Bank Bailout Fund Usage Soars To Another Record High As 2023 Sees Greatest Annual Money-Market Inflows Ever

Image Source: Unsplash

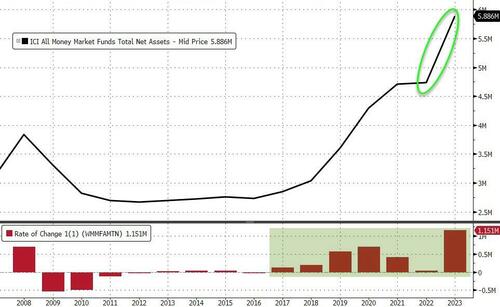

After two weeks of outflows, money-market funds returned to inflows in the week ending 12/27, adding $16.4BN to $5.89TN...

Source: Bloomberg

This means 2023 saw the largest annual money-market inflow ever - a whopping $1.151TN. That is the seventh year in a row of annual MM inflows...

Source: Bloomberg

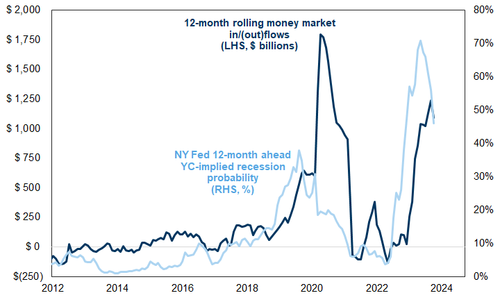

But, with recession odds declining rapidly, are we about to see MM outflows accelerate?

Source: Goldman Sachs

Retail money-market funds capped the year with yet another inflow (+$13.3BN) meaning there was only one weekly outflow from retail funds in 2023. Institutional funds saw a $3.4BN inflow also...

Source: Bloomberg

In a breakdown for the week to Dec. 27, government funds - which invest primarily in securities like Treasury bills, repurchase agreements and agency debt - saw assets rise to $4.81 trillion, an $18.9 billion gain.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets fall to $951.4 billion, a $3.8 billion decrease.

“The big question is how overweight are investors in money markets,” Kristina Hooper, chief global market strategist at Invesco, said in a Bloomberg Television interview earlier this week.

“Some exposure makes sense. That’s part of being diversified. But there is significant overweight on the part of some investors and I do think that starts to come out.”

Interestingly, bank deposits are rising rapidly in the last few weeks as are money-market funds...

Source: Bloomberg

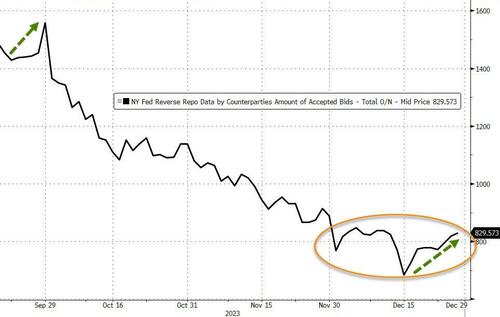

Notably, with year-end liquidity needs growing, the exodus from The Fed's reverse-repo facility has stalled (for now)...

Source: Bloomberg

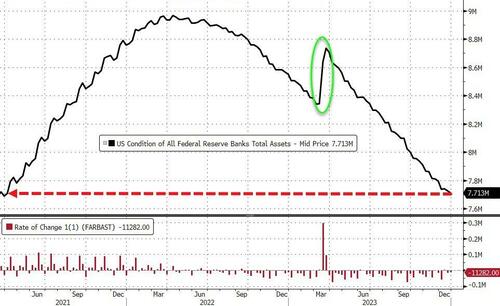

The Fed's balance sheet shrank by $11.3BN last week to its lowest level since March 2021...

Source: Bloomberg

Usage of The Fed's bank bailout facility rose by another $4.5BN last week to a new record high of $136BN...

Source: Bloomberg

But Regional bank shares don't care...

Source: Bloomberg

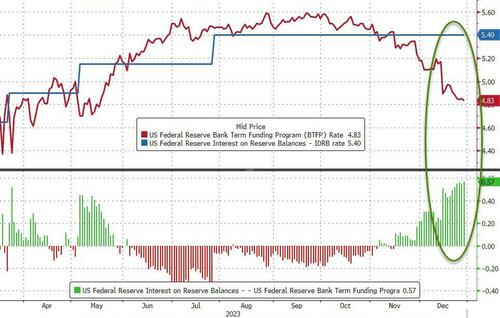

The BTFP-Fed Arb continues to offer 'free-money' (and usage of the BTFP has risen by $26.7BN since the arb existed):

The rate on the Fed’s Bank Term Funding Program - which allows banks and credit unions to borrow funds for up to one year, pledging US Treasuries and agency debt as collateral valued at par - is the one-year overnight index swap rate plus 10 basis points.

That figure is currently 4.83%, down from 5.59% in September.

For institutions that have an account at the Fed, they can borrow from the BTFP at 4.83% and park that at the central bank to earn 5.40% - the interest on reserve balances.

Source: Bloomberg

The 57bp spread is the widest level since the Fed introduced the facility to support a struggling banking system after the collapse of California’s Silicon Valley Bank and Signature Bank in New York.

Finally, equity market caps continue to soar after recoupling with bank reserves at The Fed (though the stalling in the drawdown of the RRP has slowed the expansion again this week in a bigger way)...

Source: Bloomberg

WTF are banks going to do when The Fed shuts down this 'temporary' bailout program in March?

More By This Author:

Corn, Wheat Prices Post Largest Yearly Decline In Decade As Hope For Easing Food Inflation Rises

Speculative Money Dumps Vintage Champagne Bottles As 'Bubble In Bubbly Pops'

Treasuries Tumble After $1 Trillion Reverse Repo Drains $190BN In Liquidity, Index Change

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more