20Y Auction Sees Lackluster Demand Despite 6th Consecutive Stop Through

Image Source: Pixabay

In a day when the markets have tried to make sense of today's near-record downward revision to payrolls, moments ago the US sold $16BN in 20Y paper, and despite the prevailing confusion (does the dire BLS data confirm a 50bps rate cut, or do we stick with 25bps), there were plenty of buyers, even if the auction metrics were not remarkable by any stretch.

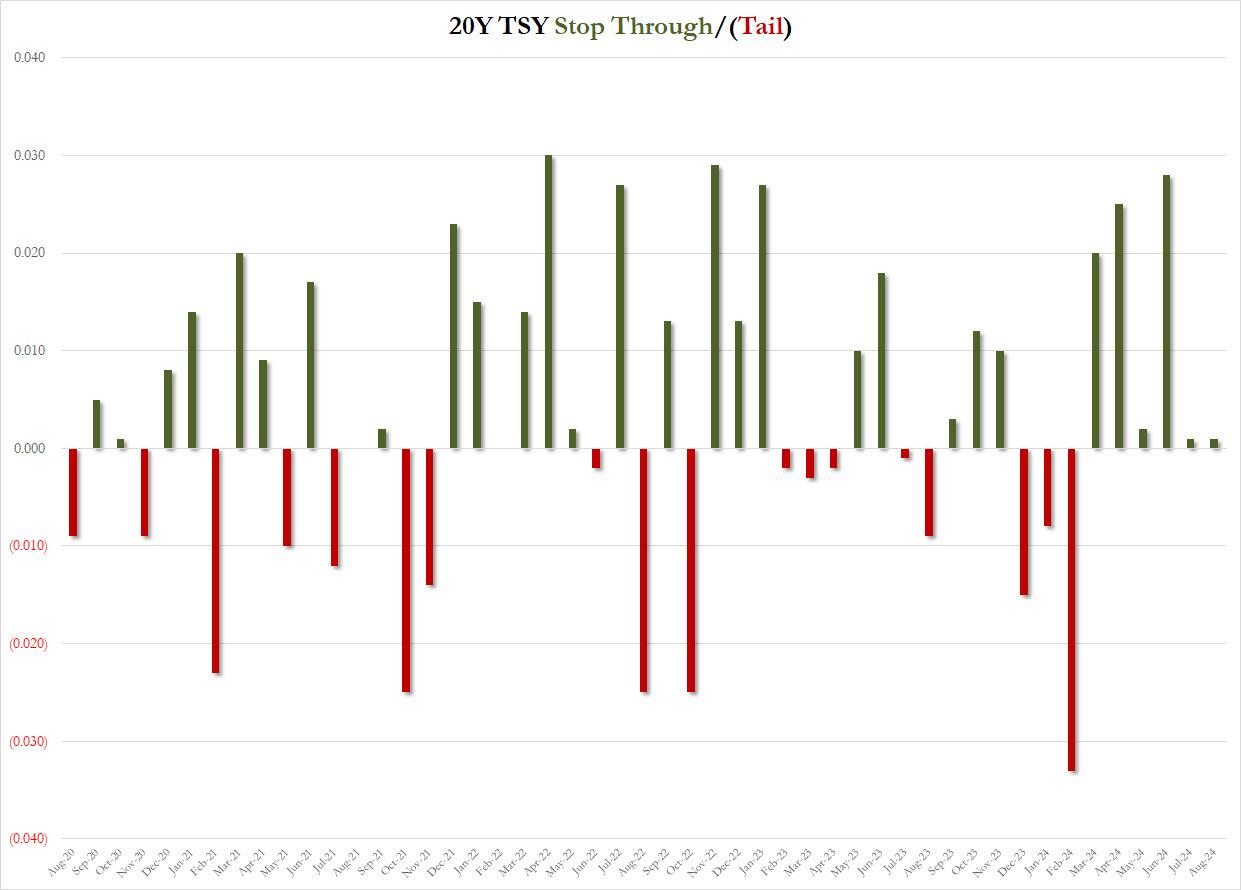

The auction, which passed without a hitch, sold at a high yield of 4.16%, which was 30bps below last month's 4.466%, and the lowest yield since last July; it also stopped through the When Issued 4.161 by the smallest possible margin: 0.1bps, and follows last month's identical 0.1bp stop through. In fact, this was the 6th consecutive stopping through auction in a row, and 9th of the past 12.

