2020: It's Over

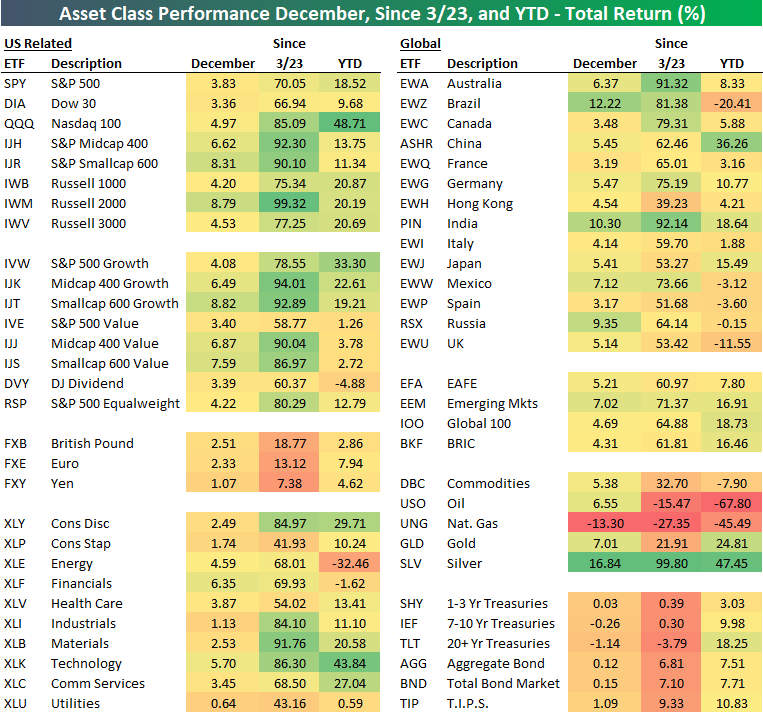

The 2020 market year is officially behind us, and for most of the ETFs in our Asset Class Performance Matrix it was a great year. The top-performing ETF in our matrix was the Nasdaq 100 (QQQ), which advanced 48.7% on a total return basis. Fittingly, in second place silver (SLV) posted a gain of 47.5%. Other big winners this year were large-cap growth (IVW), Consumer Discretionary, (XLY), Technology (XLK), Communication Services (XLC), and China (ASHR). All of these ETFs posted annual returns of more than 25%. On the downside, there were some big losers, though. Oil (USO) lost two-thirds of its value, while Natural Gas (UNG) dropped 45%. The only other ETFs that experienced declines of more than 20% were Brazil (EWZ) and Energy (XLE).

The middle column of our matrix shows each ETF’s total return since the 3/23 closing S&P 500 low. There were some truly mind-boggling returns as SLV, India (PIN), Australia (EWA), the Materials sector (XLB), Mid Cap Value (IJJ), Small Cap Growth (IJT), Mid Cap Growth (IJK), the Russell 2000 (IWM), the Small Cap S&P 600 (IJR), and the Mid Cap S&P 400 (IJH) all advanced 90% or more. Over that same span, the only ETFs that were down were long-term US Treasuries (TLT), UNG, and USO.

What was a very strong year for financial assets in 2020 was capped off with a strong December. In the US, every major index ETF was up at least 3%, every sector was positive, and every international ETF finished in the green. In fact, of the nearly 60 ETFs in the matrix, only three were down in December (IEF, TLT, and of course UNG).

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more