10 Most Overvalued Stocks Of The S&P 500 - February 2019

There are a number of great companies in the market today, but there are also a number of companies that are vastly overvalued by the market. By using the ModernGraham Valuation Model, I’ve selected the ten most overvalued companies of the S&P 500 recently reviewed by ModernGraham.

All of these companies are not suitable for the Defensive Investor and/or the Enterprising Investor. Defensive Investors are defined as investors who are not able or willing to do substantial research into individual investments, and therefore need to select only the companies that present the least amount of risk. Enterprising Investors, on the other hand, are able to do substantial research and can select companies that present a moderate (though still low) amount of risk. Each company suitable for the Defensive Investor is also suitable for Enterprising Investors.

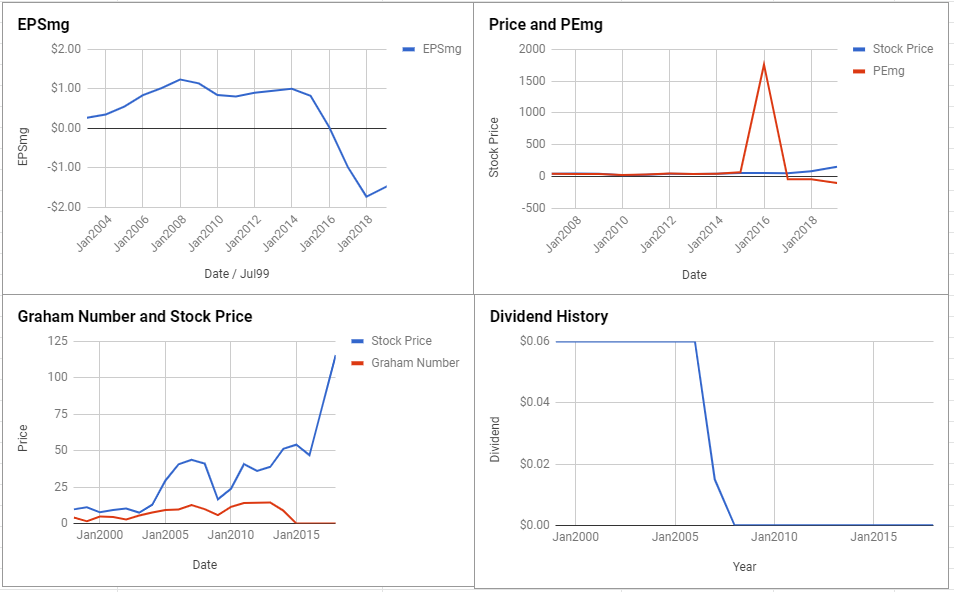

Autodesk, Inc. (ADSK)

Autodesk, Inc. does not satisfy the requirements of either the Enterprising Investor or the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, insufficient earnings stability or growth over the last ten years, and the poor dividend history, and the high PEmg and PB ratios. The Enterprising Investor has concerns regarding the level of debt relative to the current assets, and the lack of earnings stability or growth over the last five years, and the lack of dividends. As a result, all value investors following the ModernGraham approach should explore other opportunities at this time or proceed cautiously with a speculative attitude.

As for a valuation, the company appears to be Overvalued after seeing its EPSmg (normalized earnings) decline from $0.82 in 2015 to an estimated $-1.47 for 2019. This level of negative earnings does not support a positive valuation.As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value below the price.

At the time of valuation, further research into Autodesk, Inc. revealed the company was trading above its Graham Number of $0. The company does not pay a dividend. Its PEmg (price over earnings per share – ModernGraham) was -103.19, which was below the industry average of 56.55, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-11.52.

Autodesk, Inc. scores quite poorly in the ModernGraham grading system, with an overall grade of D. (See the full valuation)

(Click on image to enlarge)

AES Corp (AES)

