2,800 Tuesday And The S&P – Are We There Yet?

66.6 Thousand.

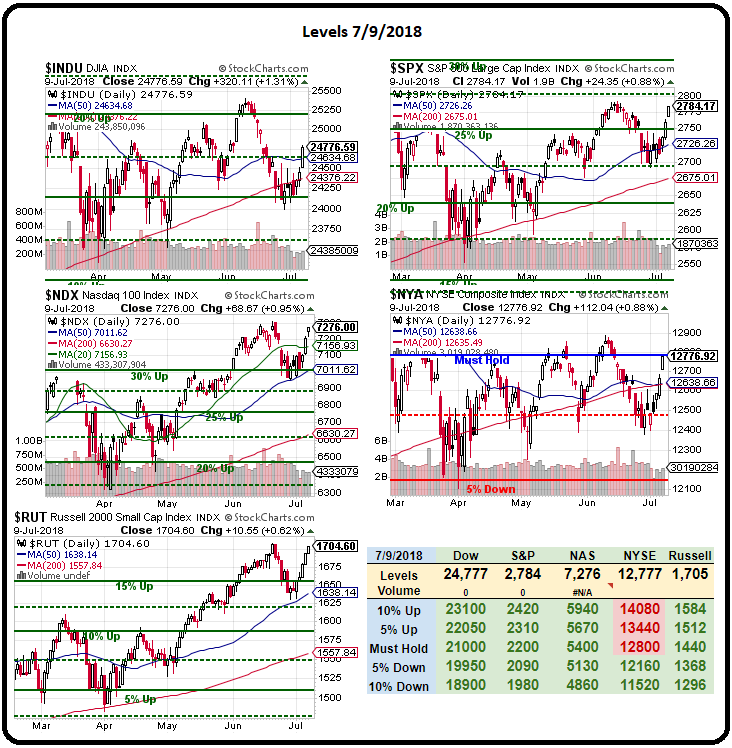

That's the volume the S&P's (SPY) ETF hasn't broken since June. Yet the S&P, on no volume at all, has gained 100 points (3.7%) in the first 10 days of July and is now just another 100 points away from the all-time high, after matching January's high at 2,872, of course. Things looked fantastick then – the S&P was on a run from 2,550 so up 322 points was 12.6% and, on the morning of Jan 18th, I noted the following in our report:

Up and up the markets go but we see shorting opportunities this morning IF we cross back below Dow (/YM) 26,100, S&P (/ES) 2,800, Nasdaq(/NQ) 6,810 and Russell(/TF) 1,585. The rule of thumb for shorting the futures is wait for 2 to cross below and then pick the next one that crosses and keep very tight stops back above the line and if ANY of the indexes go back above their line – kill the trade and wait for the next set-up.

The Dow is much lower now, at 24,850 (-4.7%) but the Nasdaq is way up at 7,320 (+7.4%) and the Russell is at 1,711 (+7.9%) and we're short both of those indexes on the assumption the Dow and the S&P are not crazy (and the much broader NYSE is down at 12,776 from 13,637 so that's 861 points or -6.3%). Of course, right after I wrote that note, the market dropped 10% into early February and boy were we glad to have been cautious then!

It was Tuesday, Jan 23rd, when Trump first declared his Trade War and now we're actually starting to fight it and the level of complacency is amazing but we were just a complacent on Jan 23rd, when the markets were blasting along to new highs – as if there wasn't a care in the World – until there was.

