2024 Starts With Bitcoin Breakout, Crude Collapse, Mega-Cap Meltdown

Image Source: Unsplash

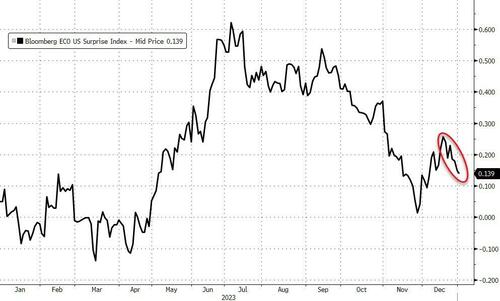

Weaker-than-expected construction spending data and a dismal (final) Manufacturing PMI print for December suggested 2024 is not off to the 'goldilocks' start so many hoped for.

However, despite the 'weak' data, Treasury yields were higher and the dollar stronger.

Treasury yields were up across the board with the short-end underperforming (2Y +9bps, 30Y +5bps). Yields gapped higher to open and then traded in a narrow range from the European open...

Source: Bloomberg

The 10Y yield gapped up to three-week-highs, hovering at the post-FOMC plunge levels...

Source: Bloomberg

The dollar ripped higher to start 2024 - its biggest daily gain since March 2023...

Source: Bloomberg

Mega-Cap stocks took a beating (not helped by AAPL downgrade), erasing all of December's gains...

Source: Bloomberg

AAPL tumbled to near two-month lows...

Semis suffered their biggest daily drop since Dec 2022...

...and that dragged Nasdaq down to its biggest drop in over two months, underperforming the rest of the US Majors. A late-day mini-melt-up added a little lipstick to this pig and The Dow was the least ugly horse in today's glue factory...

Dow futures perfectly roundtripped to Friday's cash close levels today...

Major u-turn in 'most shorted' stocks too today. Gap down open immediately squeezed higher, only to rapidly give it all back after Europe closed...

Source: Bloomberg

Bitcoin broke-out today above the early December highs to its highest since April 2022, coming within a few ticks of $46,000...

Source: Bloomberg

Ethereum also rallied on the day, above $2400 intraday, but underperformed Bitcoin, dragging ETH/BTC down

Source: Bloomberg

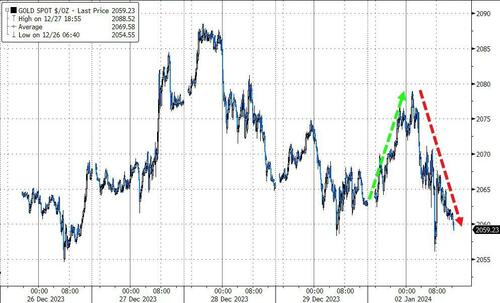

The strength of the dollar weighed on gold which ended down only modestly on the day (after losing overnight gains)...

Source: Bloomberg

But, perhaps the most notable move today was in the energy patch.

Oil prices surged overnight amid growing tensions in the MidEast but then, at around 9amET, WTI was unceremoniously dumped as if any war/geopl risk premium was entirely worthless. And then it legged down again despite headlines that Israel had killed a senior Hamas official in Beirut (potentially drawing Iran even more explicitly into the melee)...

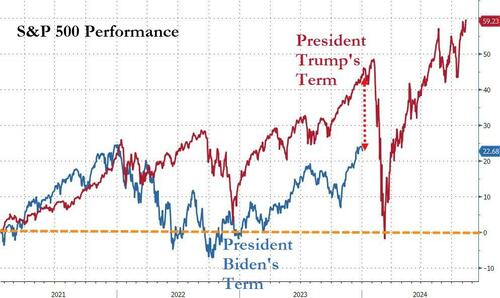

Finally, President Biden's stock market performance continues to lag that of President Trump's...

Source: Bloomberg

...but just you wait until March or April when the Biden admin will crow at their outperformance (compared to Trump's COVID collapse)

Investors are back at 'Extreme Greed' levels...

Doesn't look good for Santa-Rally support... and for the last five years, as goes the first 5 trading days, so goes the year...

Source: Bloomberg

With 150bps of rate-cuts priced in for 2024, there is not much room for error.

More By This Author:

US Manufacturing Sector Slump Accelerates In December: Orders Down, Prices Up

These Are The 20 Most Popular Neighborhoods For Potential US Homebuyers

Bank Bailout Fund Usage Soars To Another Record High As 2023 Sees Greatest Annual Money-Market Inflows Ever

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more