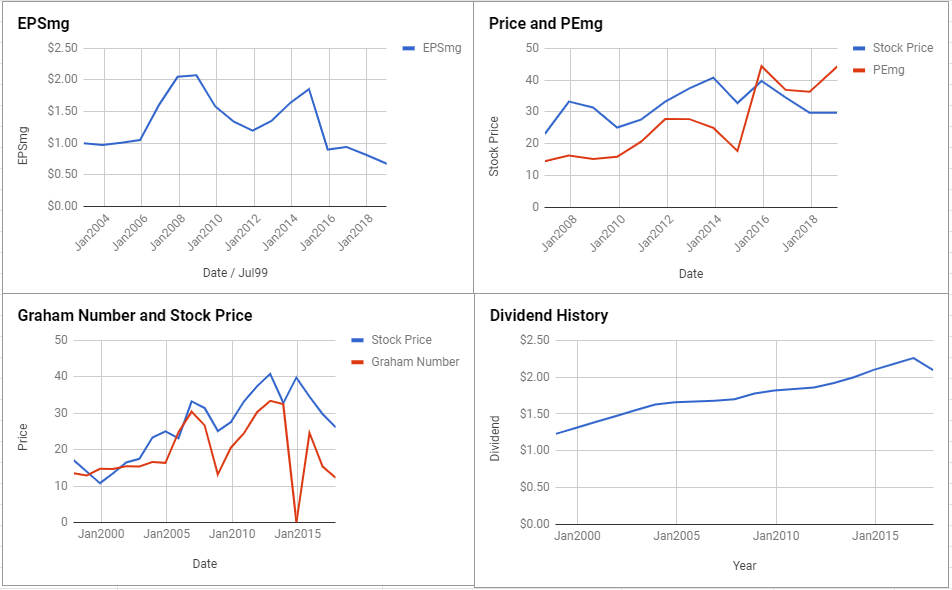

AES Corp does not satisfy the requirements of either the Enterprising Investor or the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, insufficient earnings stability or growth over the last ten years, and the poor dividend history, and the high PEmg and PB ratios. The Enterprising Investor has concerns regarding the level of debt relative to the current assets, and the lack of earnings stability or growth over the last five years. As a result, all value investors following the ModernGraham approach should explore other opportunities at this time or proceed cautiously with a speculative attitude.

As for a valuation, the company appears to be Overvalued after seeing its EPSmg (normalized earnings) decline from $0.16 in 2014 to an estimated $-0.04 for 2018. This level of negative earnings does not support a positive valuation.As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value below the price.

At the time of valuation, further research into AES Corp revealed the company was trading above its Graham Number of $12.73. The company pays a dividend of $0.48 per share, for a yield of 3.1%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was -380.66, which was below the industry average of 21.62, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-32.73.

AES Corp scores quite poorly in the ModernGraham grading system, with an overall grade of D+. (See the full valuation)

(Click on image to enlarge)

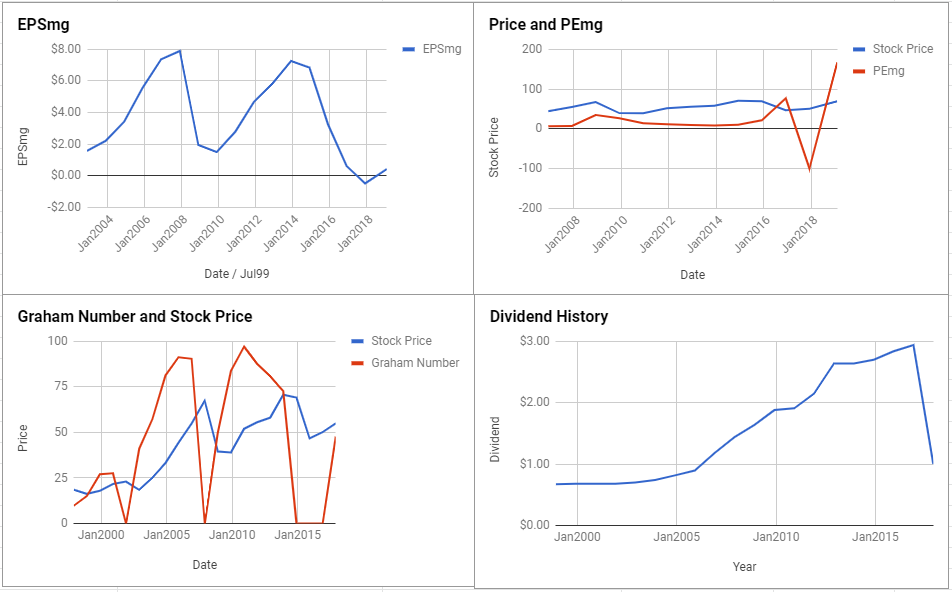

ConocoPhillips (COP)

ConocoPhillips does not satisfy the requirements of either the Enterprising Investor or the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, insufficient earnings stability or growth over the last ten years, and the high PEmg and PB ratios. The Enterprising Investor has concerns regarding the level of debt relative to the net current assets, and the lack of earnings stability or growth over the last five years. As a result, all value investors following the ModernGraham approach should explore other opportunities at this time or proceed cautiously with a speculative attitude.