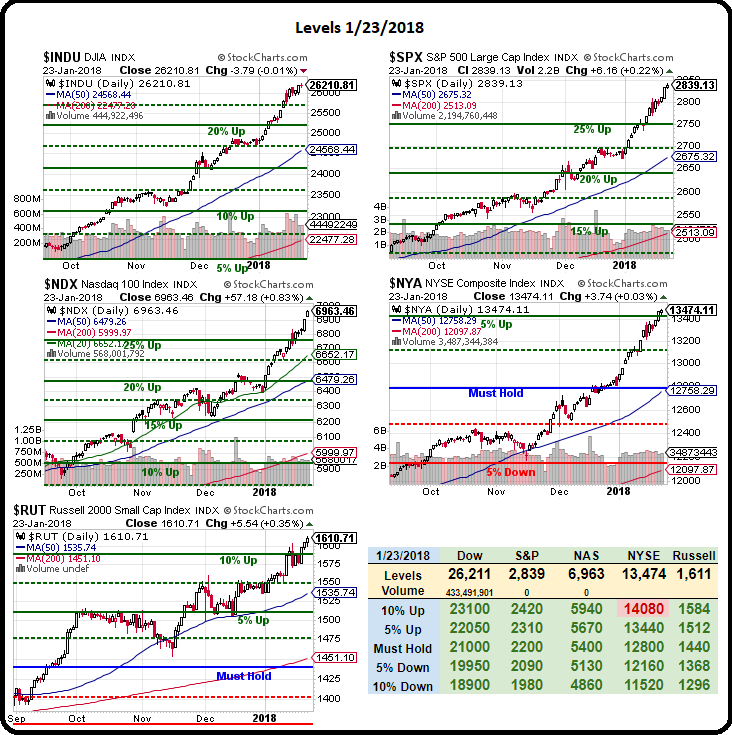

The Dollar hit a 3-year low on Jan 24th and fell below the 89 line to 88.50 before recovering back to 90.5 and, eventually, all the way to 95 so the same market levels look over 5% more expensive now to people buying it in foreign currencies. This is what our Big Chart looked like on the morning of Jan 23rd – very impressive stuff, right?

Some news from that morning was:

Stocks extend gains amid earnings rush

- Stocks open mostly higher, setting new intraday records for the three major market indexes, as corporate earnings continue to come in strong; Dow +0.5%, S&P +0.2%, Nasdaq +0.1%.

- In U.S. corporate news, Abbott Labs (+3.8%), United Technologies (flat) and Comcast (+0.2%) all reported earnings and revenue that beat analyst expectations; GE (flat) rose sharply pre-market after reaffirming its 2018 guidance even amid below-consensus earnings and revenues, but has given back its gains on news that the SEC has opened a probe of the company's accounting practices.

- Most industry groups open higher, led by telecom services (+0.9%), materials (+0.5%) and health care (+0.5%).

- J.P. Morgan's Jamie Dimon told CNBC this morning that the lower corporate tax rate would lead to higher wages and possibly 4% U.S. GDP growth later this year.

- The U.S. Dollar Index -0.7% to a new three-year low after Treasury Secretary Mnuchin spoke in favor of a weaker dollar, saying it's "good for trade."

- U.S. Treasury prices are lower, pushing the benchmark 10-year yield 3 bps higher to 2.65%.

- U.S. WTI crude oil +0.2% at $64.61/bbl.

- Holding court in Davos, the Bridgewater founder yesterday made news when he said, "If you're holding cash, you're going to feel pretty stupid." The economy was already going along nicely, he says, and now the tax cut will add a big jolt.

- Still hanging in Switzerland, Dalio today says the bond bear market has begun, and just a 1% rise in yields would spark major losses.

- The Fed, he says, is likely to hike short-term rates faster than expected, but that shouldn't hit markets for about 18 months. In the meantime: "It feels stupid to own cash in this kind of environment." There's that word again.

Goldman bearish on Valeant, sees 19% downside risk, shares off 6% premarket

- Goldman Sachs rates Valeant Pharmaceuticals (NYSE:VRX) a Sell with an $18 (19% downside risk) price target.

- In a note, analyst Dana Flanders cites the remaining high debt level, legal risks and competitive pressures that will constrain growth.

- Shares are down 6% premarket on higher-than-average volume.

As noted above, the Dollar went up 5% while the markets went down 10% so Diallo gave the worst possible advice at the worst possible moment and Valeant flew higher against Goldman's bad advice and we're still waiting for any sort of sign of Jamie Dimon's 4% growth so ALL that advice at the Top of a 10% market slide was complete and utter nonsense – just keep that in mind when you read today's batch of complete and utter nonsense telling you to keep buying when the market is topping out again.

We're already shorting the Nasdaq (/NQ) Futures at 7,300 and, of course, we added to our hedges so we'll see how it goes. Oil (/CL) is a good short again at $74.50 with a stop over $75 but I'd rather risk the loss than miss the dip – inventories tomorrow are very likely to disappoint.

At the moment, the charts look very bullish and we don't want to get ahead of them but if the Nasdaq fails at 7,300 and the S&P fails at 2,800, then those "short the laggard" rules go into effect on all of the indexes so stay tuned for the fun!

Disclosure: Our teaching theme at Phil's Stock World is "Be the House, NOT the Gambler." Please see " more