1Q22 US Corporate High-Yield Issuance Down Huge Y/Y

1Q22 US Corporate High-Yield Issuance Down Huge Y/Y; Both HYG And LQD Cling On To Crucial Support

In 1Q22, US corporate bond issuance was down 14.5% y/y, with high-yield collapsing 68%. This took place even as HYG, along with LQD – already under sustained pressure – are clinging on to crucial support.

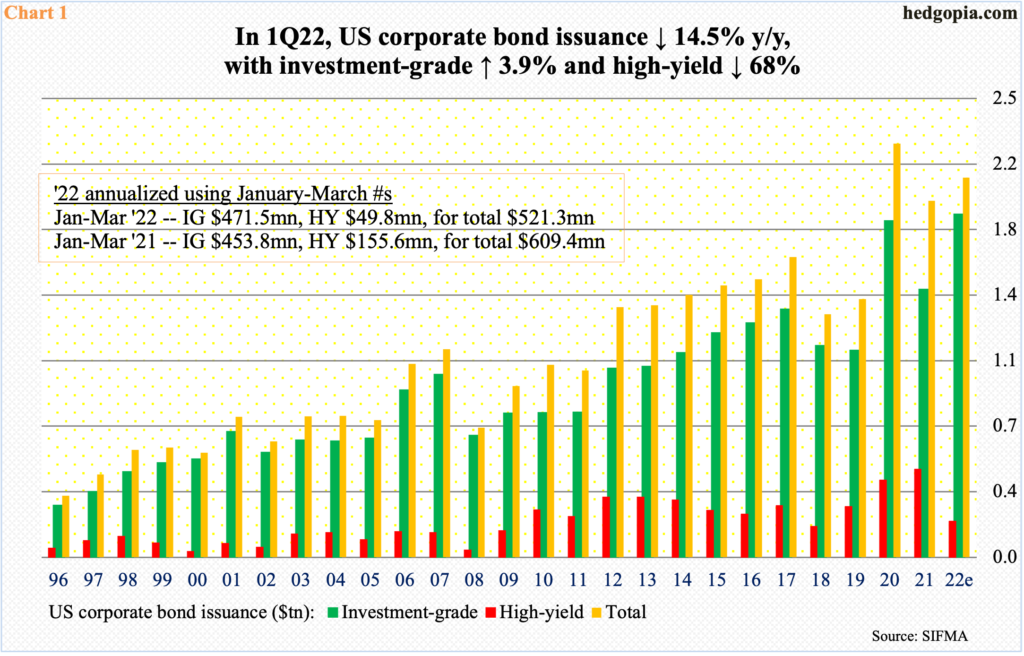

In the first three months of this year, US corporations issued $521.3 billion in bonds, comprising $471.5 billion in investment-grade and $49.8 billion in high-yield. Over the corresponding period a year ago, this represents a decrease of 14.5 percent, an increase of 3.9 percent, and a decrease of 68 percent, in that order.

It is only three months, but if January-March numbers are annualized, then 2022 is on pace to hit $1.89 trillion in investment-grade and $199 billion in high-yield, for a total of $2.09 trillion (Chart 1). Last year, these figures were respectively $1.47 trillion, $485 billion, and $1.96 trillion. High-yield issuance set a record last year. Total issuance posted a new record in 2020 when $2.27 trillion was issued. If it follows the three-month trend for the rest of this year, investment grade would have set a new record this year.

Corporations have been actively issuing bonds for a while now. Issuance first crossed a $1 trillion mark in 2006, and barring 2008 and 2009, has been north of that threshold since (Chart 1).

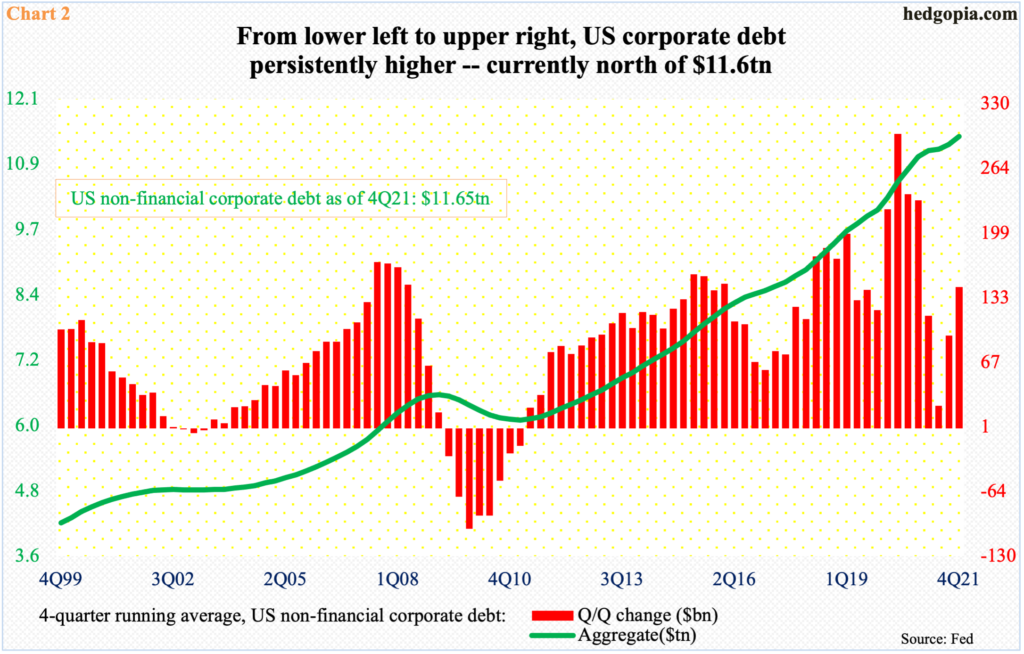

Accordingly, as of the end of last year, the non-financial corporate debt stood at $11.65 trillion – a fresh record and up to $192.4 billion over 2020. Chart 2 uses a four-quarter average, and the trend is evident. The green line has persistently risen for a year now.

Amidst all this, as far as high-yield issuance is concerned, the year 2022 has gotten off poorly (Chart 1). Once again, there are nine months left in the year, and things could pick back up at any time. Then there is the fact that last year was a record in terms of issuance, so things may have begun slowly this year.

Whatever the case, high yield is worth a watch as this can be used as a way to measure risk-on sentiment.

From this standpoint, HYG (iShares iBoxx High Yield Corporate Bond ETF) sits at a crucial juncture. After essentially going sideways for several years, it came under pressure as 2022 began, closing Wednesday at $80.86 – right near-horizontal support going back more than a decade (Chart 3). A breach of this support, followed by the loss of last month’s low of $79.88, can set in motion a new round of selling.

Incidentally, HYG’s investment-grade cousin already broke down in January. LQD (iShares iBoxx Investment Grade Corporate Bond ETF) had been caught in a descending triangle since July 2020, with the lower support line at $129. This was breached late January (Chart 4), which further added to selling pressure. For four weeks now, bids have appeared at $118 or slightly above.

Intraday Wednesday, LQD set a new two-year low of $117.80, closing at $118.68. Hence, as is the case with HYG, LQD too is sitting at important support.

In both, investors are not as enthusiastic as before and trading carefully. This sooner or later is bound to have implications for bond issuance. It may already have as far as high-yield is concerned.