As for a valuation, the company appears to be Overvalued after seeing its EPSmg (normalized earnings) decline from $6.85 in 2014 to an estimated $0.41 for 2018. This level of demonstrated earnings growth does not support the market’s implied estimate of 79.31% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value below the price.

At the time of valuation, further research into ConocoPhillips revealed the company was trading above its Graham Number of $47.64. The company pays a dividend of $1.06 per share, for a yield of 1.5% Its PEmg (price over earnings per share – ModernGraham) was 167.12, which was above the industry average of 43.92. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-20.26.

ConocoPhillips scores quite poorly in the ModernGraham grading system, with an overall grade of F. (See the full valuation)

(Click on image to enlarge)

DISCOVERY COMMUNICATIONS INC. Common Stock (DISCA)

DISCOVERY COMMUNICATIONS INC. Common Stock does not satisfy the requirements of either the Enterprising Investor or the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, insufficient earnings stability or growth over the last ten years, and the poor dividend history, and the high PEmg ratio. The Enterprising Investor has concerns regarding the level of debt relative to the current assets, and the lack of earnings stability or growth over the last five years, and the lack of dividends. As a result, all value investors following the ModernGraham approach should explore other opportunities at this time or proceed cautiously with a speculative attitude.

As for a valuation, the company appears to be Overvalued after seeing its EPSmg (normalized earnings) decline from $1.31 in 2014 to an estimated $0.88 for 2018. This level of demonstrated earnings growth does not support the market’s implied estimate of 11.78% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value below the price.

At the time of valuation, further research into DISCOVERY COMMUNICATIONS INC. Common Stock revealed the company was trading above its Graham Number of $16.36. The company does not pay a dividend. Its PEmg (price over earnings per share – ModernGraham) was 32.05, which was above the industry average of 31.72. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-26.9.

DISCOVERY COMMUNICATIONS INC. Common Stock scores quite poorly in the ModernGraham grading system, with an overall grade of F. ( See the full valuation)

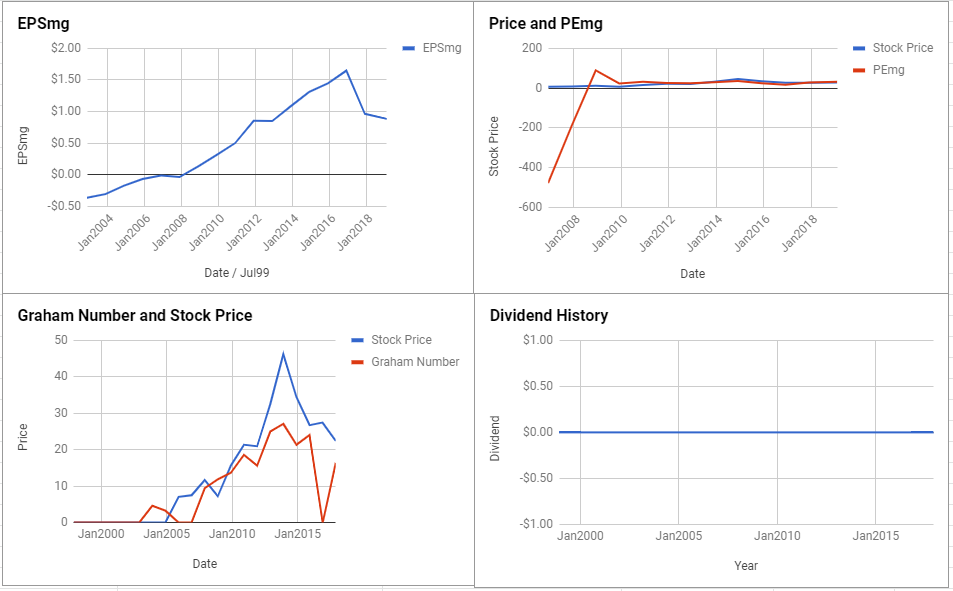

Devon Energy Corp (DVN)

Devon Energy Corp does not satisfy the requirements of either the Enterprising Investor or the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, insufficient earnings stability or growth over the last ten years, and the high PEmg and PB ratios. The Enterprising Investor has concerns regarding the level of debt relative to the current assets, and the lack of earnings stability or growth over the last five years. As a result, all value investors following the ModernGraham approach should explore other opportunities at this time or proceed cautiously with a speculative attitude.