(Click on image to enlarge)

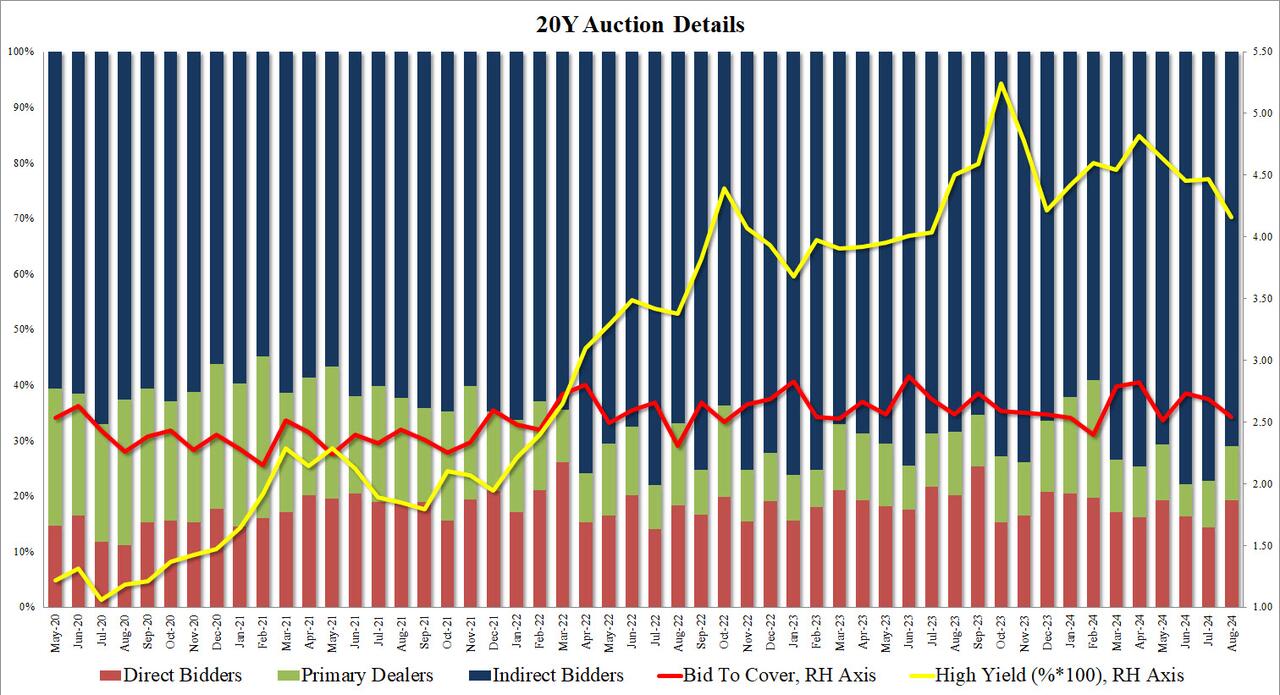

The bid to cover was less impressive, dropping to 2.54 from last month's 2.68 and below the six-auction average of 2.65.

The internals were also subpar, with Indirects awarded just 71.0%, the lowest since May and far below both last month's 77.2% and the recent average of 72.2%. And with Directs taking 19.3%, the most since February, Dealers were left holding 9.7%, the most since May.

(Click on image to enlarge)

In short, a closer look at the auction metric revealed a rather disappointing auction, the tiny stop through notwithstanding. Still, it was good enough and yields remained near session lows, just above 3.78% after the auction prices.

More By This Author:

WTI Extends Gains As US Crude Inventories Tumble To 6-Month Lows

China On The Verge: Welfare State Crumbles, Explosion In Social Unrest As Youth Unemployment Soars, Strikes Surge

WTI Extends Losses After API Reports Small (Surprise) Crude Build

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more