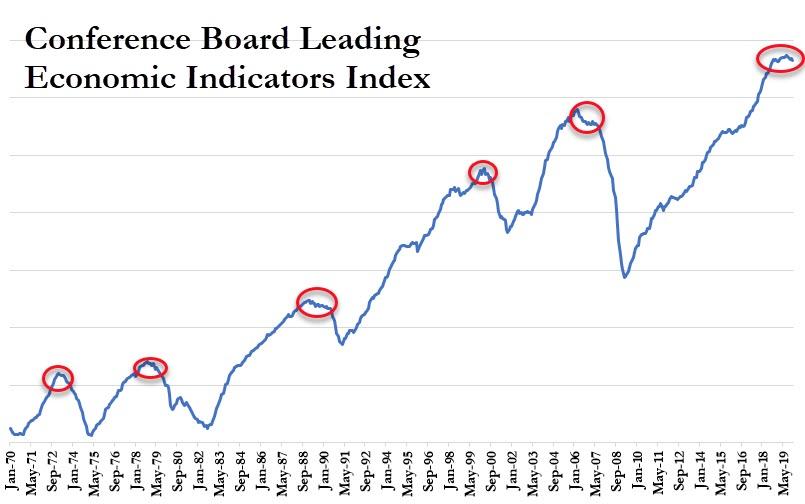

US Leading Economic Indicators Plunge At Worst Rate Since 2009

A worse-than-expected 0.3% MoM drop in the Conference Board leading economic index, ending the year with 5 down months in the last six.

- The biggest positive contributor to the leading index was stock prices at 0.09

- The biggest negative contributor was jobless claims at -0.23

The LEI is clearly not recovering...

(Click on image to enlarge)

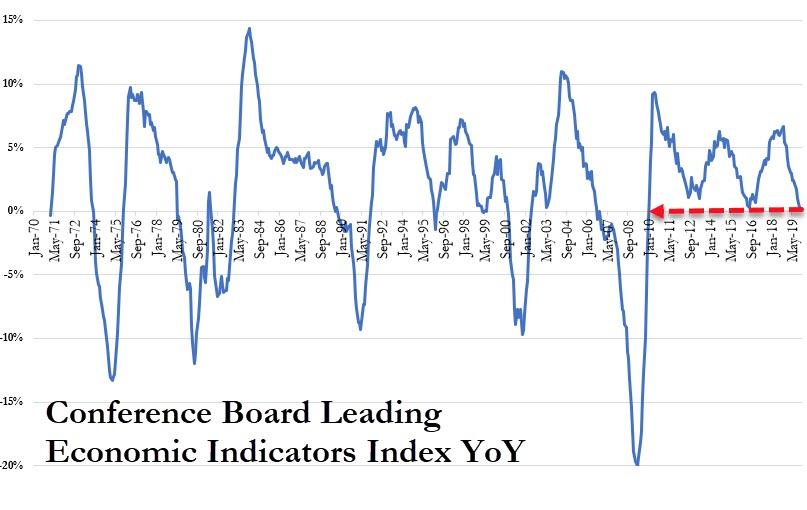

And on a year-over-year basis, the LEI is up just 0.1% - its weakest YoY move since Nov 2009...

(Click on image to enlarge)

"Probably nothing"

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

YoY earnings growth will look much worse because of the artificial rise in debt last year, unless perhaps the trade wars end. This is probably the chief reason why the indicators are not too good right now. That said, we will see if the economy will do ok this year. There still seems to be no major catalyst to create a recession/depression yet.