As for a valuation, the company appears to be Overvalued after seeing its EPSmg (normalized earnings) decline from $3.37 in 2014 to an estimated $-2.61 for 2018. This level of negative earnings does not support a positive valuation.As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value below the price.

At the time of valuation, further research into Devon Energy Corp revealed the company was trading below its Graham Number of $39.63. The company pays a dividend of $0.24 per share, for a yield of 0.9% Its PEmg (price over earnings per share – ModernGraham) was -10.16, which was below the industry average of 41.28, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-13.33.

Devon Energy Corp receives an average overall rating in the ModernGraham grading system, scoring a C-. (See the full valuation)

(Click on image to enlarge)

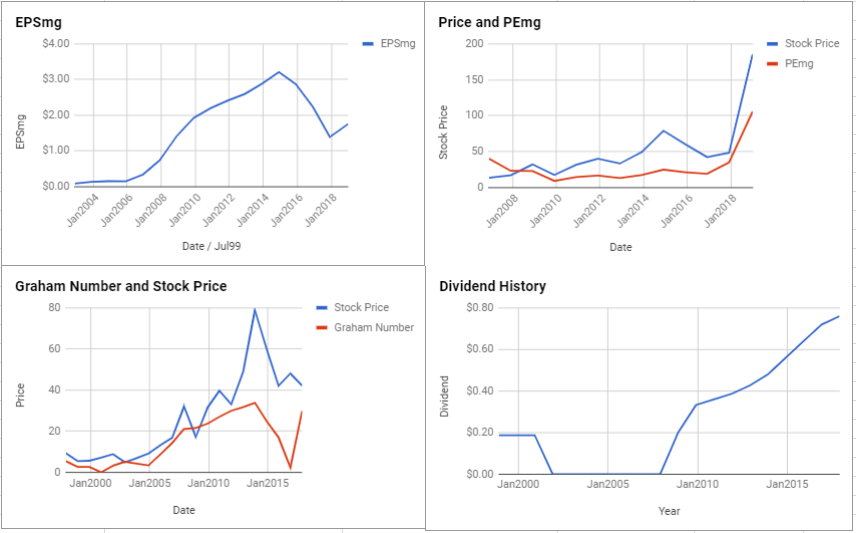

EOG Resources Inc (EOG)

EOG Resources Inc does not satisfy the requirements of either the Enterprising Investor or the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, insufficient earnings stability over the last ten years, and the high PEmg and PB ratios. The Enterprising Investor has concerns regarding the level of debt relative to the current assets, and the lack of earnings stability or growth over the last five years. As a result, all value investors following the ModernGraham approach should explore other opportunities at this time or proceed cautiously with a speculative attitude.

As for a valuation, the company appears to be Overvalued after seeing its EPSmg (normalized earnings) decline from $3.35 in 2014 to an estimated $1.82 for 2018. This level of demonstrated earnings growth does not support the market’s implied estimate of 22.22% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value below the price.

At the time of valuation, further research into EOG Resources Inc revealed the company was trading above its Graham Number of $58.15. The company pays a dividend of $0.67 per share, for a yield of 0.7% Its PEmg (price over earnings per share – ModernGraham) was 52.95, which was above the industry average of 43.92. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-17.68.

EOG Resources Inc scores quite poorly in the ModernGraham grading system, with an overall grade of F. (See the full valuation)

(Click on image to enlarge)

FirstEnergy Corp. (FE)

FirstEnergy Corp. does not satisfy the requirements of either the Enterprising Investor or the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, insufficient earnings stability or growth over the last ten years, and the high PEmg and PB ratios. The Enterprising Investor has concerns regarding the level of debt relative to the current assets, and the lack of earnings stability or growth over the last five years. As a result, all value investors following the ModernGraham approach should explore other opportunities at this time or proceed cautiously with a speculative attitude.

As for a valuation, the company appears to be Overvalued after seeing its EPSmg (normalized earnings) decline from $1.31 in 2014 to an estimated $-2.96 for 2018. This level of negative earnings does not support a positive valuation.As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value below the price.

