Small Business Outlook Cratering

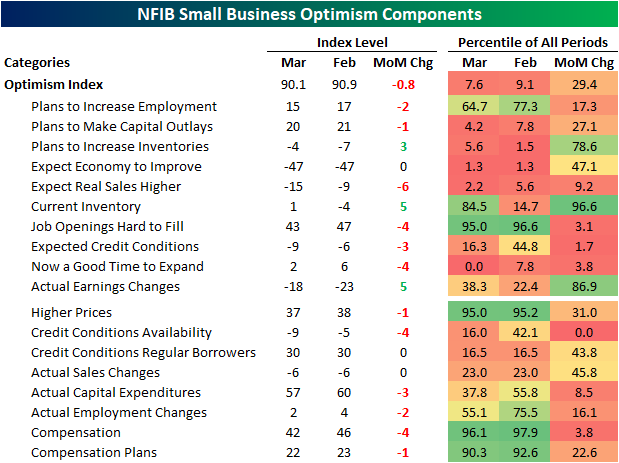

Small business optimism continued to decline in March with the headline index from the NFIB falling from 90.9 down to 90.1. That headline reading was actually better than the consensus forecast of 89.3, but it was still in the bottom decile of the indicator’s historical range dating back to 1986.

Looking across individual categories, breadth was weak in the report with only three indices moving higher month over month, three going unchanged, and all the others falling. As with the headline number, many categories are also historically depressed in the bottom decile of readings including a record low.

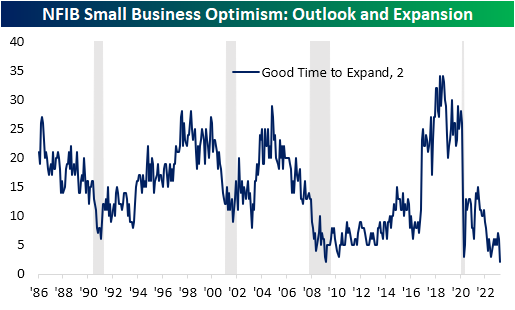

That record low was in the percentage of respondents reporting now as a good time to expand.Only 2% reported now as a good time to expand, down 4 points month over month. Albeit the reading has been at the low end of its historical range for much of the past year, March’s reading matched the historical low form March 2009.

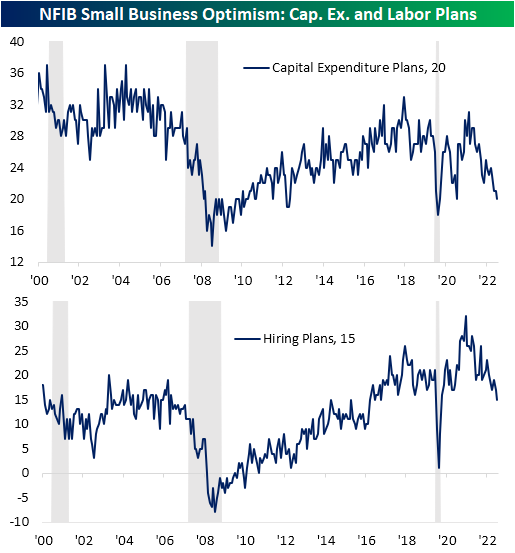

Given the small business outlook for the economy has soured, fewer firms are reporting plans to increase hiring or capital expenditures. In fact, the index for Capex plans fell to 20, which alongside March 2021, is the lowest reading since the spring of 2020. Similarly, hiring plans are at new lows for the post-pandemic period.

One factor likely impacting business plans has been financial conditions. The most pronounced decline of any category last month was a record 4-point decline in the availability of loans. While the reading has been rolling over for some time, that drop leaves the index at the lowest level since December 2012.

More By This Author:

Full-Time Septuagenarian Workers Put In The Most HoursClaims Get Revised

Sentiment Back To Bullish

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more