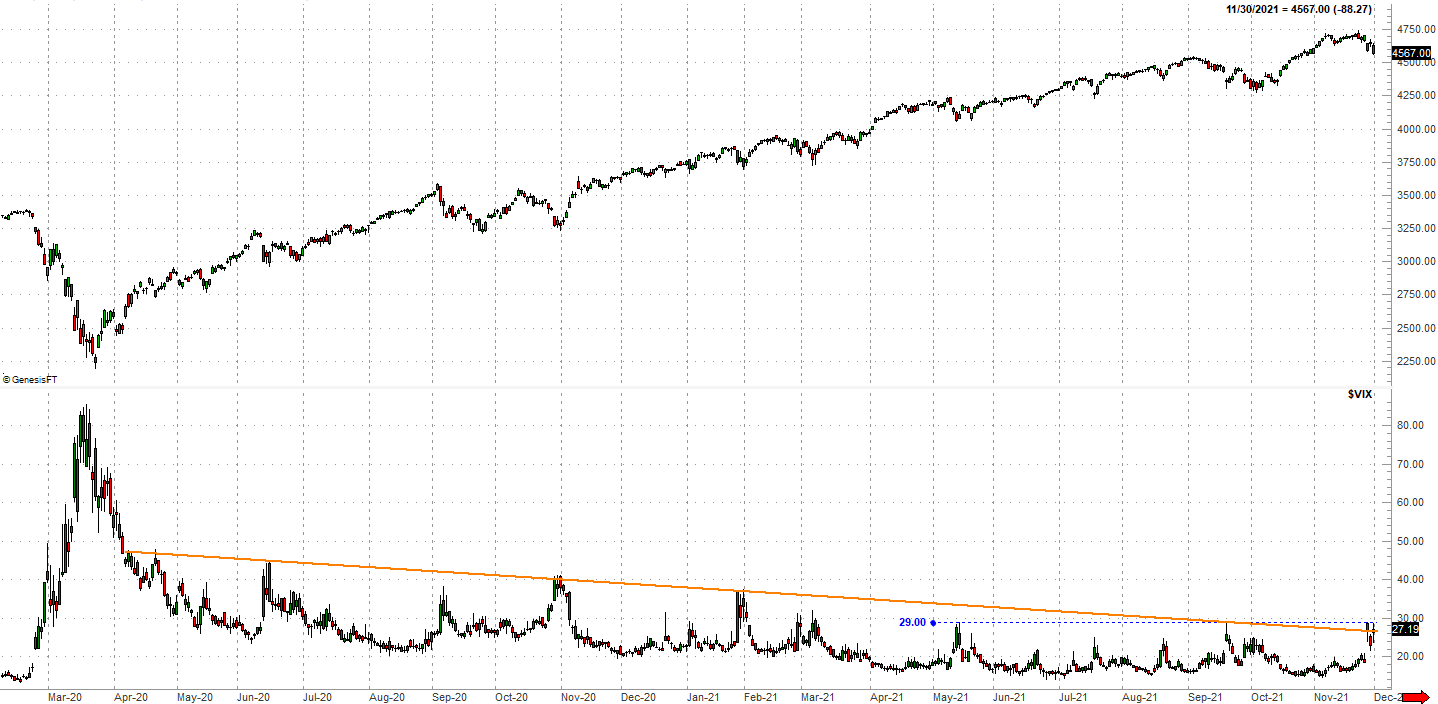

2. The S&P 500's Volatility Index could push above a key technical ceiling at 29.0

We've discussed this before -- usually in the Weekly Market Outlook-- but it merits a special mention now. That is, the S&P 500's Volatility Index (VIX) is on the verge of punching through horizontal resistance at 29.0 (blue, dashed), after it's already moved above the falling resistance line (orange) that's guided it lower since April of last year.

Generally speaking, the volatility indices move inversely with the market. It's not always necessarily a dollar-for-dollar move, although that doesn't necessarily matter. Just to see the S&P 500's volatility index finally break above long-standing ceilings now for the first time in a long time is telling, given that it arguably could have done so several times since early last year. To finally see this sort of shift in sentiment (which is really what the volatility indices are) may well be a precursor to a bigger wave of selling, as it says traders are already starting to posture themselves defensively in a way they haven't in months. A small move just above 29.0 could seal the deal, so to speak.

3. The S&P 500 itself could move below the technical support line that's been prodding it higher since the middle of last year

Finally, while we're certainly watching its volatility index, the S&P 500 (SPX) itself is within spitting distance of a move that would snap a long-standing floor.

Take a look at the weekly chart below. The past year and a half have been bound in a strangely-narrow trading range framed by orange lines. The index brushed the upper boundary of this range in October, and has been peeling back pretty precipitously since May of 2020. In fact, it's closer to the lower boundary as of right now than the upper boundary.

Granted, we've seen pullbacks to this floor go nowhere. This one might not either. Each time we brush that floor though, we're one instance closer to "the one" that finally fails.

Be reactive, not proactive

Of course, just because something technically problematic for the broad rally might happen doesn't mean it will happen. There are still paths to, and room for, a recovery. We're also at a time of year that's particularly bullish. Don't get too presumptive here based on this trio of concerns.

On the flipside, this trio of concerns is materializing simultaneously... something we've not actually seen since February/March of last year when COVID-19 was just making landfall in the U.S. To see this convergence of technical breakdowns all take shape at the same time ramps up the level of concern, as it amps up the likelihood that this pullback may be stronger than the bulls can resist.