At the time of valuation, further research into FirstEnergy Corp. revealed the company was trading above its Graham Number of $20.98. The company pays a dividend of $1.44 per share, for a yield of 3.7%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was -13.12, which was below the industry average of 21.62, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-59.35.

FirstEnergy Corp. scores quite poorly in the ModernGraham grading system, with an overall grade of D+. (See the full valuation)

(Click on image to enlarge)

Flowserve Corp (FLS)

Flowserve Corp does not satisfy the requirements of either the Enterprising Investor or the more conservative Defensive Investor. The Defensive Investor is concerned with the insufficient earnings growth over the last ten years, and the high PEmg and PB ratios. The Enterprising Investor has concerns regarding the level of debt relative to the net current assets, and the lack of earnings growth over the last five years. As a result, all value investors following the ModernGraham approach should explore other opportunities at this time or proceed cautiously with a speculative attitude.

As for a valuation, the company appears to be Overvalued after seeing its EPSmg (normalized earnings) decline from $3.21 in 2014 to an estimated $1.04 for 2018. This level of demonstrated earnings growth does not support the market’s implied estimate of 14.04% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value below the price.

At the time of valuation, further research into Flowserve Corp revealed the company was trading above its Graham Number of $16.73. The company pays a dividend of $0.76 per share, for a yield of 2% Its PEmg (price over earnings per share – ModernGraham) was 36.58, which was above the industry average of 20.63. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-4.95.

Flowserve Corp scores quite poorly in the ModernGraham grading system, with an overall grade of F. (See the full valuation)

(Click on image to enlarge)

FleetCor Technologies, Inc. (FLT)

FleetCor Technologies, Inc. does not satisfy the requirements of either the Enterprising Investor or the more conservative Defensive Investor. The Defensive Investor is concerned with the insufficient earnings growth over the last ten years, and the high PEmg and PB ratios. The Enterprising Investor has concerns regarding the level of debt relative to the net current assets, and the lack of earnings growth over the last five years. As a result, all value investors following the ModernGraham approach should explore other opportunities at this time or proceed cautiously with a speculative attitude.

As for a valuation, the company appears to be Overvalued after seeing its EPSmg (normalized earnings) decline from $3.21 in 2014 to an estimated $1.76 for 2018. This level of demonstrated earnings growth does not support the market’s implied estimate of 48.63% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value below the price.

At the time of valuation, further research into FleetCor Technologies, Inc. revealed the company was trading above its Graham Number of $29.9. The company pays a dividend of $0.76 per share, for a yield of 0.4% Its PEmg (price over earnings per share – ModernGraham) was 105.76, which was above the industry average of 25.74. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-4.95.

FleetCor Technologies, Inc. scores quite poorly in the ModernGraham grading system, with an overall grade of F. (See the full valuation)

(Click on image to enlarge)

HCP, Inc. (HCP)

HCP, Inc. does not satisfy the requirements of either the Enterprising Investor or the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, insufficient earnings stability or growth over the last ten years, and the high PEmg ratio. The Enterprising Investor has concerns regarding the level of debt relative to the current assets, and the lack of earnings stability or growth over the last five years. As a result, all value investors following the ModernGraham approach should explore other opportunities at this time or proceed cautiously with a speculative attitude.

As for a valuation, the company appears to be Overvalued after seeing its EPSmg (normalized earnings) decline from $1.85 in 2014 to an estimated $0.67 for 2018. This level of demonstrated earnings growth does not support the market’s implied estimate of 17.91% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value below the price.

At the time of valuation, further research into HCP, Inc. revealed the company was trading above its Graham Number of $12.24. The company pays a dividend of $1.48 per share, for a yield of 5%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was 44.33, which was below the industry average of 70.5, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-14.6.

HCP, Inc. scores quite poorly in the ModernGraham grading system, with an overall grade of D+. (See the full valuation)

(Click on image to enlarge)

Disclosure: The author held a long position in WestRock Co (WRK) but did not hold a position in any other company mentioned in this article at the time of publication and had no ...

more

Many companies that have declining earnings and sales tend to be overvalued from a technical perspective. The hope of many investors that stick with the company is that things will turn around or that it was transitive due to one reason or another. They are either rewarded for sticking through the downturn or punished as the stock price adapts to its new lowered profile. In most cases just looking at such stocks from a pure numbers valuation is dangerous.

There are a lot of overvalued stocks. I think there are more than just these and many are just because investors have valued the stocks too high rather than them already showing growth and profitability declines.